Climate Salience and the Demand for Green Stocks by Mutual Funds Around the World

By Dominic O’Kane, Research Director, EDHEC-Risk Climate Impact Institute & Professor of Finance, EDHEC Business School and Teodor Dyakov, Affiliate Member, EDHEC-Risk Climate Impact Institute & Associate Professor, EDHEC Business School

- We conjecture that personal experiences associated with extreme weather events drive the perceptions about climate change among fund managers and get reflected in the stocks they trade.

- To test this prediction, we study the effect of climate salience on the demand for green stocks among active mutual funds operating in 280 distinct global locations.

- We find that climate salience is associated with an increased demand for stocks with lower emission levels and lower emission intensities.

- Our findings suggest that as the frequency of extreme climate events increases, we may observe a further greening of funds’ portfolios.

Introduction

Institutional investors around the world are becoming increasingly concerned about their role in meeting global climate targets (e.g., Krueger, Sautner and Starks, 2020; Stroebel and Wurgler, 2021). In addition, public expectations for a “greener” fund industry have never been higher. The Paris agreement, signed in 2015, calls for the global average temperature increase to remain below 2°C above pre-industrial levels. It specifically asks for us to make “finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development” (United Nations, 2015, page 3). Yet, the impact of climate change on the composition and trading decisions of fund managers remains unclear, with conflicting evidence.[1] Considering the urgency of climate change and the massive commitments of institutional investors around the world to sustainable investing, it is important to perform research to better understand the role of climate change on the mutual fund industry.

We study the role of salient climate events, such as the experience of extremely hot weather, in forming the beliefs and investment portfolios of professional asset managers. Our research is based on a large body of literature, showing that large climate events increase individual awareness about climate change and its consequences (e.g., Akerlof et al., 2013; Myers et al., 2013; Zaval et al., 2014). Since investors are impacted by individual experiences (e.g., Malmendier and Nagel, 2011; Luo, Yao and Zhu (2022)), salient climate events are likely to be important for their asset allocation decisions. Related work by Choi, Gao and Jiang (2020) documents that retail investors pay more attention to infrequent large climate events rather than more frequent events that are smaller in importance.

Our analysis offers support for the importance of climate salience in forming managerial perceptions, using a sample of actively managed mutual funds from 34 domiciles situated in 280 distinct geographical locations. Specifically, we find that managers experiencing abnormally high temperatures during the previous 12 months are more likely to tilt their portfolios towards greener stocks (i.e. stocks with lower levels of emissions and lower emission intensities). Abnormally high temperatures are less likely to change the perceptions of managers who already show awareness of climate change. Consistent with this prediction, green funds exhibit significant demand for green stocks, irrespective of recent temperatures. In contrast, managers of non-green funds are less likely to be aware of the effects of climate change. We show evidence that they exhibit a demand for green stocks only when climate is salient.

Our study is related to an emerging literature investigating the link between environmental concerns and the investment decisions of asset managers. The evidence is mixed. Some studies find a trend of decreasing exposure of institutional investors to companies with high emissions (e.g, Choi, Gao and Jiang, 2023; Gibson Brandon et al. (2022)). In addition, Starks, Venkat and Zhu (2023) show that institutions with long investment horizon hold stocks with higher ESG scores and Nofsinger, Sulaeman and Varma (2019) find that institutions underweight stocks with poor ESG profiles. Atta-Darkua et al. (2023) document that asset managers who join climate-related investor initiatives tilt their portfolios towards stocks with lower emissions. Again, the effects are weak and conditional on the presence of carbon emission schemes within different jurisdictions. Within the US, Pástor, Stambaugh and Taylor (2023) also find weak evidence of the importance of climate for the asset allocation of fund managers. They document that the aggregate tilt of the mutual fund industry towards green stocks is a mere 4% of the assets under management. Bolton and Kacperczyk (2021) show that institutions underweight firms with high emissions, although the effect is limited to the most salient polluting industries, such as oil and gas. Lastly, Fernando, Sharfman and Uysal (2009) show that greener firms tend to have fewer institutional investors but more retail ones. Choi, Gao and Jiang (2020) find similar results.

