Green(ish) Bonds – is the growth sustainable?

By Nanni Cotronei and Lorenzo Genovese (EDHEC Student Finance Club - ESFC)

On the 25th of February 2021, Justine Leigh-Bell (slides), Deputy CEO of Climate Bond Initiative, together with Professor Gianfranco Gianfrate (slides), professor at EDHEC Business School, held an online debate on the topic of “Green Bonds” and climate change finance. The debate, hosted by the Florence School on Banking and Finance, and moderated by Professor Thorsten Beck, focused on the value and development of “Green Bonds” market. Indeed, there has been an increasing focus in the past years on the numerous issues related to climate change and the environment, a focus that has spread through the financial markets. On one side, there is a strong effort for developing instruments that incentivize, or at least price correctly, initiatives that have in mind a positive effect on the environment. On the other side, as with any new movement in the market there is the concrete risk of it being a momentary trend, perhaps even a bubble. Through their discussion, Professor Gianfranco and Justine Leigh-Bell shed some light on the reality of this relatively new market, from both an academic and policy-maker point of view.

The first question that an investor may raise is what Green bonds are. To distinguish Green bonds from other types of debt instruments linked to ESG goals, the industry generally defines green bonds as those securities linked to assets that are 100% contributing to an environmental objective. Sustainability bonds, on the other hand, are much broader in definition, and can include social elements in addition to environmental ones. As Justine highlighted during her presentation, this fundamental question underlines the importance of the taxonomy around green bonds. Although there is not yet a universal standard for the definition of what is a green bond, both Justine and Professor Gianfranco have noted that there are several governments and institutions that are setting standards that are being widely adopted. From a governmental point of view, the European Union and China have been leading the regulation of this new market, adopting rules for both the issuance of green bonds and the trading of these securities. Professor Gianfranco also notes that there are several private institutions, which academia often use for their studies on the subject, that function as credit agencies on the “shade of greenness” of the issuance.

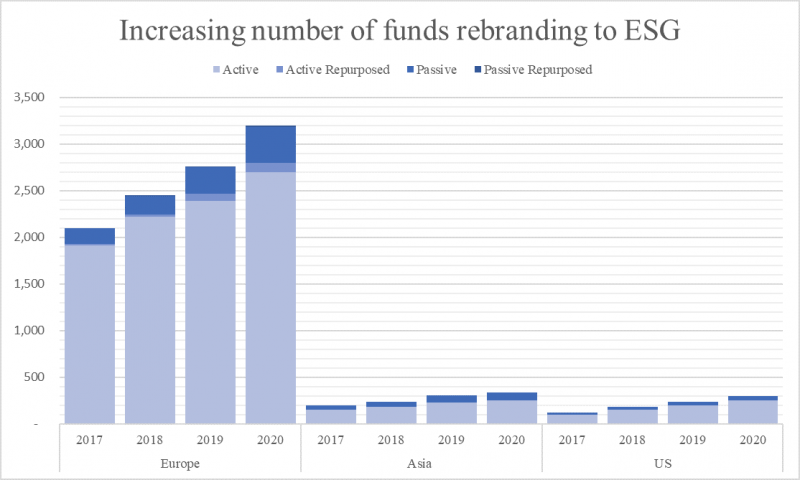

In the past five years, particularly since the Covid-19 pandemic, the attention on Green Finance and Green Bonds has exploded. Green bonds alone have gone from having a market size of less than $50 billion in 2014 to more than $250 billion in 2020. With this incredible growth and flow of capital, it is normal for some investors to be skeptical and to fear the phenomenon of “greenwashing”. In fact, both from the issuers’ side and from the asset managers’ side, there is the incentive to be categorized as “green issuers” or “green fund managers”. Furthermore, as Professor Gianfranco stated in an interview in the Financial Times, the increasing focus on environmental issues from the younger demographics is translated into their consumer behavior, and the market is reacting accordingly. Although in his empirical study, conducted together with Marco Spinelli, they find that the market does not seem to price differently the green bonds compared to normal ones, there still is a much higher level of ownership among UNPRI institutional investors. Companies are therefore incentivized to be labelled as green, so to have a relatively easier access to large pools of capital. In this context, the efforts on building a strict taxonomy and regulatory framework become increasingly important, as they are key for preventing companies and funds to misuse the green label. As the Financial Times notes, this trend is further boosted by the recent report published by Morningstar which highlighted how in the past decade funds investing in ESG strategies have outperformed the respective non-ESG counterparts. Although the study refers to ESG Finance in general, and not solely on green bonds, this is contributing to the growing market for green debt.

