Applying Goal-Based Investing Principles to the Retirement Problem

Feature

Applying Goal-Based Investing Principles to the Retirement Problem

A major global pension crisis is threatening the two main pillars of pension systems, due to a combination of increasing demographic imbalances and decreasing economic productivity growth. In parallel, defined-benefit arrangements, which used to be dominant among occupational pension schemes, are progressively being closed and replaced by defined-contribution arrangements for new workers. As a result, individuals are increasingly responsible for their own savings and investment decisions.

In most developed countries, pension arrangements are organised on the basis of a three-pillar system. The first pillar, which is key for social coherence, is made of public social security benefits and aims at providing a universal core of pension coverage to address basic consumption needs in retirement through funded public pension systems or unfunded pay-as-yougo systems. Most countries that have opted for a funded system, as is the case in the United Kingdom, are faced with a systemic deficit that is getting worse. The situation is unfortunately no better in countries like France that have adopted an unfunded pay-as-you-go system, the sustainability of which is deeply threatened by rising life expectancy and the impending retirement of baby boomers, as well as low population and productivity growth. The second pillar of pension systems, made of public or private occupational pensions that are expected to provide additional replacement income for retirees, is also weakening. In particular, private pension funds have been strongly impacted by the shift in accounting standards towards the valuation of pension liabilities at market rates, instead of fixed discount rates, which has resulted in increased volatility for pension liabilities. This new constraint has been reinforced in parallel by stricter solvency requirements following the 2000-2003 pension fund crisis. The evolution of accounting and prudential regulations have subsequently led a large number of corporations to close their defined-benefit pension schemes to new members and increasingly to further their accrual of benefits to reduce the impact of pension liability risk on their balance sheets and income statements. Overall, a massive shift from defined-benefit pension to defined-contribution pension schemes is taking place across the world, implying a transfer of retirement risks from corporations to individuals. As a result of these evolutions, public and private pension schemes deliver replacement income levels that are significantly lower than labor income. According to the OECD report Pensions at a Glance 2017, pension replacement rates range from 42.4% to 52.9% in the US and fall to 11.9% for high-earnings individuals in South Africa.

With the need to supplement public and private retirement benefits via voluntary contributions, individuals are becoming increasingly responsible for their own retirement savings and investment decisions within individual retirement accounts, which form the third pillar of pension systems. This global trend poses substantial challenges, not only to individuals, who typically lack the time and expertise required to make such complex financial decisions, but also to policy makers and regulators. In the context of such a massive shift of retirement risk onto individuals, the investment management industry is facing an ever greater responsibility in terms of the need to provide suitable retirement solutions. Unfortunately, available retirement products distributed by asset managers or insurance companies hardly provide a satisfactory solution to investors’ and households’ replacement income needs in retirement.

Insurance companies, asset managers and investment banks offer a variety of so-called retirement products such as annuities and target date funds, but they hardly provide a satisfactory answer to the need for retirement investment solutions. Annuities lack flexibility and have no upside potential, and target date funds have no focus on securing minimum levels of replacement income.

The most natural way to frame an investor’s retirement goal is in terms of how much lifetime guaranteed replacement income they can afford at retirement. Given that the biggest risk in retirement is the risk of outliving one’s retirement assets, securing replacement income in retirement can be achieved with annuities distributed by insurance companies. Annuities, as well as variable annuities (annuity products that offer participation to the upside of equity markets) suffer from a number of fatal flaws, namely, their cost-inefficiency due to prohibitive costs of capital for insurers offering formal guarantees, their unavailability early on in the accumulation phase, as well as a severe lack of transparency and lack of flexibility, which leaves investors with no exit strategy other than high cost surrender charges.

These elements undoubtedly explain a large part of the “annuity puzzle”, which refers to the fact that individual do not invest in annuities unless such an investment is mandatory or strongly incentivised. A good case can actually be made that annuitisation is a decision that is best taken close to retirement, if ever, and that annuities should be used for hedging against late life longevity risk, and not for providing replacement income in early retirement. Turning to asset management products, life-cycle funds (also known as target date funds), which are often used as the default option in retirement plans, may seem attractive alternatives to annuities due to the fact that these are positioned as one-stop solutions to provide long-term investors with a diversified investment and an allocation strategy that favours wealth accumulation in early years and gradually switches towards safety as retirement date approaches.

