Climate scenarios for financial risk analysis

By Irene Monasterolo, Research Programme Director, EDHEC-Risk Climate Impact Institute; Professor of Climate Finance, EDHEC Business School

This article by Irene Monasterolo has been originally published in the EDHEC Research Insights Supplement to Investment & Pensions Europe and Pensions & Investments and the inaugural EDHEC-Risk Climate Impact Newsletter. To subscribe to this complimentary newsletter, please contact: [email protected].

- Climate scenarios have become an important tool for investors, including those in the insurance and reinsurance industry who traditionally dealt with disaster risks.

- To meet supervisory requests, many investors must now disclose and assess their climate-related financial risks using climate scenarios. (eg those developed by central banks and financial regulators for Greening the Financial System).

- Our understanding of the characteristics of these scenarios in comparison to short-term scenarios traditionally used for stress-test is still limited.

- Here we provide an overview of the existing scenarios, discussing current challenges and opportunities for further development.

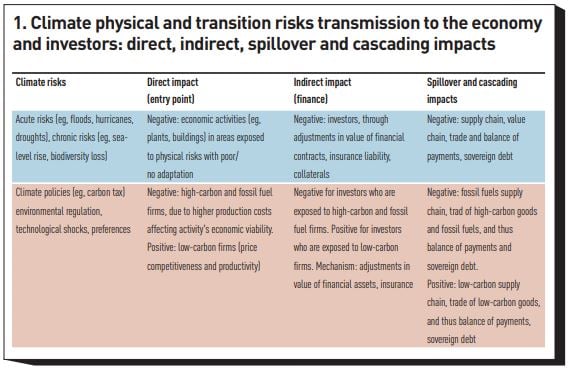

Climate-related financial risks

The assessment of climate-related financial risks plays an important role in the agenda of central banks and financial supervisors. In 2015, the then Governor of the Bank of England and Financial Stability Board Chair Mark Carney, in his speech to the Lloyd’s of London about the “Tragedy of the Horizons”, warned the financial industry about the losses that it could face due to the unfolding of climate risks (Carney, 2015). In particular, Carney identified three main channels through which climate risks could affect the financial industry, namely physical, transition and liability risks. These are characterised by different drivers, and thus by different entry points in the economy, and transmission channels to the agents in the economy, to investors and sovereigns:

- Physical risks refer to the impacts on business performance and, through that, on the value of firms’ financial assets and investors’ portfolios, induced by acute risks, i.e. weather-related events such as floods and hurricanes, and chronic risks, e.g. temperature increase, sea-level rise and biodiversity loss. For instance, a flood that critically damages a firm’s productive plants could impair the firm’s profitability and even lead to bankruptcy, if the affected plants are a core part of the firm’s business. The economic loss can then translate to a financial loss, whereby the loss in performance translates to a negative adjustment in the financial assets (e.g. stocks, bonds) or an inability to repay outstanding loans that eventually affecting investors directly. If these activities have liability cover, e.g. insurance, then insurance (and reinsurance) firms could also suffer from larger claims.

- Transition risks refer to the impacts on business performance and, through that, on the value of firms’ financial assets and investors’ portfolios, induced by a change in the climate policy and regulatory environment (e.g. a late and sudden introduction of a carbon tax), technological shocks and changes in consumers’ preferences. For instance, a late introduction of a carbon tax would lead to larger costs and lower profits for firms that extract, produce or use fossil fuels for their business, being fossil fuel combustion a main driver of CO2 emissions[1]. This economic loss can translate then in a financial loss, whereby the loss in firm’s performance translates to a negative adjustment to financial assets or an inability to repay outstanding loans, eventually affecting investors through carbon stranded assets (i.e. assets whose value could decrease abruptly as a result of a phase out of fossil fuels and high-carbon activities). See Lenton et al. (2011 and McGlade and Ekins (2015).

- Liability risks refer to economic and financial actors who have experienced losses from the effects of climate change or climate policies and regulations and seek compensation from those they hold responsible. We already see examples of liability risks involving fossil fuel extractive companies and sovereigns that passed legislation aimed at preventing new fossil fuels explorations (see e.g. the case of Rockhopper Exploration against Italy[2]).