We contribute to this literature by providing the first global study on the importance of climate salience to the allocating decisions of fund managers. In the aggregate, funds’ investment decisions do not reflect concerns about the climate. However, personal experiences of abnormally high temperatures are reflected in the stocks that funds trade in the form of stronger demand for green stocks.

We further contribute to the literature on the importance of individual life experiences to financial decision making (e.g., Malmendier and Nagel, 2011; Benmelech and Frydman, 2015; Bernile, Bhagwat and Rau, 2017; Cronqvist and Yu, 2017). For example, previous research documents the importance of macro-economic conditions when entering the workplace (Chen et al., 2021) and experience with bubbles (Luo, Yao and Zhu, 2022) to the portfolio choices of fund managers. We contribute by providing fresh evidence on the importance of experiencing salient events, such as the ones related to climate change, in forming the investment decisions of professional asset managers. Related work by Pástor, Stambaugh and Taylor (2021) argue that certain investors enjoy holding green assets as they are willing to sacrifice returns to hold their desired portfolios. In a follow-up paper, Pástor, Stambaugh and Taylor (2022) also argue that green stocks have outperformed in recent years due to previously unanticipated increases in environmental concerns. Our study suggests that personal experience with climate change may contribute to these effects.

Data and Main Variables

Our dataset spans the trading decisions of global actively managed equity mutual funds between 2009 and 2021, combining data from Factset, Morningstar Direct, and Compustat. We restrict our analysis to funds’ trading decisions among equities that are part of the MSCI World Index (consisting of 2,266 unique companies over our sample). There are three advantages to our approach.

- First, the index constituents are among the largest publicly traded companies in the world, for which there are relatively few concerns about data quality.

- Second, emissions data from Trucost do not cover most publicly traded companies. By choosing the equity part of the MSCI World Index, we limit the impact of any selection effects associated with the set of companies covered by Trucost.

- Third, since the MSCI World Index is a widely popular benchmark, the index constituents represent the most liquid stocks in the world. Thus, if managers update their beliefs about climate change, they are likely to trade in the stocks we focus on. The disadvantage of our approach is that we drop trades that are potentially informative about the perceptions of fund managers about climate change. However, the dollar positions among MSCI World stocks represent on average 66% of the total assets under management for the funds in our sample.

Our goal is to study the role of perceptions about climate change in the global asset management industry. Since we conjecture that managers update their beliefs about climate change at the same time as they are experiencing extreme temperature, they are going to contemporaneously enter and exit stocks with the same characteristics, i.e. “herd” into the same type of stocks. Thus, our empirical approach follows the earlier literature on mutual fund herding, which studies the determinants of the fraction of funds buying and selling stocks (“fund demand”) at the same time. In addition, as the greenness of individual stocks is correlated with stock characteristics (Pástor, Stambaugh and Taylor, 2021), we test for the role of perceptions about climate change in driving fund demand for green stocks beyond what can be explained by stock characteristics.

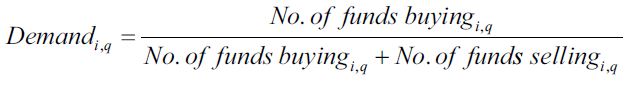

Following Sias (2004), we compute the demand of mutual funds for stock i in quarter q as the raw fraction of funds buying a given stock:

One approach to measure company greenness would be to use the environmental ‘Escores’ provided by one or more of the ESG rating agencies. However, we opt out of this approach, for two reasons. First, previous research documents a substantial variation in scores across the different data providers (e.g., Berg, Kolbel and Rigobon, 2022). The industry disagrees on the scope, measurement, and weight of the various indicators used to construct the scores. Second, Berg, Fabisik and Sautner (2023) point out that at least some of the rating agencies might be retroactively changing scores. This implies that we cannot be certain what exact ratings were available to investors at the time of their trading decisions. We opt to use the firm’s emissions levels and intensities instead[2]. The focus on emissions is motivated by the measure’s popularity among practitioners, the media, and academics. Emission intensities are also easy to interpret and understand. Our source of emissions data, Trucost, reports emissions under the greenhouse gas (GHG) protocol, measured in tonnes of CO2 equivalent (tCO2e) per year. We use the reported values of Scope 1 emissions, which reflect direct emissions produced by companies, as well as total emissions (Scope 1-3). Bolton and Kacperczyk (2021) use the log of reported emissions to uncover a relationship between emissions and returns, which suggests that investors pay attention to that measure. However, Aswani, Raghunandan and Rajgopal (2023) show that emission intensity (emissions scaled by sales) is a better measure of company greenness due to large correlations between emissions and company size. We use both levels and intensities in our analysis.

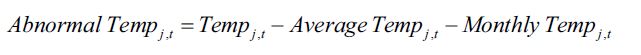

To capture climate salience, we measure abnormal temperature using historical weather data from the National Centers for Environmental Information (NCEI) in the US. This data consists of a daily record of temperatures from more than 9,000 worldwide stations. We extract a time-series of daily mean temperatures from the weather station closest to the physical location of the fund’s office for the period from 2000 to 2023. To compute our quarterly measure of abnormal temperature, we further require that the closest weather station has at least 10 years of historical data with at least 300 observations per year. Following Choi, Gao and Jiang (2020), we decompose observed temperatures into predictable, seasonal, and abnormal components. Specifically:

where  is the average daily temperature in month t for city j; Average

is the average daily temperature in month t for city j; Average  is the average monthly local temperature for city j over the 120 months prior to month t; and Monthly

is the average monthly local temperature for city j over the 120 months prior to month t; and Monthly  is the average temperature for city j in the same calendar month over the last 10 years minus Average

is the average temperature for city j in the same calendar month over the last 10 years minus Average  . The remainder, Abnormal

. The remainder, Abnormal  , captures the abnormal temperature.

, captures the abnormal temperature.

Following Di Giuli et al. (2023), we identify fund managers as experiencing abnormally hot temperatures if Abnormal  is on average higher than 2°F during the previous 12 months. The cutoff of 2°F roughly corresponds to one-standard deviation in the distribution of the abnormal temperature and reflects our choice to focus on the most salient weather events.

is on average higher than 2°F during the previous 12 months. The cutoff of 2°F roughly corresponds to one-standard deviation in the distribution of the abnormal temperature and reflects our choice to focus on the most salient weather events.

Empirical Tests

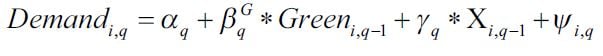

We estimate panel regressions of the demand of mutual funds for green stocks, controlling for stock and industry characteristics:

where  ,q−1 measures the ‘greenness’ of a stock using either company emissions levels or intensities computed at the end of the previous quarter. The vector of control variables

,q−1 measures the ‘greenness’ of a stock using either company emissions levels or intensities computed at the end of the previous quarter. The vector of control variables  includes characteristics associated with funds’ demand: size, book-to-market, profitability, investment, dividends-to-book, market beta, short-term reversal, momentum, and lagged demand (Gompers and Metrick, 2001; Sias, 2004; Koijen and Yogo, 2019; Pástor, Stambaugh and Taylor, 2023). Our regressions include both time and industry-fixed effects.

includes characteristics associated with funds’ demand: size, book-to-market, profitability, investment, dividends-to-book, market beta, short-term reversal, momentum, and lagged demand (Gompers and Metrick, 2001; Sias, 2004; Koijen and Yogo, 2019; Pástor, Stambaugh and Taylor, 2023). Our regressions include both time and industry-fixed effects.