Source: FT

Indeed, regulators and private agents are reacting to this natural reaction by less-ethical investment managers by creating systems of pre-certification and post-certifications of both issuers and investments managers. For instance, private agencies such as CICERO, which Professor Gianfranco uses in his research, works to give a second opinion on the quality of the green bonds, assigning different shades of green. On the institutional side, the EU is implementing the Sustainable Finance Disclosure Regulation (SFDR), which imposes new rules on financial products and fund managers, by increasing the required disclosure of the sustainability issues tackled. Furthermore, the US SEC has just recently created the Climate and ESG Task Force, which has similar objectives of increasing the industry transparency.

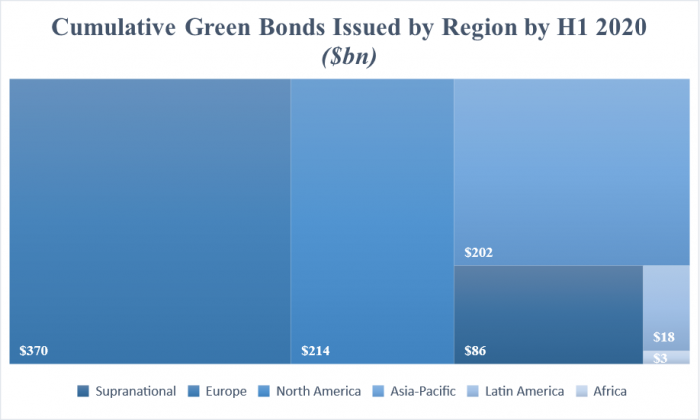

Today there is much talk about the various issues related to the environment and climate, which are becoming increasingly central and trendy in society. People look forward to a radical change in environmental policies, which will have to be based on models increasingly oriented on green economy and renewable energy. It is in this contest that Green Finance and, in particular, green bonds, are becoming increasingly important. For instance, institutions such as the World Bank and the European Central Bank (ECB) are investing large amounts of money, trying to lower carbon emissions by 2030. Indeed, about 10 years ago the World Bank and the European Investment Bank (EIB) have launched several green bonds, which have blazed a trail for investments that could eventually reach into trillions of dollars in climate-related projects, including renewable energy, energy efficiency, and ecosystem protection and restoration. Therefore, as reported by many industry professionals, this trend has the potential of becoming increasingly central in our life and subsequently in the economy and markets, which will look with different eyes and more attention to the ESG criteria and UN Responsible Investment Principles (UN-PRI).

Source: Climate Bonds Initiative

Finally, we can say that Green Bonds are here to stay and grow, and although there are many issues of credibility and accuracy that ought to be addressed, the market is pushing in that direction. Through the intervention of non-profit organizations and regulators we are seeing an increasing attention to ensuring the correctness of market activities around the issuance of green bonds. Given the centrality of the climate crisis in our lives, it is fundamental for governments and industry participants to implement sustainable and profitable infrastructures to facilitate investments that tackle the climate crisis to different degrees. Indeed, as certifications specifying the “degree of greenness” become mandatory, fund managers and issuer will be compelled to adopt greener strategies. In fact, as Professor Gianfranco confirmed to the FT, this trend will definitively be boosted by the increased awareness of the new generation.

You can access here the replay of the webinar Green(ish) Bonds?

About Gianfranco Gianfrate

Gianfranco Gianfrate is Professor of Finance at EDHEC Business School and Research Director at EDHEC-Risk Climate Impact Institute. He writes and researches on topics related to innovation financing, corporate valuation, and climate change finance. Prior to joining EDHEC Business School, he held teaching and research positions at Erasmus University (Netherlands), Harvard University (USA), and Bocconi University (Italy). Gianfranco also has extensive experience in the financial industry, having worked, among others, for Deloitte Corporate Finance (Italy), Hermes Investment Management (UK), and iStarter (UK). Gianfranco holds a BA and a PhD in Business Administration from Bocconi University and a Master in Public Administration from Harvard University.