Target date funds, however, generally focus on reducing uncertainty over capital value near the retirement date, regardless of the beneficiaries’ objectives in terms of replacement income in retirement. The so-called “safe” bond portfolio used in these strategies is actually unsafe when it comes to securing a replacement income because it is not explicitly designed to deliver a stable income during the decumulation period. As a result, they offer no protection to investors with respect to unexpected changes in retirement risk factors. Besides, academic research has shown that the deterministic strategy is suboptimal and that the true optimal strategy should depend on market conditions in addition to the investment horizon.(1)

Other products are also proposed by investment banks, such as capital guarantee products, which are considered as a possible default investment option in the legislative proposal for a regulation on a pan-European personal pension product by the European Commission on 29 June 2017. It can be argued that such guaranteed products are not suited to the needs of future retirees because even though capital is protected, the replacement income that it delivers is not known in advance, which does not facilitate retirement planning. Besides, presence of the formal guarantee implies a strong opportunity cost in terms of upside potential, especially when excessively high distribution costs are factored in.

In retirement investing, the goal is to generate replacement income. The EDHEC-Princeton Goal Price Index series measures the cost of one dollar of replacement income for a fixed period of time in retirement and thus allows investors to find out how much income can be financed with current savings. A truly safe “goal-hedging portfolio” should track the performance of the Goal Price Index. Bonds and cash are not good substitutes for this suitably-designed retirement bond.

The goal-based investing (GBI) paradigm puts investors’ goals at the heart of the design of the investment strategy (see Chhabra (2005); Wang et al. (2011); Deguest et al. (2015)). The first step is the identification of a safe “goal-hedging portfolio”(GHP), which effectively and reliably secures an investor’s essential goal, regardless of assumptions on parameter values such as risk premia on risky assets. In other words, the GHP should secure the purchasing power of retirement savings in terms of replacement income, an objective that is clearly different from securing the nominal value of retirement savings.

To help investors find how much replacement income can be financed with a given capital, EDHEC-Risk Institute and the Operations Research and Financial Engineering (ORFE) department of Princeton University have partnered to launch the EDHEC-Princeton Retirement Goal Price Index series. Each Goal Price Index is associated with a fixed retirement date, and it gives the price of one dollar per year starting at the retirement date for a fixed period roughly equal to the average life expectancy in retirement (say 15 or 20 years). Following no-arbitrage pricing principles, each index is simply valued by discounting the one-dollar cash flows at the zero-coupon rates of appropriate maturities. To address the concern over inflation, there exists a version of the indices with a cost-of-living adjustment (COLA). For example, a 2% COLA means that income grows by 2% per year in order to make up for expected inflation. The Goal Price Index series can be used to measure the purchasing power of a given capital in terms of replacement income in a straightforward way. For instance, if the index value is 10, it means that a $100,000 contribution can finance $100,000/10=$10,000 per year for the specified period.

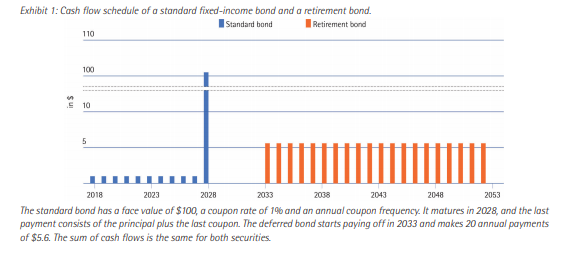

A Goal Price Index can be regarded as the price of a “retirement bond”, which starts paying off at the retirement date and pays constant or cost-of-living adjusted cash flows for a fixed period in retirement (e.g. for the first 20 years of retirement). This cash flow schedule is different from the pattern of standard sovereign and corporate bonds, which provide unequal cash flows by delaying capital amortisation (see Exhibit 1). In the absence of these retirement bonds that could be issued by sovereign states or highly rated corporations, the GHP can be synthesised by standard cash flow-matching or duration-matching techniques. It is important to note that assets traditionally regarded as safe, such as short-term or long-term sovereign bonds, are actually highly risky when it comes to securing a stream of income unless they are combined in such a way as to match the duration of the required replacement income cash flows. While they have low standalone volatility (especially for cash), the duration mismatch implies the presence of unrewarded interest rate risk and a large tracking error with respect to replacement income cash flows.