The analysis of climate risks is particularly relevant to the insurance and reinsurance industry. On the one hand, insurers and reinsurers are expected to provide tailored financial instruments, including disaster risk financing, agricultural insurance, property catastrophe risk insurance, and expertise to help governments and businesses copying with disasters. Yet, at the current time, the most catastrophe losses, including those caused by climate change, are not covered by insurance, leaving millions of households and businesses faceing a large and widening protection gap[3]. Furthermore, the same insurance industry has already highlighted that unmitigated climate change could lead to risks that would be uninsurable, in particular in the absence of timely policy action for mitigation (e.g. carbon pricing) and adaptation finance.

On the other hand, insurance and reinsurance firms are increasingly required by regulators to disclose and assess climate risks on both sides of the balance sheet, considering uncertainties of scenarios and different time horizons, and to develop climate risk management strategies.[4].

Climate risk scenarios

The use of scenarios is not a novelty in stress-test exercises. However, the novelty of climate scenarios compared with traditional stress-tests scenarios is the longer time horizon (starting from 10 years for transition risk up to 2100 for physical risks). The need to consider longer time horizons corresponds with the nature of climate risks, whose greatest negative impacts on the economy are expected to play out in the mid-term as a consequence of poor mitigation leading to increases in emissions concentration in the atmosphere and a lack of investment in adaptation. Furthermore, the data and models to develop climate scenarios differ from standard scenarios.

Physical risks

Between 2011 and 2021, economic losses from natural disaster events globally reached USD363 billion[5] ; some 80% of the economic losses due to natural disasters are triggered by extreme weather and climate-related events[6] . Disaster risk derives from the interaction of social and environmental processes, and is defined as the combination of physical hazards and the vulnerabilities of exposed elements (Cardona et al., 2012). Vulnerability of households and business to climate risks is heterogeneous across countries and geographies.

Physical risks are particularly relevant to the insurance and reinsurance industry, which has long used catastrophe risk models to assess them. Acute physical climate risks (i.e., weather events or hazards) have traditionally been analysed with probabilistic risk assessment models and catastrophe risk models used, for instance, by the insurance industry. These models translate the strength of a meteorological event (e.g. wind) into the power of a hazard related to that (e.g. hurricanes) and from that, through a damage function, into the economic losses for the activities located in areas hit by the hazard.

These models build on loss and damage data provided by loss databases that contain a record of events and related economic losses. However, only a few large-scale, consistent, open-access disaster risks and losses databases exist. Many are hazard specific (e.g. the European Commission Joint Research Center Global Database of Drought Events for droughts, the Global Risk Data Platform (UNEP-GRDP) for storms, floods and cyclone wind, and Fathom-Global provides flood hazard data. In addition, the accuracy and consistency of reporting across databases for the same hazard hitting the same country is often low, due to different data collection and cleaning procedures. Examples of open-access disaster risks databases include EM-DAT[7] (which provides aggregate losses at national level at the global scale) and DesInventar Sendai[8] (which records losses at the subnational level disaggregated by type of activity but mostly covering low-income and emerging countries).

An analysis of the evolution of disaster risk and overall the “health” of the climate is provided every seven years by the IPCC, which releases a report divided into chapters and working groups, the first one covering the physical science basis (IPCC, 2021). Scenarios used by the IPCC are characterized by four Representative Concentration Pathways (RCPs), which consist of pathways of GHG emissions levels and other radiating forces (i.e. the difference between incoming and outgoing energy in the Earth’s climate) that might occur up to 2100:

- RCP2.6, a stringent mitigation scenario, which correspond to less than 2°C of (global average) temperature increase above pre-industrial levels.

- RCP4.5 and RCP6.0, which are intermediate GHG emissions scenarios leading to a 2.7-5°C increase.

- RCP8.5, the high-end scenario characterized by high GHG emissions.

The Shared Socioeconomic Pathways (SSPs), by contrast, represent different narratives of socio-economic and geopolitical developments to explore how societal choices (e.g. reliance on fossil fuels, trade agreements and barriers, demographic growth) would affect GHG emissions and, therefore, the achievement of the temperature targets of the Paris Agreement. The RCPs can be combined with the SSPs to analyse the role of climate policies that would enable us to mitigate and adapt to climate change, as in the 6th Assessment Report CMIP6 global climate modelling exercise.

