Goal-Based Investing and its Application to the Retirement Problem

Industry Analysis

Goal-Based Investing and its Application to the Retirement Problem

Lionel Martellini Vincent Milhau John Mulvey

Draft version, February 2018. Please do not disseminate.

The need for new retirement investment solutions

Financing consumption in retirement has arguably become the greatest challenge for most individuals following a number of important changes, including the weakening state pension systems and the shift from defined-benefit to defined-contribution schemes in the corporate world that has left individuals more exposed to retirement risks. With the need to supplement retirement savings via voluntary contributions, individuals are increasingly responsible for their own savings and investment decisions.

This global trend poses substantial challenges as individual investors not only suffer from behavioural limitations, but also typically lack the expertise needed to make educated investment decisions.  In response to these concerns, insurance companies, investment banks and asset management firms have proposed a number of so-called retirement products. There are reasons to believe, however, that these products fall short of providing satisfactory solutions to the problems faced by individuals when approaching investment saving decisions. In this paper, we describe how goal-based investing principles can be used to design scalable mass-customised forms of retirement solutions that can address the specific retirement needs and constraints of a large number of individuals in a parsimonious manner. As an example of the framework in application, we propose a goal-based investing strategy for retirement needs in accumulation that can be regarded as a simple and pragmatic risk-managed improvement over existing forms of target-date funds, making them better suited to investors who are saving for retirement in the accumulation phase of their life cycle. In parallel, and in an effort to help increase awareness around the need for improved retirement solutions, EDHEC-Risk Institute and the Princeton Operations Research and Financial Engineering (ORFE) Department have teamed up to launch the EDHEC-Princeton Goal Based Investing Index series. These indices are based on joint academic research conducted with the support of Merrill Lynch Wealth Management on the application of goal-based investing (GBI) principles to the retirement problem.[1]

In response to these concerns, insurance companies, investment banks and asset management firms have proposed a number of so-called retirement products. There are reasons to believe, however, that these products fall short of providing satisfactory solutions to the problems faced by individuals when approaching investment saving decisions. In this paper, we describe how goal-based investing principles can be used to design scalable mass-customised forms of retirement solutions that can address the specific retirement needs and constraints of a large number of individuals in a parsimonious manner. As an example of the framework in application, we propose a goal-based investing strategy for retirement needs in accumulation that can be regarded as a simple and pragmatic risk-managed improvement over existing forms of target-date funds, making them better suited to investors who are saving for retirement in the accumulation phase of their life cycle. In parallel, and in an effort to help increase awareness around the need for improved retirement solutions, EDHEC-Risk Institute and the Princeton Operations Research and Financial Engineering (ORFE) Department have teamed up to launch the EDHEC-Princeton Goal Based Investing Index series. These indices are based on joint academic research conducted with the support of Merrill Lynch Wealth Management on the application of goal-based investing (GBI) principles to the retirement problem.[1]

A careful analysis of retirement investment solutions is rather timely – on 29 June 2017, the European Commission published a legislative proposal for a regulation on a pan-European personal pension product (PEPP). According to the proposal, PEPP providers shall offer up to five investment options to PEPP savers, including a default investment option. In its current format, the Commission’s text (article 37.2) suggests that the default option could be accompanied by a guarantee. While it seems intuitively desirable that the default option should aim to preserve capital over time, one key concern is that the introduction of minimum return or capital guarantees would have a number of negative consequences. The most important of these consequences would be an exceedingly large opportunity cost for beneficiaries, given the presence of strict prudential regulations such as Solvency II, which make such guarantees prohibitively expensive.

In addition to the direct opportunity cost deriving from the introduction of a formal insurance guarantee, as well as the costs implied by the typical distribution channels for such guaranteed products, one may also be concerned by the indirect opportunity costs implied by the use of low-yielding fixed-income instruments in the hedging component of the guaranteed products. Moreover, the typical use of single-class liquid underlying instruments such as stock indices for guaranteed products (as opposed to well-diversified multi-asset portfolios) may also contribute to a lack of diversification.

