Features from the 13th EDHEC Eur ETF, Smart Beta & Factor Investing Survey

by Véronique Le Sourd, Senior Research Engineer, EDHEC-Risk Institute

Since 2006, EDHEC-Risk Institute has annually surveyed European professional investors about their views and uses of ETFs, and more recently about their use of smart beta and factor investing strategies, as part of the Amundi research chair at EDHEC-Risk Institute on “ETF, Indexing and Smart Beta Investment Strategies”. In this 13th edition of the survey, we felt it was time to add a focus on SRI (Socially Responsible Investing)/ESG (Environmental, Social, Governance) investing, both in the context of ETFs and smart beta and factor investing strategies. The notable results of this year were a slowdown in the use of smart beta and factor investing strategies, and a growing interest in the integration of an SRI/ESG component into investment.

The EDHEC European ETF, Smart Beta and Factor Investing Survey 2020 took the form of an online questionnaire addressed to European professionals in the asset management industry. It targeted institutional investors, as well as asset management firms and private wealth managers. Our 191 respondents were high-ranking professionals within their organisations (49% belong to executive management and 29% are portfolio managers), with large assets under management (35% of respondents represent firms with assets under management exceeding €10bn). Respondents were distributed across different European countries, with 15% from the United Kingdom, 65% from other European Union member states, 16% from Switzerland and 4% from other countries outside the European Union.

Here we provide a summary of the survey results emphasising the key conclusions.

HOW INVESTORS SELECT AND USE ETFS AND HOW THIS USE WILL DEVELOP IN THE FUTURE

Over the years, our surveys have shown a wide adoption of ETFs to invest in the main asset classes, with 92% of respondents using ETFs to invest in equities in 2020, and 97% being satisfied with them, high levels that have been observed for a decade. For other asset classes, such as SRI/ESG and smart beta and factor investing, the use of ETFs has developed more recently. These asset classes deserve special attention, as shown by the results of this year’s survey.

SRI/ESG ETFs

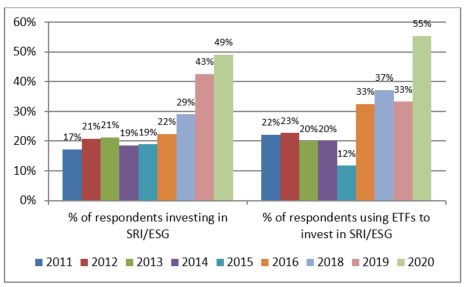

In 2011, only 17% of respondents were investing in SRI/ESG, compared to about one in two respondents (49%) in 2020, of whom 55% have used ETFs to invest in SRI/ESG in 2020, whereas the figures were only 22% in 2011 and 33% in 2019 (see Exhibit 1). Aggregating these results, we see that more than a quarter (27%) of ETF users were using ETFs based on SRI/ESG in 2020, compared to only 4% in 2011. The significant development in the use of ETFs to invest in SRI/ESG was observed not only in the rate of usage, but also in the intensity of usage, as ETFs accounted for 39% of total investment in SRI/ESG in 2020, compared with 13% in 2011. In addition, 87% of respondents using ETFs to invest in SRI/ESG are currently satisfied with them.

Exhibit 1: SRI/ESG ETF Usage

Smart beta and factor investing ETFs

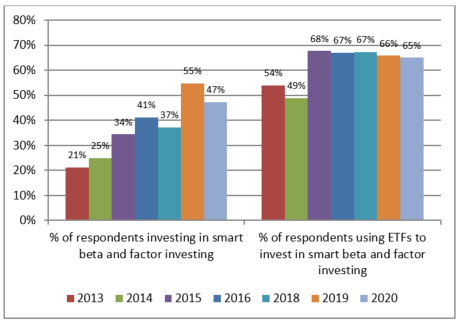

65% of respondents were using ETFs to invest in smart beta and factor investing in 2020, versus 66% in 2019, a proportion which has remained fairly stable since 2015, with a slight downward trend. If we look at the proportion of respondents investing in this asset class, we also see a decline: 47% in 2020, compared to 55% in 2019 (see Exhibit 2). However, ETFs remain an appealing instrument for this asset class, as 47% of investment in smart beta and factor investing was made through ETFs in 2020, versus 38% in 2019, and 77% of respondents were satisfied with them.