Transition risk

The IPCC reviews the trajectories of energy technologies (e.g. primary energy/coal, secondary energy/electricity/wind) and their uses in economic activities, provided by process-based Integrated Assessment Models, or IAMs (Weyant, 2017). These are scientific models that link components of demographics and the economy into one “integrated” modelling framework along with the biosphere, the atmosphere and the climate. Process-based IAMs provide scenarios of climate change mitigation coherent with a given temperature target (e.g. “below 2°C”). They include a detailed representation of the physical system, energy systems, land-use change, agriculture, infrastructure, technology, etc. Process-based IAM also provide a detailed description of the impacts of mitigation scenarios on the energy demand and emissions trajectories and on energy technology (fossil fuels, including coal, oil, gas, and renewable energy, including wind, solar, hydropower, etc). However, they have a relatively simple low granularity in the representation of the economy, composed of a few representative sectors whose investment decisions are based on either welfare maximization or cost minimization.

Given a certain carbon budget consistent with a specific temperature target, e.g. 1.5°C or 2°C, these models provide the minimum-cost trajectory consistent with a given target and the cost of a global carbon tax on fossil fuel energy. They also show how the energy demand by technology, by country or region, should adjust (i.e. increase or decrease) through time.

How climate scenarios help us understand climate risks for the insurance sector

The European Insurance and Occupational Pension Authority (EIOPA) and the Bank of England[9] are recent examples of supervisory calls for the insurance and reinsurance industry to run climate stress-test using climate scenarios (EIOPA 2022b, Bank of England 2022).

EIOPA recommended the scenarios developed by the NGFS in collaboration with the process-based IAM community for transition risk[10] , and with the catastrophe risk modelling community to approach physical risks (using CLIMADA; see Bresch and Aznar-Siguan 2021). These scenarios, which have been launched in 2020, are now at their third release (NGFS 2022) and are continuously updated to keep pace with advancements in the science of climate change, data availability and modelling.

The NGFS scenarios build on the IPCC scenarios, characterised by SSPs and RCPs discussed above, and attach to that explicit dimension of physical and transition risk, depending on how climate policy (i.e. a carbon tax) is introduced.

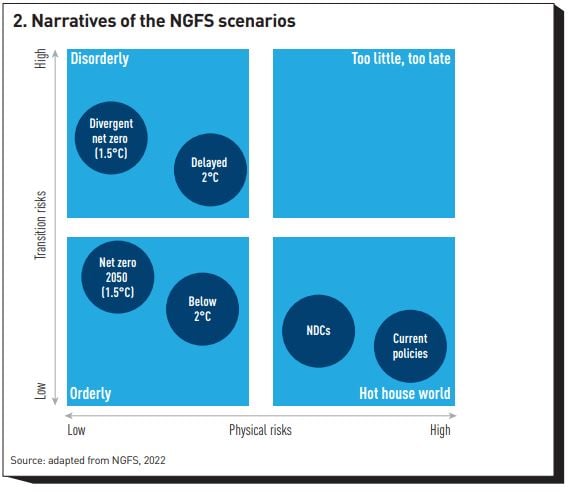

In this regard, the NGFS scenarios are characterized by different levels of physical and transition risks, driven by scenario-specific characteristics including:

- The level of policy ambition, i.e. whether the temperature objectives are consistent with the Paris agreement (1.5°C, 2.0°C) or higher, which would yield higher physical risk.

- The timing of the policy response, either immediate or delayed after 2030. The more delayed the policy action, the smaller the remaining carbon budget for any level of policy ambition, leading to greater transition risk, especially for high ambition scenarios (1.5°C).

- The level of policy coordination across countries and the effects of different carbon prices across economic sectors. The more variation in regional or sectoral policies, the greater the transition risk.

- The pace of technological change. On the one hand, the faster the technological development, the larger the economic disruption experienced by incumbent firms. On the other hand, the faster green technology develop, the easier it will be to decarbonize the economy and reach global climate goals.

- The availability and deployability of carbon sequestration and CO2 removal technologies (CDR), which would translate into less deep emissions cuts, reducing transition risk.