In this context, the enhanced upside potential offered by life-cycle strategies, also known as target-date fund strategies, may seemingly make them attractive alternatives due to the fact that these are inherently designed as long-horizon strategies that explicitly benefit from the well-documented presence of mean-reversion in risk premia to be found in the equity market and beyond.

On the other hand, target-date funds offer a sole focus on an investment horizon without any protection of investors’ minimum retirement needs. In particular, these products are not engineered to deliver replacement income in retirement, and do not adequately hedge the main risks related to retirement investing decisions, namely investment risk, interest rate risk, inflation risk and longevity risk. Another important restriction is that most target-date funds do not allow for revisions of the asset allocation as a function of changes in market conditions. This is entirely inconsistent with academic prescriptions and also, perhaps more importantly, with common sense, which both suggest that a meaningful investment strategy should also display an element of dependence on the state of the economy as well as a dependence on investors' goals.

Replacement income, not absolute wealth, should be the focus!

Currently available investment options hardly provide a satisfying answer to the retirement investment challenge and most individuals are left with an unsatisfying choice. On the one hand, they have safe strategies with very limited upside potential, which will not allow them to generate the kind of target replacement income they need in retirement; on the other hand, they have risky strategies offering no security with respect to minimum levels of replacement income.

The most natural way to frame an investor’s retirement goal is in terms of how much lifetime guaranteed replacement income they will be able to afford at retirement. More often than not, investors in accumulation are concerned with the purchasing power of their replacement income in terms of consumption goods and services in retirement. Given that the biggest risk in retirement is the risk of outliving one’s retirement assets, securing replacement income within the decumulation period can be achieved with annuities (possibly inflation-linked or cost-of-living-adjusted), which are the true risk-free assets for individuals preparing for retirement. Annuity products, however, are cost inefficient, irreversible, and do not contribute to bequest objectives. These elements undoubtedly explain the low demand for annuities, a.k.a. the “annuity puzzle”, that is of course when annuitisation is not incentivised or mandatory. A good case can actually be made that annuitisation is a decision that is best taken close to retirement, if ever.

In the UK, the 2015 Pension Act, which has nullified the compulsory annuity purchase, creates a tremendous opportunity for asset managers to launch meaningful forms of retirement solutions. A key ingredient in these retirement solutions is a novel form of retirement bond portfolio, where the key focus should be on generating replacement income for a period roughly corresponding to the average life expectancy in retirement (say for 15 or 20 years after the retirement date).

In parallel, late-life annuities can be purchased in decumulation to obtain protection against tail longevity risk. It would actually be extremely useful for governments and central banks to start issuing these "retirement bonds".[2] While most existing bonds are useful for corporations and sovereign states to finance their activities, they are not useful investment vehicles for investors. Indeed, investors in the accumulation phase of their life cycle do not need a stream of coupon payments plus principal at maturity date, which is the typical structure of available bond offerings. What individuals need are bonds paying no cash flow in the accumulation phase, that is no cash flows until the retirement date, and then paying monthly, quarterly or annual (possibly inflation-linked) coupons for a given number of years (e.g. 15 or 20 years in retirement) and no principal at the maturity date.

In the absence of such retirement bonds, forward-start bond ladder structures can be synthesised via standard cash-flow-matching or duration-matching techniques to obtain a dedicated retirement goal-hedging portfolio (GHP). Purchasing $1 worth of face value of the synthetic retirement bond is thus equivalent to securing an additional $1 worth of replacement income (possibly inflation-linked) say for the first 15 or 20 years in retirement.