The control variables and fixed effects are important for teasing out the relationship between fund demand and stock greenness. Pástor, Stambaugh and Taylor (2021) show that stock characteristics are correlated with ESG scores. Hence, mutual funds might appear to be trading on “green” information while they actually change their portfolio exposure following, for instance, a style exposure. In addition, funds may be restricted in their investment opportunity set because of their mandated investment objectives. For example, value funds may appear to be less green than growth funds, simply because value stocks appear to have on average lower environmental scores than growth stocks. However, a climate conscious value investor might still tilt their portfolio towards greener value stocks part of their investment opportunity set, even though that set consists of stocks that have on average lower environmental ratings.

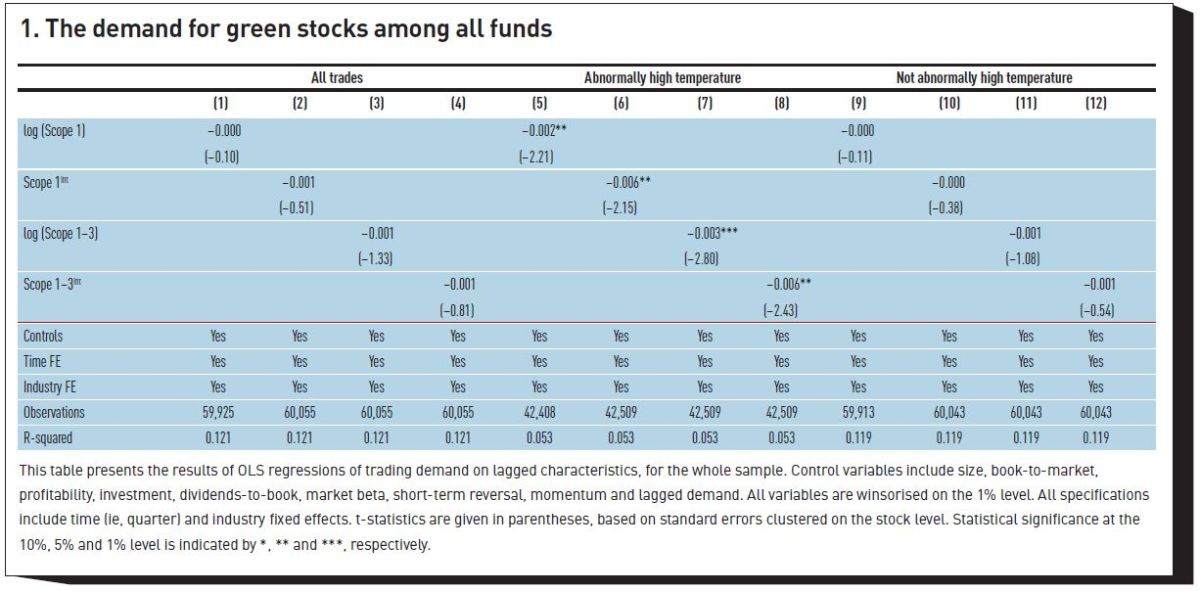

We report our main findings in Table 1. Overall, active funds do not trade in the direction of emissions (specifications 1-4). However, following abnormally high temperatures, funds tilt their portfolios towards greener stocks (specifications 5-8). The results hold when we proxy for green stocks using both the level or intensity of emissions, as well as when we use direct (Scope 1) and total emissions (Scope 1-3). Thus, increased awareness about climate change changes perceptions about the importance of climate in forming the investment decisions of professional asset managers.