Today’s NGFS scenarios provide a common reference point for understanding how climate change (physical risk) and climate policy and technology trends (transition risk) could evolve given the potential introduction of climate policies (carbon tax), GHG emissions trajectories and other variables. These futures are translated into narratives of how the transition could occur and their implications in terms of physical and transition risks (NGFS, 2022). It is important to highlight that the NGFS scenarios are not forecasts of what will happen in the future but provide trajectories of how the energy demand of individual sectors, by country or region, should adjust (i.e. increase or decrease) through time, to decarbonize the economy and achieve a pre-specified carbon budget objective.

In their 3rd revision, the NGFS scenarios explore a set of six scenarios and sub-scenarios, summarised in Figure 2:

- Orderly scenarios (OS), which assume that climate policies (i.e. a carbon tax) are introduced early and become gradually more stringent. OS include i) Net Zero 2050, which aims to limit global warming to 1.5°C through stringent climate policies and innovation, reaching global net zero CO2 emissions around 2050, and ii) Below 2°C, in which the stringency of climate policies gradually increases, giving a 67% chance of limiting global warming to below 2°C. OS are characterized by low transition risk and low physical risk because mitigation is done early.

- Disorderly scenarios (DS), which explore higher transition risk due to policies (i.e. a carbon tax) being delayed or divergent across countries and sectors. The later the policy introduction, the costlier, e.g. carbon prices are typically higher for a given temperature outcome if introduced after 2030. DS include i) Divergent Net Zero, which reaches net zero around 2050 but with higher costs due to divergent policies introduced across sectors, leading to a quicker phase out of oil use, and ii) Delayed transition, which assumes that annual emissions do not decrease until 2030 thus requiring a strong carbon tax to limit warming to below 2°C, and that the use of negative emissions is limited. DS are characterized by high transition risk because policies are introduced later and are thus costlier. However, physical risk is low because mitigation is eventually done.

- Hot house world scenarios (HHW), which assume that some climate policies are implemented in some jurisdictions, but globally efforts are insufficient to halt significant global warming. HHW scenarios include Nationally Determined Contributions (NDCs), i.e. all pledged targets even if not yet backed up by implemented effective policies, and Current Policies, which assume that only currently implemented policies are preserved, leading to high physical risks. HHW scenarios result in severe physical risk including irreversible impacts like sea-level rise.

Operationalization of climate scenarios for financial risk analysis

Several central banks and financial supervisors across the world have conducted climate-stress test on the banks and other financial institutions under their supervision, using the NGFS scenarios. These include the European Central Bank (e.g. Alogoskoufis et al., 2021), Banque de France (Allen et al. 2020), the Austrian National Bank (Gurth et al. 2021), and the French Regulatory Authority (Clerc et al. 2021). In the European Union, banks and financial institutions such as insurance firms are required to use the NGFS scenarios in their climate stress tests and scenario analyses (see e.g. ECB 2022).

But what does it mean in practical terms to use the NGFS scenarios for climate stress test? The methodological framework used now by several of these actors to translate climate scenarios trajectories developed by process-based IAM into financial risk analysis was introduced by Battiston et al. (2017) in the context of climate stress-testing of the financial system.

Using NGFS scenarios for climate financial risk assessment consists of the translation of output of trajectories provided by the process-based IAM for different types of economic activities depending on their energy technology input (e.g. primary energy/fossil, secondary energy/electricity/wind) into adjustments of sectoral performance (e.g. profits). The adjustment in sectoral performance occurs across policy scenarios as a difference in the output of the activity when moving from a baseline scenario of current policy to a 2°C or to a 1.5°C scenario (see e.g. Monasterolo, Zheng and Battiston, 2018).

The adjustment in performance is translated into adjustments in firm’s risk metrics, e.g. the probability of default (PD) or Loss Given Default (LGD), which in then translated into the adjustment of the valuation of financial contracts and securities (e.g. stocks, bonds) owned by the investor (Battiston et al., 2017; Monasterolo and Battiston, 2020).

The adjustments in financial valuation of contracts and securities are then used as an input for the adjustment in financial risk metrics (e.g. climate VaR, climate ES) of the investor who holds firms’ contracts and securities, conditional on the climate scenarios (Battiston et al. 2017).

Finally, an analysis of the reverberation of losses can be conducted, usually using a financial network model, considering second, third and fourth round losses (e.g. in networks of banks and investment fund, Roncoroni et al., 2021).