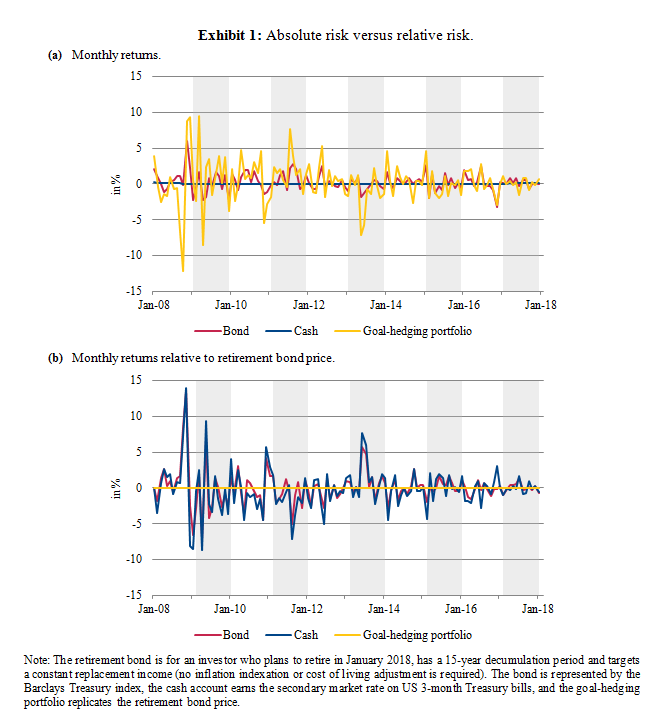

To illustrate the fact that assets such as a Treasury bond portfolio or a money market account (which are traditionally regarded as safe investments) are actually highly risky when it comes to securing a stream of replacement income cash-flows, Exhibit 1 plots the monthly returns on these investments in absolute terms and relative to the present value of replacement income. Returns on money market accounts (cash) are very stable and consistently close to zero, while Treasury bond returns exhibit more short-term volatility. Note that they both appear much less volatile than the returns on the GHP, which is more exposed to interest rate risk because of its long duration. Note, however, the picture is completely different when returns are computed with respect to the retirement bond price (i.e. relative to purchasing owner in terms of replacement income). By construction, the GHP does indeed have zero relative risk, while cash and bonds now appear to be highly risky. Overall, the distinction between absolute and relative risk, which is well established in asset-liability management, is also of key relevance in the retirement funding problem: replacement income, not absolute wealth, should be the focus!

Given the price of the retirement bond (i.e. given the market value of replacement income cash flows), it is straightforward to calculate the purchasing power of a given level of retirement savings in terms of replacement income, (i.e. the level of replacement income that these savings can finance). It is equal to the value of savings divided by the retirement bond price. As such, the retirement bond price, which provides the proper reference point, or numeraire, is an important piece of information in goal-based reporting. In what follows, we argue from a risk management standpoint that it is also useful for the construction of strategies that maximise the probability of reaching target levels of replacement income.

Key requirements for improved goal-based retirement solutions

Individuals can set target levels of replacement income expected from retirement savings as a function of their estimated consumption needs in retirement as well as income generated by other sources such as Social Security and employer-sponsored pension plans. Should a replacement income target be affordable given the current level of retirement, it could be secured by investing the required amount of wealth in the GHP. In most cases, however, individuals and households are under-funded: their replacement income needs in retirement exceed what can be financed via savings alone. In other words, the desired replacement income level is not affordable and therefore represents an aspirational goal (in the terminology of Chhabra et al. (2015)), the presence of which justifies the need for upside performance. In this context, a well-designed retirement solution should simultaneously generate a high probability for individuals to achieve their aspirational/target levels of replacement income, but it should also secure some essential/minimum levels of replacement income in order to ensure that basic needs in retirement will be satisfied regardless of market performance. The recognition that investors aspire to secure their essential goals while also having high chances of reaching their aspirational goals is leading to the new GBI investment paradigm in individual money management, where investors' problems can be fully characterised in terms of their goals. Goal-based investing is the counterpart of liability-driven investing (LDI), which has become the relevant paradigm in institutional money management where investors' problems are broadly summarised in terms of their liabilities. From a financial engineering standpoint, any GBI retirement solutions should be grounded on sound and robust risk-management principles and involve the following ingredients:

- A dedicated safe goal-hedging portfolio (GHP) that replicates risk factor exposures in investors’ replacement income goals (dynamic replicating bond portfolio for the aforementioned retirement bonds);

- A common well-rewarded risky performance-seeking portfolio (PSP) that efficiently harvests risk premia in equity markets;

- A dynamic allocation to the PSP versus GHP portfolios that secures minimum replacement income levels while generating a high probability of achieving target replacement income levels.