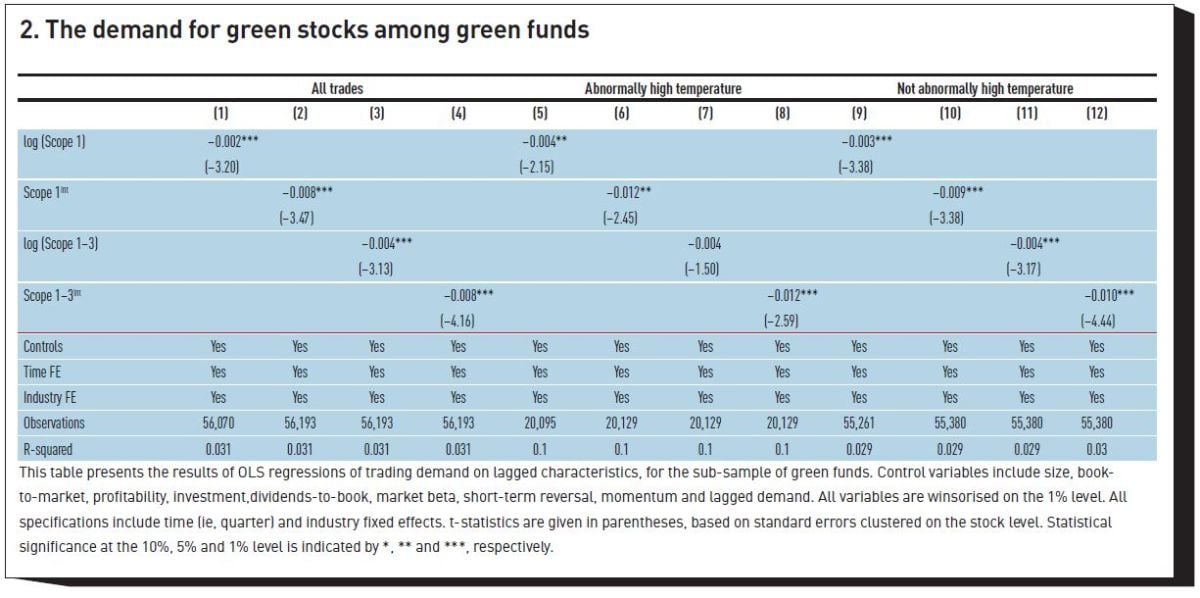

Some investors may already be aware of the effects of climate change, even when climate is not salient. To test this prediction, we focus on a sub-sample of green funds only. These funds are most likely to incorporate beliefs about climate change in their trades, even when climate is not salient. A fund is classified as green if its name or reported strategy in Morningstar contains one of the strings: SRI, ESG, Social, Green, Environ, Responsible, Clean, Renewable, Sustain, or Impact. We study the demand of green funds for green stocks and report the results in Table 2. The demand of green funds is strongly related to all proxies of stock greenness, reflecting green funds’ preference for green stocks. The findings support our intuition that in general, managers of green funds have stronger perceptions about the effects of climate change.