To maximise the probability of reaching a non-affordable target level of replacement income while protecting should engage in a dynamic portfolio strategy invested in a performance-seeking portfolio and the suitably-designed goal-hedging portfolio. Such strategies are known as goal-based investing strategies since they make explicit use of the information about investor’s goals for defining the allocation to the performance and hedging portfolios at each point in time. A target level of replacement income that the investor would like to reach but is unable to secure given current resources is said to be an aspirational goal. On the other hand, an essential goal is an affordable level of income that the investor would like to secure with the highest confidence level. In most cases, current savings are insufficient to finance the target income level that allow the desired standard of living to be financed, so the investor needs to have access to upside potential via some performance-seeking portfolio (PSP). Mathematically, the retirement investing problem can be laid out as follows: maximise the probability of reaching a target level of replacement income in retirement, while securing a minimum level. This problem can be solved by standard probabilistic techniques, but the theoretically optimal approach would not be implementable because it would require unreasonably high levels of leverage as well as continuous trading.

Fortunately, it can be shown that the optimal payoff can be approximated with a simple dynamic (GBI) strategy in which the dollar allocation to the PSP is given by a multiple of the risk budget, defined as the distance between current savings and a floor equal to the present value of the essential goal. This form of strategy is reminiscent of the dynamic core-satellite investment approach of Amenc, Malaise, and Martellini (2004), with the GHP as the core and the PSP as the satellite. It allows the tracking error with respect to the replacement income portfolio to be managed in a non-symmetric way, by capturing part of the upside of the PSP while limiting funding ratio downside risk to a fixed level. From an implementation standpoint, it has the advantage over the probability-maximising strategy that it is only based on observable parameters.

In order to achieve the highest success probability, the GBI strategy embeds a stop-gain mechanism, by which all assets are transferred to the GHP on the first date the aspirational goal is hit, that is if and when current wealth becomes sufficiently high to purchase the target level of replacement income cash flows.

To provide a more meaningful retirement investment solution to individuals, a new target date fund strategy can be designed, which uses the GHP as a safe building block and includes a risk control mechanism in order to protect the purchasing power of invested contributions on an annual basis. The EDHEC-Princeton Retirement Goal-Based Investing Index series represents the performance of these strategies that can be regarded as improved forms of “risk-controlled life-cycle funds”.

The previously defined GBI strategy allows a well-defined essential goal to be secured, while opening access to the upside performance of the PSP, in the context of a transparent and liquid investment vehicle. This represents an improvement over annuities, which are irreversible and have no upside potential, and over target date funds, which use a mislabelled “safe” building block and neither secure nor explicitly intend to secure any minimum level of income.

In order to take care of periodic, say annual, contributions, the minimum funding ratio level must be secured on an annual basis. Assuming that new contributions are made at the end of each calendar year, we introduce a class of retirement GBI strategies in which the floor is reset at the beginning of every year to protect 80% of the purchasing power of accumulated capital in terms of replacement income over the following 12-month period. In addition, we take the multiplier to be a decreasing function of time as opposed to being a constant, so that the percentage allocation to the PSP matches the equity allocation of a deterministic target date fund at the beginning of the year, and reflects the desire to benefit from mean reversion in the equity risk premium. For instance, if the target allocation at the 20-year horizon is 80%, the multiplier to be applied within the 40th year to retirement is 80/[100 — 80] = 4.

With this investment policy, which is rebalanced on a monthly basis, the GBI strategy represents an improvement over standard forms of target date funds, which do not enjoy the benefits of risk management. In the retirement GBI strategy, the safe component is truly safe because it is defined as a GHP determined by the investor’s goal and horizon, and the allocation strategy is designed to reliably secure a well-defined essential goal, namely to cap the annual loss of purchasing power in terms of replacement income.

The EDHEC-Princeton Retirement Goal-Based Investing Index series complements the EDHEC-Princeton Retirement Goal Price Index series by representing the performance of dynamic GBI strategies invested in the hedging and performance building blocks. The live performance of these indices is available on the the EDHEC-Risk Institute and Princeton ORFE websites

GBI strategies deliver attractive probabilities of reaching aspirational goals set by investors, while securing their essential goals. As such they stand in sharp contrast with traditional target date funds, which can experience potentially unbounded losses in adverse market conditions. Our hope and ambition is that the publication of the EDHEC-Princeton Retirement Goal Price Index series will provide incentives for investment management firms to develop and launch welfare-improving forms of retirement investment solutions.