As such, the framework builds upon a comprehensive and holistic integration of the three forms of risk management, namely hedging, diversification, insurance, in contrast with existing products or approaches used in institutional or individual money management, which are only based on selected risk management principles. While each of these sources of added value is already used to some extent in different contexts, a comprehensive integration of all these elements within a comprehensive disciplined investment management framework is required for the design of useful investment solutions. In the next section, we provide an example of implementation of goal-based investing principles applied to retirement, and present design features that have been used in the EDHEC-Princeton Goal Based Investing Index series.[3]

Introducing a new generation of risk-managed target-date retirement solutions

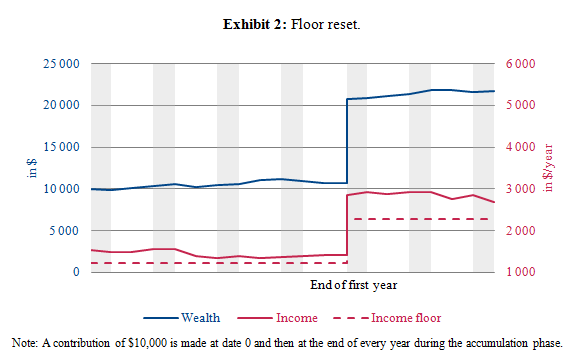

Let us consider for concreteness an investor preparing for retirement who seeks to obtain protection on a yearly basis with respect to the purchasing power in terms of replacement income in decumulation of any contribution made in accumulation or transition phases. Assuming for simplicity that contributions are made once a year, say at the end of December, one would naturally introduce the essential goal to cap the loss relative to replacement income to a fixed limit, e.g. 20%, over a calendar year. This short-term essential goal commands a floor that the strategy should respect at all times, and is equal to 20% of the price of the retirement bond that pays the replacement income that was affordable at the beginning of the year. This floor is reset every year to be equal to 80% of current savings, including the annual contribution.

This mechanism is depicted in Exhibit 2, where we plot the value of accumulated savings and the level of affordable income for an investor who starts with $10,000 in January 2010 and adds another $10,000 every year to his/her account. The floor expressed in terms of affordable income is by definition equal to 80% of the income level that was affordable in January, so it is constant within a year.

This mechanism is depicted in Exhibit 2, where we plot the value of accumulated savings and the level of affordable income for an investor who starts with $10,000 in January 2010 and adds another $10,000 every year to his/her account. The floor expressed in terms of affordable income is by definition equal to 80% of the income level that was affordable in January, so it is constant within a year.

Protection of the floor can be achieved by the means of a dynamic insurance strategy, in which the dollar allocation to the PSP is taken to be a multiple of the risk budget or margin for error, defined as the distance between current wealth and floor levels. Thus, if wPSP,t denotes the percentage allocation to the PSP and mt is the (time-varying) multiplier, we obtain an allocation that reacts to changes in the risk budget according to the following linear rule, with a rebalancing frequency taken to be monthly in our base case analysis:[4]

![]()

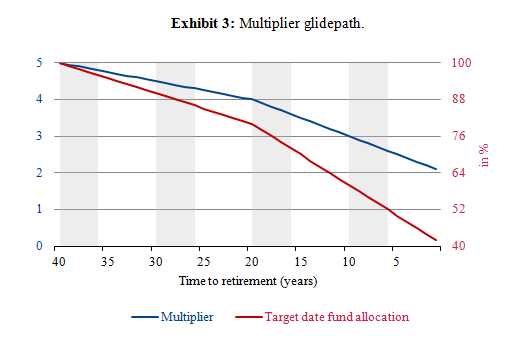

In order to anchor the design of the retirement GBI solutions with respect to existing target-date fund, we set the value of the multiplier at the beginning of every year in such a way that the percentage allocation to the PSP, taken for simplicity to be some equity index, matches the equity allocation of a deterministic target-date fund. This allows us to benefit from mean-reversion in equity markets, which implies that the allocation to equities should be higher for younger investors. With this rule, the multiplier is the deterministic function plotted in Exhibit 3, and the GBI strategy has exactly the same allocation to its performance-seeking equity component as the corresponding target-date fund at the beginning of each year. Within any given year, however, the allocation to equities does not stay constant and instead reacts to changes in the distance between current wealth and the floor, to protect the essential goal.[5]