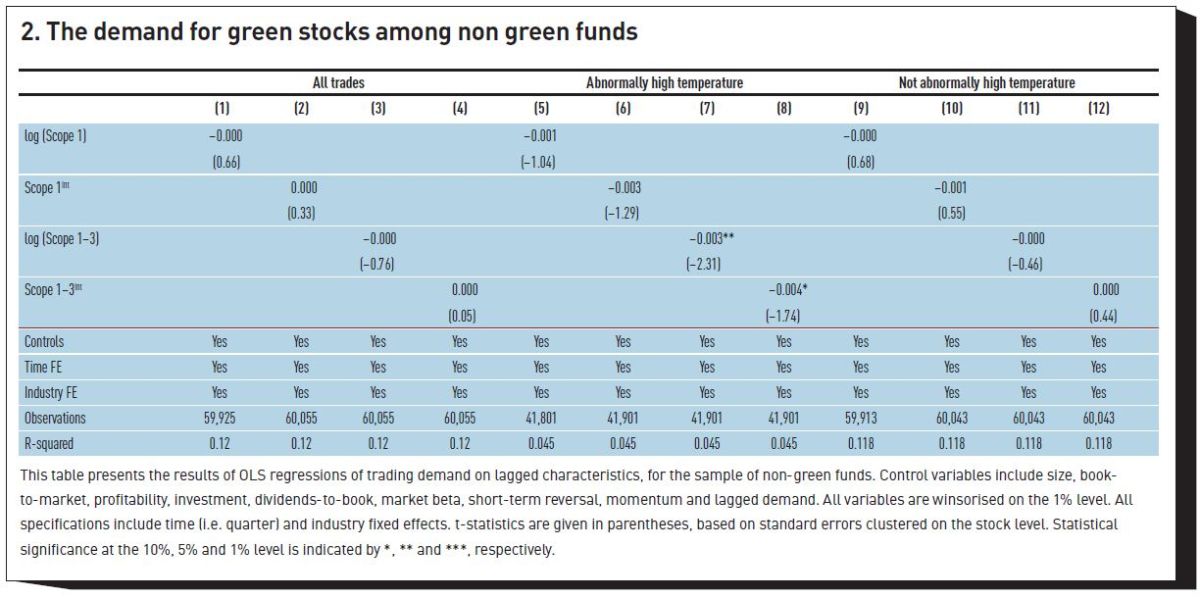

In contrast, abnormally high temperatures are likely to change the perceptions of investors who are less aware of the consequences of climate change. To test this, we first focus on a sub-sample of non-green funds. Overall, the demand of non-green funds is not driven by our proxies of stock greenness (specifications 1-4 in Table 3). However, following abnormally high temperatures, managers in non-green funds appear to buy stocks with relatively lower Scope 1-3 emission levels and intensities (specifications 7-8). We don’t find statistically significant results when we proxy for greenness using only Scope 1 emissions, although the estimated coefficients point in the same direction (specifications 5-6).

One potential reason for this might be that Scope 1-3 emissions may be perceived to be more informative about the stock greenness than the direct Scope 1 emissions. Last, there is no evidence that managers in non-green funds tilt their portfolios towards green stocks when climate is not salient, consistent with our intuition that they are in generally less perceptive about the impact of climate change (specifications 9-12).

Conclusion

We show that climate salience is important for the perceptions of mutual fund managers, as reflected in their trading decisions. Following abnormally high temperatures, the fund industry prefers to buy stocks with lower emission levels and emission intensities. We further show that the effect of abnormal temperatures on portfolio choices likely stems from fund managers who are most likely to update their perceptions about climate change. Our findings are informative about the formation of perceptions of climate change in the global fund industry, and the possible changes of these perceptions in the future. As the frequency of extreme climate events continues to increase, we are likely to see further greening of funds’ portfolios.

We are currently conducting research, investigating the role of news mentions about climate change in the media as an additional driver of climate change salience. Our results also offer directions for future research. For example, the salience of climate change may have a more pronounced impact on the way investors allocate capital across fund managers rather than the way fund managers allocate across holdings. That is, climate salience may impact aggregate institutional holdings via a stronger demand for green funds among fund investors rather than a stronger demand for green stocks among fund managers. For policymakers interested in the greening of institutional portfolios, a fruitful direction of research would be the implementation of tools that increase awareness about the impact of climate change particularly among managers of funds without an explicit mandate of investing in green assets.

The research from which this article was drawn was supported by Amundi.

Footnotes

[1] See, for example, Choi, Gao and Jiang, 2020; Bolton and Kacperczyk, 2021; Gibson Brandon et al., 2022; Atta-Darkua et al., 2023; Choi, Gao and Jiang, 2023; Starks, Venkat and Zhu (2023); Pástor, Stambaugh and Taylor (2023)

[2] A company’s C02 emission intensity is measured as the company’s CO2 equivalent annual output divided by its annual sales revenue.

References

Akerlof, K., E.W. Maibach, D. Fitzgerald, A.Y. Cedeno and A. Neuman (2013). Do people “personally experience” global warming, and if so how, and does it matter? Global Environmental Change 23(1): 81–91.

Aswani, J., A. Raghunandan and S. Rajgopal (2023). Are Carbon Emissions Associated with Stock Returns? Review of Finance.

Atta-Darkua, V., S. Glossner, P. Krueger P. and Matos (2023). Decarbonizing Institutional Investor Portfolios: Helping to Green the Planet or Just Greening Your Portfolio? Working Paper.

Benmelech, E. and C. Frydman (2015). Military CEOs. Journal of Financial Economics 117(1): 43–59. NBER Conference on the Causes and Consequences of Corporate Culture.

Berg, F.,K. Fabisik and Z. Sautner (2023). Is History Repeating Itself? The (Un)Predictable Past of ESG Ratings. Working Paper.