Scenario limitations and opportunities for development

Climate scenarios play an increasingly important role in financial risk assessment as a result of evolving regulatory requirements and voluntary adoption for internal risk management. However, while scenarios have gone through several rounds of updates already, some limitations persist.

First, current climate scenarios do not properly account for acute risks from extreme weather events (Ranger Mahul, & Monasterolo, 2022). In the NGFS scenarios, acute risks from natural disasters are underrepresented. So far, physical risk scenarios have a good representation of hurricanes and yet partially of floods (at a less granular resolution). However, other main sources of stress such as droughts, which have been particularly relevant for the EU in the last summer, and water scarcity, are not considered yet. Furthermore, the translation of hazards into economic losses is still done at an aggregate level. A more granular representation of the productive assets exposed to losses from natural disaster would contribute to a better assessment of economic and financial risks for firms owning the assets, and their investors (Bressan, Monasterolo & Battiston, 2022).

Second, the scenarios currently neglect the fact that climate-related risks do not happen in isolation, but they may compound with shocks of other nature, such as pandemics and debt crises. This is for instance the case of several countries in the African continent that were already affected by drought when COVID-19 emerged. Other examples include several Caribbean countries that have been affected by tropical cyclones during the COVID-19 crisis; some were already under fiscal surveillance of the IMF, such as Barbados. Accounting for compound risk matters in designing an effective fiscal and financial response. Indeed, research shows that when climate risks compound, either among themselves (such as the case of multiform floods – Kruczkiewicz et al 2022) or with other forms of risks such as pandemics, they can amplify the magnitude and duration of economic losses (Dunz et al 2021).

Third, the climate scenarios recommended by the regulators focus on the stand-alone damages caused by climate change in isolation. There are, however, relatively rare but plausible cases of more than one stress event, of different natures, happening at the same time (eg, high climate damage combined with a pandemic or a war – as was again the case for African nations already hit by droughts and COVID-19. If this joint occurrence materialises, the compound damages can be much higher than the sum of the stand-alone damages (see, eg, Dunz et al 2011). To the extent that these ‘joint catastrophes’ are considered sufficiently likely to warrant attention, this should influence the design of an effective fiscal and financial response. Unfortunately, the stand-alone nature of the climate scenarios recommended by the regulators does not enable this rare but potentially very severe compounding of effects to be taken into account. Thought should be given to how this shortcoming could be fixed – or, at the very least, scenario users should keep in mind these limitations when assessing the model outputs.

Fourth, spillover and cascading climate risks are still neglected by climate scenarios. On the one hand, research shows that climate transition risks are not constrained within a country’s borders (imagine the introduction of climate policies and regulations in a country that ratified the Paris Agreement). Transition risk can spill over from a country that introduced climate policies – such as carbon pricing – to its fossil fuel trading partner. The fossil fuel exporting country would be indirectly and negatively affected by the introduction of climate policies in its trading partner through lower quantity exported and prices, which in turn would negatively affect the balance of payment, fiscal revenues and sovereign debt (Gourdel et al 2021). Consider for instance the case of China, which is a main importer of fossil fuels from Indonesia. Since China recently introduced ambitious regional carbon pricing, its future import of coal from Indonesia would decline. This, in turn, would negatively affect exports of Indonesia’s mining firms, their profitability and contribution to Indonesia’s fiscal revenues, with negative implications for Indonesia’s balance of payment and sovereign debt/GDP.

Fifth, climate scenarios are currently constructed without accounting for the role of the financial system. In particular, they do not account for the impact of investors’ expectations on the realization of the scenarios themselves. This is a limitation to the relevance of climate scenarios for the analysis of climate risks and opportunities from climate-aligned portfolio rebalancing (Battiston et al. 2021). Indeed, if investors trust that countries will embrace a decarbonization trajectory, e.g. by introducing a carbon tax, they will adjust risk perception and reallocate capital towards low-carbon activities. This is because estimates of the value of investments in low resilience activities under transition scenarios are typically lower than in business-as-usual scenarios. Therefore, investors’ expectations and interplay with policy credibility play a main role for aligning investors’ incentives to the transition objectives, and thus for failing or making the mitigation.