To compare the risk-managed target-date retirement strategy to its standard target-date fund benchmark, we simulate 10,000 scenarios for equity returns and interest rates, and we look into the evolution of the level of affordable income over the accumulation phase. As argued before, this indicator is more relevant than the absolute performance of the strategy in the retirement financing context. Formally, we calculate a “funding ratio”, defined here as the ratio of the current level of affordable income to the initial level of affordable income.

To compare the risk-managed target-date retirement strategy to its standard target-date fund benchmark, we simulate 10,000 scenarios for equity returns and interest rates, and we look into the evolution of the level of affordable income over the accumulation phase. As argued before, this indicator is more relevant than the absolute performance of the strategy in the retirement financing context. Formally, we calculate a “funding ratio”, defined here as the ratio of the current level of affordable income to the initial level of affordable income.

This quantity is independent from the capital invested in the strategy and it measures the performance of the strategy relative to the retirement bond price. It would be constant at 100% for a portfolio fully invested in the GHP, and it grows above 100% if affordable income increases. In order to isolate the effect of the investment strategy, we assume in these simulations that no further contributions take place after inception.

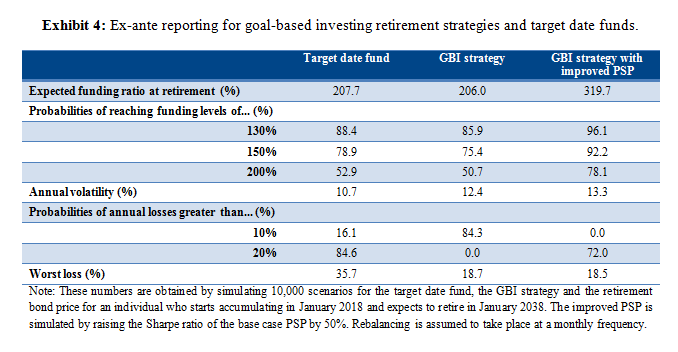

Exhibit 4 reports a series of ex-ante indicators on the distribution of future funding ratios. To obtain these numbers, assumptions must be made on the dynamics of returns and risk factors impacting prices. We simulate the returns on an equity index by setting its annual volatility to 16.2% and its Sharpe ratio to 0.395, two values that are consistent with long-term risk and return estimates for the S&P 500 index. The bond component of the target-date fund is modelled as a portfolio with 6.4% volatility and 0.234 Sharpe ratio, and the GHP of the risk-controlled strategy replicates the returns of the retirement bond for an individual who retires in January 2038. This retirement bond is priced as the discounted value of future given the current term structure of interest rates.

For parsimony, we assume a one-factor interest rate model, the parameters of which are calibrated to historical series of US zero-coupon rates spanning the period from January 1998 through January 2018.[6] With the estimated parameters, the GHP has a volatility of 5.4% on average (decreasing over time as duration decreases) and a mean return of 3.05%. We emphasise that these parameter values are only needed to simulate future scenarios, but that they are not involved in the implementation of the GBI strategy.