Berg, F., J.F. Kolbel and R. Rigobon (2022). Aggregate Confusion: The Divergence of ESG Ratings. Review of Finance 26(6): 1315–1344.

Bernile, G., V. Bhagwat and P.R. Rau (2017). What doesn’t kill you will only make you more risk-loving: Early-life disasters and CEO behavior. The Journal of Finance 72(1): 167–206.

Bolton, P. and M. Kacperczyk (2021). Do investors care about carbon risk? Journal of Financial Economics 142(2): 517–549.

Chen, J., M. Lasfer, W. Song and S. Zhou (2021). Recession managers and mutual fund performance. Journal of Corporate Finance 69:102010.

Choi, D., Z. Gao and W. Jiang (2020). Attention to Global Warming. The Review of Financial Studies 33(3): 1112–1145.

Choi, D., Z. Gao, W. Jiang and H. Zhang (2023). Global Carbon Divestment and Firms’ Actions. Working Paper.

Cronqvist, H. and F. Yu (2017). Shaped by their daughters: Executives, female socialization, and corporate social responsibility. Journal of Financial Economics 126(3): 543–562.

Di Giuli, A., A. Garel, R. Michaely and A. Petit-Romec (2023). Climate Change and Mutual Fund Voting on Environmental Proposals. Working Paper.

Fernando, C.S., M.P. Sharfman and V.B. Uysal (2009). Do investors want firms to be green? environmental performance, ownership, and stock market liquidity. Academy of Management Proceedings 2009(1): 1–6.

Gibson Brandon, R., S. Glossner, P. Krueger, P. Matos and T. Steffen, T. (2022). Do Responsible Investors Invest Responsibly? Review of Finance 26(6): 1389–1432.

Gompers, P. and A. Metrick (2001). Institutional Investors and Equity Prices. Quarterly Journal of Economics 116(1): 229–259.

Koijen, R.S.J. and M. Yogo (2019). A demand system approach to asset pricing. Journal of Political Economy 127(4): 1475–1515.

Krueger, P., Z. Sautner and L.T. Starks (2020). The Importance of Climate Risks for Institutional Investors. The Review of Financial Studies 33(3): 1067–1111.

Luo, D., Z. Yao and Y. Zhu (2022). Bubble-crash experience and investment styles of mutual fund managers. Journal of Corporate Finance 76: 102262.

Malmendier, U., and S. Nagel (2011). Depression Babies: Do Macroeconomic Experiences Affect Risk Taking? The Quarterly Journal of Economics 126(1): 373–416.

Myers, T., E. Maibach, C. Roser-Renouf, K. Akerlof, A.A. and Leiserowitz (2013). The relationship between personal experience and belief in the reality of global warming. Nature Climate Change 3: 343–347.

Nofsinger, J.R., J Sulaeman and A. Varma (2019). Institutional investors and corporate social responsibility. Journal of Corporate Finance 58: 700–725.

Pástor, L., R.F. Stambaugh and L.A. Taylor (2021). Sustainable investing in equilibrium. Journal of Financial Economics 142(2): 550–571.

Pástor, L., R.F. Stambaugh and L.A. Taylor (2022). Dissecting green returns. Journal of Financial Economics 146(2): 403–424.

Pástor, L., R.F. Stambaugh and L.A. Taylor (2023). Green Tilts. Working Paper.

Sias, R.W. (2004). Institutional Herding. The Review of Financial Studies 17(1): 165–206.

Starks, L., P. Venkat and Q. Zhu (2023). Corporate ESG Profiles and Investor Horizons. Working Paper.

Stroebel, J. and J. Wurgler (2021). What do you think about climate finance? Journal of Financial Economics 142(2): 487–498.

United Nations (2015). Paris Agreement. United Nations Treaty Collection. Accessed: 1 July 2023.

Zaval, L., E. Keenan, E.J. Johnson and E.U. Weber (2014). How warm days increase belief in global warming. Nature Climate Change 4: 143–147