Exhibit 2: Smart Beta and Factor Investing ETF Usage

The Role of ETFs in the Asset Allocation Process

We observe dominant usage of ETFs for long-term buy-and-hold investment, with 67% of respondents using ETFs for that purpose, versus 43% for tactical allocation. Moreover, achieving broad market exposure remains the main focus of ETFs for 77% of users, compared with 51% of respondents using ETFs to obtain specific sub-segment exposure.

Cost and quality of replication are the two main drivers for selecting ETF providers (91% and 86% of respondents, respectively), related to the main motivations for using ETFs, namely reducing investment costs while tracking the performance of the index. Qualitative criteria considered by investors are broadness of the range and the long-term commitment of the provider (47% and 43% of respondents, respectively).

Future Development of ETFs

In 2020, 54% of investors plan to further increase their use of ETFs in the future, despite the already high maturity of this market and high adoption rates. Lowering investment costs is the primary driver behind investors’ future adoption of ETFs (81% of respondents in 2020). In addition, investors are not only planning to increase their ETF allocation to replace active managers (70% of respondents in 2020) but are also seeking to replace other passive investing products through ETFs (44% of respondents in 2020).

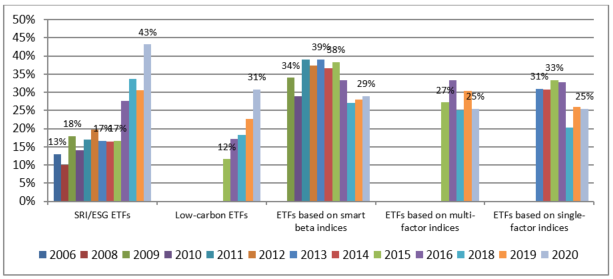

The top concern for 43% of respondents is currently the further development of SRI/ESG ETFs. In second position, 31% of respondents called for more development of low-carbon ETFs. Additionally, for ETFs related to advanced forms of equity indices – namely those based on smart beta and multi-factor indices – 29% and 25% of respondents called for further developments in these two areas, respectively (see Exhibit 3).

Exhibit 3: Type of ETF Products to be Further Developed in the Future

If we aggregate the responses concerning SRI/ESG and low-carbon ETFs, we see that 50% of respondents would like to see further developments in at least one of the two categories, compared with 38% in 2019. In the same way, if we aggregate the responses concerning smart beta indices, single-factor indices and multi-factor indices, we see that 43% of respondents would like to see further developments in at least one category related to smart beta equity or factor indices, compared with 45% in 2019.

A SPECIAL FOCUS ON SRI/ESG

As respondents were asked about the integration of SRI/ESG into ETFs and smart beta and factor investing, it is interesting to show their point of view on SRI/ESG through a few figures.

- 45% of respondents prefer the best-in-class approach (i.e. positive screening) for SRI/ESG, far ahead of the thematic approach (30%) and the negative screening approach (25%).

- 41% of respondents intend to replace standard ETF exposures by SRI/ESG exposures, 37% intend to introduce SRI/ESG into equity/fixed-income ETFs and 36% intend to use ETFs within a specific SRI/ESG portfolio.

- 65% of respondents report incorporating ESG into their investment decisions to allow for a positive impact on society and 58% to reduce long-term risk.

- 63% of respondents do not want the incorporation of ESG to be done at the expense of performance.

- Only 25% of respondents think that incorporating ESG will serve to enhance portfolio performance.

- 57% of respondents identify the E (Environmental) as the most important dimension of ESG, 36% the G (Governance) and only 7% the S (Social).

- 45% of respondents consider that the best approach to reduce the carbon footprint of a portfolio is positive screening, 32% prefer portfolio optimisation, and only 23% consider negative screening as the best approach.

KEY OBJECTIVES DRIVING THE USE OF SMART BETA AND FACTOR INVESTING STRATEGIES AND FUTURE DEVELOPMENTS

Use of Smart Beta and Factor Investing Strategies

The main motivation behind the adoption of smart beta and factor investing strategies is to improve performance. Managing risk is also considered an important criterion. 38% of participants currently invest in smart beta and factor investing strategies; 24% do not but are considering adopting such strategies in the future. However, despite a high rate of adoption, these investments typically make up only a small fraction of portfolio holdings among those respondents who have made investments in these strategies. More than two-thirds of respondents (70%) invest less than 20% of their total investments in smart beta and factor investing strategies, and only 13% of respondents invest more than 40%. However, 48% of respondents are planning an increase of more than 10% in terms of assets in their use of smart beta and factor investing products in the near future, while only 7% indicate a planned decrease.