When analysing the results displayed in Exhibit 4, it appears that risk-managed target-date GBI retirement solutions are comparable to conventional target-date funds in terms of long-term expected funding ratio and probabilities of reaching aspirational levels of funding. On the other hand, standard forms of target-date funds are unable to reliably secure annual losses to the specified level of 20%, with a 16.1% probability of experiencing at least one loss above this threshold over the period, when the GBI strategy reaches the objective of securing 80% of the initial annual funding ratio in all scenarios.[7] In the most extreme negative scenario in our simulations, the worst loss in terms of funding ratio for the target-date fund exceeds 35%, while it does not exceed the 20% limit set as an essential goal for the GBI strategy. Interestingly, realistic improvements to the PSP, which can be obtained by shifting from a cap-weighted index to a well-diversified portfolio of smart factor indices, would lead to extremely significant increase in the probability for investors to achieve their target levels of replacement income. For example a 200% increase in purchasing power can be obtained with close to 80% probability (78.1% given our parametric assumptions) for the GBI strategy with an improved PSP, to be compared with about 50% probability for both the target-date fund and the GBI strategy with a poorly diversified cap-weighted equity portfolio.

Mass customisation in retirement investing

Goal-based investing principles can be used to effectively address the retirement investing problem by allowing investors in transition (say from age 55 to 65) to secure minimum levels of replacement income for a fixed period of time (say 15 years) in retirement, and also generate the kind of upside needed to reach target levels of replacement income with attractive probabilities. At retirement date (say at age 65), an investor may decide on how to split the available surplus in two components, one dedicated to securing more replacement income for the early stage of decumulation and one dedicated to purchasing deferred inflation-linked late life annuities to take care of tail longevity risk above and beyond for the late stage of retirement.

It is only recently that the emergence of the goal-based investing paradigm has effectively allowed for the development of such mass-customised investment solutions to individuals (see Martellini and Milhau (2015) for a detailed analysis). Mass-customisation is facilitated by the convergence of powerful forces. On the one hand production costs are strongly reduced, due to the emergence of smart factor indices as cost-efficient alternatives to active managers for risk premia harvesting. On the other hand, distribution costs are also bound to go down as the trend towards disintermediation is accelerating through the development of FinTech and robo-advisor initiatives.

Risk management, defined as the ability for investors, or asset and wealth managers acting on their behalf, to efficiently spend their dollar and risk budgets so as to enhance the probability to reach their meaningful goals, will play a central role in what should be regarded as nothing short of an industrial revolution that is impacting the investment management industry.

References

- Chhabra, A., R. Deguest, L. Martellini, V. Milhau, A. Suri and H. Wang. 2015. Introducing a Comprehensive Risk Allocation Framework for Goals-Based Wealth Management. EDHEC-Risk Institute Publication.

- Giron, K., L. Martellini, V. Milhau, J. Mulvey and A. Suri. 2018. Applying Goal-Based Investing Principles to the Retirement Problem. EDHEC-Risk Publication.

- Martellini, L. and V. Milhau. 2016. Mass Customisation versus Mass Production in Retirement Investment Management: Addressing a “Tough Engineering Problem”. EDHEC-Risk Institute Publication.

- Merton, R.C. and A. Muralidhar. 2007. "Time for retirement ‘SeLFIES’?" IPE magazine article. April issue.

Notes

[1] The launch is scheduled to take place in early Q2 2018, and the performance of the EDHEC-Princeton GBI indices will be posted on both the EDHEC-Risk Institute and Princeton ORFE websites.

[2] A similar argument was put forward by Robert C Merton and Arun Muralidhar in an article entitled, "Time for retirement ‘SeLFIES’?", published in the April 2017 issue of IPE magazine.

[3] For more detail, see Giron et al. (2018).

[4] The allocation to the PSP is typically capped to 100% to avoid leverage.

[5] In implementation, it would also be useful to make it a function of market conditions, based on the finding that higher volatilities and lower expected returns should imply lower multiplier values, and that conversely, lower volatility and higher expected returns should result in higher multiplier values. [6] Details on the calibration procedure can be found in Martellini, L. and V. Milhau. 2016. Mass Customisation versus Mass Production in Retirement Investment Management: Addressing a “Tough Engineering Problem”. EDHEC-Risk Institute Publication.

[7] In robustness checks, we have found that some gap risk arises when the GBI strategy is rebalanced quarterly, as opposed to monthly. On the other hand, gap risk is limited in probability (0.2%) and in severity (worst annual loss at 23.4%).