Footnotes

[1] The later the introduction of the tax, the higher the value and thus the larger the costs for high-carbon firms. This is due to the fact that the more we wait to introduce the tax, the lower the carbon budget (i.e. the amount of anthropogenic CO2 emissions that can still be introduced in the atmosphere given a certain temperature target, Allen et al. 2009) available coherent with the Paris Agreement temperature target of 2°C temperature increase by 2100.

[2] In 2022, after a five-year arbitration under the Energy Charter Treaty, Italy was ordered to pay €190 million to Rockhopper Exploration, an UK oil and gas company, over a ban on near-shore drilling that prevented opening a new oilfield in the Adriatic Sea.

[3] See e.g. Swiss Re: https://www.swissre.com/risk-knowledge/mitigating-climate-risk/natcat-co...

[4] Recent examples are Art. 262 of the delegated Solvency II regulation; the European Supervisory Authorities’ Joint Regulatory Technical Standards on Environmental Social Governance (ESG) disclosure; the Securities and Exchange Commission (SEC) and the National Association of Insurance Commissioners (NAIC)’s proposals for climate risks disclosure. In the European Union (EU), the European Insurance and Occupational Pension Authority (EIOPA) provided an application guidance on for climate scenarios analyses in the Own Risk and Solvency Assessment (ORSA) that considers the scenarios reviewed by the Intergovernmental Panel on Climate Change (IPCC) and the scenarios developed by the Central Banks and Financial Regulators’ Network for Greening the Financial System (NGFS) (EIOPA 2022a).

[5]https://www.statista.com/statistics/510894/natural-disasters-globally-an...

[6] UNISDR (2017).

[7] EM-DAT, The International Disaster Database. https://www.emdat.be/

[8] DesInventar Sendai, a Disaster Information Management System. https://www.desinventar.net/

[9] Note that the Bank of England’s Climate Biennial Exploratory Scenario (CBES) includes different scenarios from the EIOPA’s exercise. The CBES includes three scenarios exploring both transition and physical risks, to different degrees. The exercise considered two possible routes to net-zero UK greenhouse gas emissions by 2050: an ‘Early Action’ (EA) scenario and a ‘Late Action’ (LA) scenario. A third ‘No Additional Action’ (NAA) scenario explores the physical risks that would begin to materialise if governments around the world fail to enact policy responses to global warming.

[10] The NGFS adopted three of the existing process-based IAM, i.e. GCAM, MESSAGE-Globiom and REMIND-MagPie.

References

Allen, T., Dees, S., Caicedo Graciano, C. M., Chouard, V., Clerc, L., de Gaye, A., ... & Vernet, L. (2020). Climate-related scenarios for financial stability assessment: An application to France. Banque de France working paper 774.

Alogoskoufis, S. et al. (2021). ECB economy-wide climate stress-test. Methodology and results. Occasional Paper Series 281. European Central Bank.

Bank of England (2022). Results of the 2021 Climate Biennial Exploratory Scenario (CBES), 24 May 2022.

Battiston S., I. Monasterolo, K. Riahi, K. and B. van Rujiven (2021). Accounting for finance is key for climate mitigation pathways. Science 372(6545): 918-920.

Battiston S., A. Mandel, I. Monasterolo, F. Schuetze & G. Visentin (2017). A Climate stress-test of the financial system. Nature Climate Change 7, 283–288.

Bresch, D.N., & Aznar-Siguan, G. (2021). Climada v1.4.1: Towards a globally consistent adaptation options appraisal tool. Geoscientific Model Development, 14, 351–363.

Bressan, G., I. Monasterolo and S. Battiston (2022). Sustainable investing and climate transition risk: a portfolio rebalancing approach. Journal of Portfolio Management, special issue “Novel risks” edt. by F. Fabozzi (https://jpm.pm-research.com/content/early/2022/07/14/jpm.2022.1.394).

Cardona, O.D., M.K. van Aalst, J. Birkmann, M. Fordham, G. McGregor, R. Perez, R.S. Pulwarty, E.L.F. Schipper, and B.T. Sinh (2012). Determinants of risk: exposure and vulnerability. In: Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation [Field, C.B., V. Barros, T.F. Stocker, D. Qin, D.J. Dokken, K.L. Ebi, M.D. Mastrandrea, K.J. Mach, G.-K. Plattner, S.K. Allen, M. Tignor, and P.M. Midgley (eds.)]. A Special Report of Working Groups I and II of the Intergovernmental Panel on Climate Change (IPCC). Cambridge University Press, Cambridge, UK, and New York, NY, USA, pp. 65-108.