Implementation of Smart Beta and Factor Investing Strategies

Our survey generates several insights into how investors implement their smart beta and factor investing strategies. More respondents are using discretionary smart beta and factor investing strategies (65% in 2020), rather than replicating (52% in 2020). In terms of the actual product wrapper used for smart beta and factor investing exposure, respondents currently favour passive funds that replicate smart beta and factor investing indices (57% of respondents), ahead of active solutions, i.e. approaches including a significant amount of discretion (43% of respondents. Respondents most frequently use smart beta/factor-based exposures to harvest long-term premia (as opposed to tactical use).

Smart Beta and Factor Investing Strategies in Fixed Income

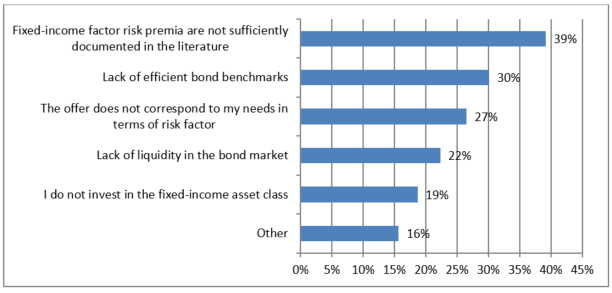

The results of our survey show that 11% of the whole sample of respondents currently use smart beta and factor investing for fixed income. However, about two-thirds (68%) of this sub-sample of respondents do so with less than 20% of their total investment. The additional 89% of respondents say they do not invest in smart beta and factor investing products for fixed income mainly because risk premia are not sufficiently documented in the literature (39%), because there is a lack of efficient bond benchmarks (30%) and because the offer does not correspond to their needs in terms of risk factor (27%) (see Exhibit 4).

Exhibit 4: Main Reasons for not Using Fixed-Income Smart Beta and Factor Investing Products

It appears that all respondents, including those who already invest in smart beta and factor investing for fixed income, and those who do not yet invest, show a significant interest in it. However, they are mitigated in their plans to increase their investment in smart beta and factor investing for fixed income in the future, because they have doubts about the maturity of research results for fixed-income strategies.

56% of respondents indicate that smart beta and factor investing bond solutions are useful in performance-seeking portfolios for harvesting risk premia. To achieve efficient harvesting, less than half of respondents (47%) think that the best solution is to use factor investing, i.e. selecting bonds according to rewarded attributes (value, momentum, credit, liquidity). About three-fifths of respondents believe that the three typical factors of the credit risk market, namely carry/level of the yield curve, credit and slope of the yield curve, are the most relevant rewarded factors in fixed-income markets (63%, 60% and 59% respectively).

Information about Smart Beta and Factor Investing Strategies

The existence of factor risk premium, ease of implementation and academic evidence are the primary concerns when it comes to smart beta and factor investing strategy factors. There is an important gap between required information about smart beta and factor investing products and ease of accessing it, especially crucial information such as data-mining risk and information about transparency on portfolio holdings over a back-test period. This may explain why these investments make up only a small fraction of respondents’ portfolio holdings, despite showing a significant interest in smart beta and factor investing strategies.

Future Development of Smart Beta and Factor Investing Strategies

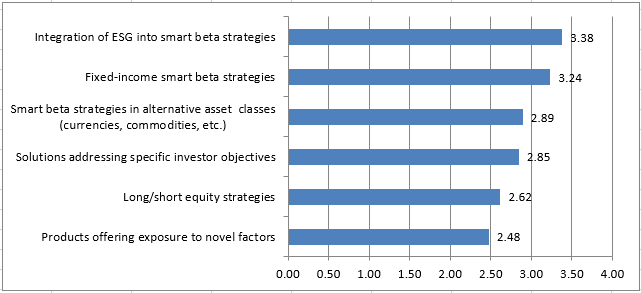

SRI/ESG, fixed income and alternative asset classes are the main expectations for future development of smart beta and factor investing products. Respondents would also like more customised smart beta and factor investing solutions to be developed (see Exhibit 5).

Exhibit 5: Type of Solutions Requiring Further Developments in the Future (on a scale from 0 – not required – to 5 – strong priority).

Smart beta researchers and product providers doubtless must work to integrate SRI/ESG concerns into their solutions for smart beta and factor investing strategies. The development of new products corresponding to these demands may lead to a wider adoption of smart beta solutions.

The research from which this article was drawn was produced as part of the Amundi ETF, Indexing and Smart Beta Investment Strategies research chair at EDHEC-Risk Institute.