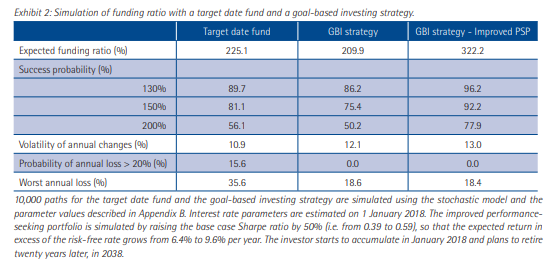

While asset management products are often marketed on the basis of their past track records, historical scenarios are not of direct relevance for investment solutions, even though they can be used to perform stress test analysis. The proper evaluation criterion for a retirement investment solution is indeed its ability to secure an essential goal and its potential to reach aspirational goals over multiple scenarios. Monte-Carlo analysis is well suited for this purpose because it can be used to simulate a wide range of possible market environments, and allows for an analysis of the opportunity costs of various essential goals in terms of the probability to reach aspirational goals. Exhibit 2 shows some statistics on the simulated distribution of the funding ratio, defined as the ratio of the currently affordable income level to the initially affordable one. A ratio of 100% means that the purchasing power of wealth in terms of replacement income has not changed since inception, while a ratio greater than 100% means that the portfolio has outperformed the Goal Price Index, thus leading to an improvement in purchasing power. Exhibit 2 shows that the GBI strategy has similar upside potential as a traditional target date fund, as can be seen from the comparable, albeit slightly lower, probabilities of reaching aspirational goals. Chances of success are further improved if a PSP with a higher Sharpe ratio is available in place of the standard cap-weighted index, thus suggesting that improved benchmarks based on so-called smart factor indices (see Amenc, Goltz, and Lodh (2012); Amenc et al. (2014)) are ideally suited as ingredients in retirement solutions.

The main difference between the standard form of a target date fund and its goal-based investing risk-controlled version is in the annual losses in terms of purchasing power, that is relative to the retirement Goal Price Index. For the GBI strategy, these losses are limited at 20% by construction, although the presence of gap risk inherent in dynamic portfolio strategies can on occasion cause mild violations of these targets, violations that do not materialise in this analysis with monthly rebalancing. In contrast, the target date fund can experience losses as large as 35.6% and has a 15.6% probability of experiencing at least one loss larger than 20%. More importantly, the 0% failure rate for the GBI strategy is robust with respect to parametric assumptions (again in the limits of gap risk) while the probability for its deterministic counterpart to maintain losses in purchasing power below 20% on an annual basis is highly parameterdependent. In robustness checks, we find that raising equity volatility from its base case value of 16.2% to 24.3% implies that the probability jumps from 15.6% to 51.4%.

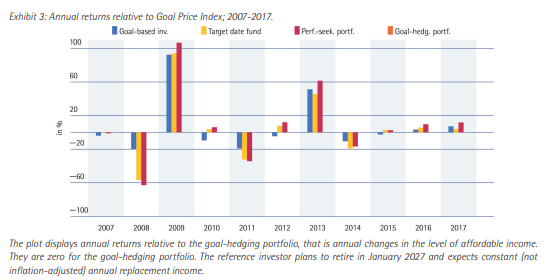

The lack of robustness of target date fund strategies can also be seen in stress tests conducted over historical periods with strong adverse market conditions. Exhibit 3 shows the annual relative returns of the PSP as well as target date fund and retirement GBI strategies between 2007 and 2017. In 2008 and 2011, the severe underperformance of the PSP with respect to the GHP caused losses in the level of affordable income for both strategies, but such losses are much larger for the target date fund, reaching respectively 56.7% and 32.3%. In these years, the built-in risk control mechanism of the GBI strategy maintains the loss roughly at the target level of 20%.

Taken together, these results suggest that GBI principles can be used to design improved forms of retirement investment strategies that retain some of the desirable features of existing target date funds and annuities, which are, respectively, the ability to generate upside potential in a liquid investment vehicle and the ability to secure minimum levels of replacement income, while avoiding their respective drawbacks. By using the proper GHP and a risk-controlled investment approach, retirement GBI strategies secure a fixed fraction of the purchasing power of each dollar invested without sacrificing upside potential. The publication of the EDHECPrinceton Retirement Goal-Based Investing Index series can be regarded as an attempt to provide the investment industry with an incentive to launch new forms of retirement investment solutions better aligned with investors’ objectives.

References

(1) - See Kim and Omberg (1996), Munk, Sørensen, and Vinther (2004) and Sangvinatsos and Wachter (2005) for examples of optimal strategies exhibiting dependence with respect to market conditions. See Cocco, Gomes, and Maenhout (2005) and Cairns, Blake, and Dowd (2006) for the calculation of utility costs with respect to deterministic policies.