Carney, M. (2015). Breaking the tragedy of the horizon–climate change and financial stability. Speech

given at Lloyd’s of London by the Governor of the Bank of England.

Clerc, L., A.-L. Bontemps-Chanel, S. Diot, G. Overton, S. Soares de Albergaria, L. Vernet and M. Louardi (2021). A First assessment of financial risks stemming from climate change: The main results of the 2020 climate pilot exercise. ACPR-Banque de France, Analyses et synthèses, n. 122-2021.

Dunz, N., A. Mazzocchetti, I. Monasterolo, A. Essenfelder and M. Raberto (2021). Compounding COVID-19 and climate risks: the interplay of banks’ lending and government’s policy in the shock recovery. Journal of Banking and Finance, 106303.

ECB (2022). 2022 climate risk stress test. Technical Report. doi: 10.2866/97350.

EIOPA (2022a). Application guidance on running climate change materiality assessment and using climate change scenarios in the ORSA. EIOPA-BoS-22/329, August 2022.

EIOPA (2022b). Methodological Principles of Insurance Stress Testing – Climate Change Component. EIOPA-BOS-21/579, January 2022.

Gourdel, R., I. Monasterolo and K. Gallagher (2021). Climate transition spillovers and sovereign risk: evidence from Indonesia. Working paper, G24-V20 Task Force on Climate Policy for Development at the International Monetary Fund (https://bit.ly/3JYpzfM).

Guth, M., J. Hesse, C. Königswieser, G. Krenn, C. Lipp, B. Neudorfer, ... & P. Weiss (2021). OeNB climate risk stress test–modeling a carbon price shock for the Austrian banking sector. Financial Stability Report 42, 27-45.

IPCC. (2021). Summary for Policymakers. In: Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press. Forthcoming.

Kruczkiewicz, A., F. Cian, I. Monasterolo, G. Di Baldassarre, A. Caldas, M. Royz, M. Glasscoe, N. Ranger and M. van Aalst. (2022). Multiform flood risk in a rapidly changing world: what we do not do, what we should and why it matters. Environmental Research Letters 17(8): 1-9.

Leaton, J. (2011). Unburnable carbon—Are the world’s financial markets carrying a carbon bubble. Carbon Tracker Initiative, 6-7.

McGlade, C., & P. Ekins (2015). The geographical distribution of fossil fuels unused when limiting global warming to 2 C. Nature 517(7533), 187-190.

Monasterolo, I., I. Jiani Zheng and S. Battiston (2018). Climate transition risk and development finance: a climate stress-test of China’s overseas energy portfolios. China & World Economy 26(6): 116–142.

Monasterolo I. and S. Battiston (2020). Assessing forward-looking climate risks in financial portfolios: a science-based approach for investors and supervisors. NGFS Occasional Papers Case Studies of Environmental Risk Analysis Methodologies. Published on 09/10/2020; 616 pages: https://www.ngfs.net/en/case-studies-environmental-risk-analysis-methodo...

NGFS (2022). NGFS Climate Scenarios for central banks and supervisors. Tech. rep. Network for Greening the Financial System.

Ranger, N., O. Mahu and I. Monasterolo (2022). Assessing Financial Risks from Physical Climate Shocks: A Framework for Scenario Generation. Equitable Growth, Finance & Institutions Insight; Other Financial Sector Studies, Washington, DC: World Bank.

Roncoroni, A., S. Battiston, L.O. Escobar-Farfán and S. Martinez-Jaramillo (2021). Climate risk and financial stability in the network of banks and investment funds. Journal of Financial Stability, 54, 100870.

UNISDR (2017) Technical Guidance for Monitoring and Reporting on Progress in Achieving the Global Targets of the Sendai Framework for Disaster Risk Reduction (April), 2017b.

Weyant, J. (2017). Some Contributions of Integrated Assessment Models of Global Climate Change. Review of Environmental Economics and Policy 11(1): 115–137. https://doi.org/10.1093/reep/rew018.