Equity Portfolios with Liability-hedging Benefits

Industry Analysis

Equity Portfolios with Liability-hedging Benefits

Lionel Martellini

Vincent Milhau

Liability-Driven Investing and Beyond: Fund Separation versus Fund Interaction Theorems

Asset-liability management (ALM) for pension funds has become relatively straightforward, in principle, within the paradigm known as liability-driven investing (LDI). In a nutshell, when extended to ALM, modern portfolio theory and the fund separation theorem unambiguously advocate that pension plans should implement the suitable combination of a liability-hedging portfolio (LHP) invested in fixed-income securities and aiming to match the risk factors impacting the value of their liabilities as well as possible, and a performance-seeking portfolio (PSP) aiming to efficiently harvest risk premia across and within risky asset classes, and most importantly in equity markets around the globe.

When a pension fund is underfunded, pension assets are by definition insufficient to cover the liabilities, but the pension fund may in principle optimally borrow the required amount to make up for the gap between pension assets and pension liabilities and also maintain a levered investment in performance-seeking assets which may contribute to solving the funding problem without requiring exceedingly high levels of additional contributions.

While this clear separation between the search for performance and the desire to hedge liabilities is perfectly intuitive and sensible in theory, it suffers from a number of limitations in terms of real-world implementation. The main limitation is undoubtedly the presence of leverage constraints, which implies that most underfunded pension funds cannot use as much leverage as would be required to fully hedge their liabilities. In practice, pension funds end up investing all their assets in a zero- or low-leverage portfolio mostly containing stocks and bonds, with a key trade-off between a dominant allocation to equities (say a 60:40 stock-bond split), which generates attractive levels of expected returns but also implies high levels of funding ratio volatility, or a more moderate equity allocation (say a 40:60 stock-bond split), which requires lower ALM risk budgets but correspondingly also generates lower upside potential.

While this clear separation between the search for performance and the desire to hedge liabilities is perfectly intuitive and sensible in theory, it suffers from a number of limitations in terms of real-world implementation. The main limitation is undoubtedly the presence of leverage constraints, which implies that most underfunded pension funds cannot use as much leverage as would be required to fully hedge their liabilities. In practice, pension funds end up investing all their assets in a zero- or low-leverage portfolio mostly containing stocks and bonds, with a key trade-off between a dominant allocation to equities (say a 60:40 stock-bond split), which generates attractive levels of expected returns but also implies high levels of funding ratio volatility, or a more moderate equity allocation (say a 40:60 stock-bond split), which requires lower ALM risk budgets but correspondingly also generates lower upside potential.

In this context, the question arises whether it would it make sense for a pension fund to hold a customised equity portfolio engineered to exhibit enhanced liability-hedging properties versus holding an off-the-shelf broad equity index. Intuition indeed suggests that a better alignment of the PSP with respect to the liabilities would lead to an increased allocation to stocks for the same level of volatility of the funding ratio, which in turn would generate higher access to the equity risk premium.

In a recent paper (Coqueret, Milhau and Martellini, 2016)[1], we analyse whether LDI solutions can be enhanced by the design of performance-seeking equity benchmarks with improved liability-hedging properties. We confirm this intuition and show that improving hedging characteristics of the performance portfolio generates welfare gains unless this improvement comes at an exceedingly large opportunity cost in terms of performance, a result that we call the fund interaction theorem. While two competing effects exist in principle (a better alignment of the equity portfolio with the liabilities leads to a higher allocation to equities for the same ALM risk budget due to enhanced liability-friendliness, but it may also lead to a lower reward per dollar invested compared to a pure focus on performance), our empirical analysis actually suggests that the selection of stocks with above-average liability-hedging properties leads to both a higher degree of liability-friendliness (as expected) and also to better performance due to increased exposure to rewarded factor tilts.

In this context, we find that very substantial increases in investor welfare would result from switching from a standard off-the-shelf cap-weighted (CW) equity benchmark to an equity benchmark designed to exhibit above-average liability-hedging properties. For inflation-linked liabilities, we find that the use of a minimum variance equity benchmark based on a double-sort procedure of stocks according to (high) dividend yield and (low) volatility would have generated, over the period 1999-2012, an annualised excess return reaching 270 basis points for the same funding ratio volatility, as well as a lower funding ratio drawdown, compared to what is obtained with the use of the standard cap-weighted S&P 500 index as a benchmark.

Equity Benchmarks with Improved Liability-Friendliness

We consider two alternative approaches to the definition of liability-friendliness. The first one is based on cash-flow matching capability: under this definition, liability hedging aims to find securities with dividend payments that match the pension payments as closely as possible. The stocks which are expected to display above-average liability-friendliness in terms of cash-flow matching capacity are those that generate large and stable dividend yields.

The second definition is based on factor exposure matching. Since perfect cash-flow replication is typically difficult to achieve in practice, investors who need to hedge liabilities may instead choose to match the risk factor exposures of their assets with those of their liabilities. The objective pursued in this case is to immunise the funding ratio against variations in the risk factors that impact liabilities, and the success is measured in terms of tracking error with the liability proxy.

In this setting with a focus on risk factor matching, a stock will be said to be liability-friendly if the tracking error of the stock returns with respect to the returns on the liability proxy is low. Given the decomposition of the tracking error into two components (one that is related to the portfolio volatility and one that is related to the portfolio correlation with the liability proxy), a low tracking error can be achieved if the volatility of the stock is low and/or if the correlation between the stock and the liability proxy is high.

Using data from the CRSP database from 1975-2012, we construct portfolios with stocks originating from the S&P 500 universe. We cast the analysis at the individual stock level, as opposed to the sector level, given the expected presence of very substantial levels of cross-sectional dispersion in interest rate hedging benefits across individual stocks. The portfolios are rebalanced every year in March. In the analysis, the liability proxy is computed as a constant maturity bond and its returns are computed using 15Y US Treasury yields. The second step of the procedure establishes the weights that are assigned to each stock. We start by considering equal weights for all stocks (no selection EW) to assess the benefits of the selection stage, and we additionally provide the results for the cap-weighted portfolio of all stocks (no selection CW), which is the commonly used benchmark.

We find that the various selection procedures indeed deliver what they are designed for. In particular, the equally-weighted (EW) portfolio of the 20% of stocks with the lowest volatilities has a tracking error of 14.6% with respect to our liability proxy over the sample period, while the EW portfolio of the 20% of stocks with the highest volatilities is almost twice as large at 27.8%. This spectacular improvement in tracking error does not only emanate from a lower portfolio volatility; it is also linked so a strong increase in correlation with the liabilities. Hence, the selection of low volatility stocks generates a positive 7.7% correlation with the liability proxy, while a selection of high volatility stocks generates a negative correlation of -6.7%. Intuitively, this improvement can be traced down to the fact that low volatility stocks, which tend to be low dividend uncertainty stocks, are the stocks that tend to be the closest approximations to fixed-income securities, and as a result, the best approximation to bond-like liabilities. In terms of correlations, the high correlation selection ranks only second (although close to first), with a large turnover, suggesting that empirical correlations are highly unstable. We further observe that all selections increase the Sharpe ratio as well as the turnover, compared to both the EW and CW benchmarks, and the increased liability-friendliness of the portfolios is therefore not penalised by lower risk-adjusted performance. We also confirm that the selection on dividend yields generates a statistically and economically significant increase in this dimension with respect to the use of the standard S&P 500 index as a benchmark.

Addressing the focus on liability hedging through a double-sort procedure, starting with the 200 highest dividend yield (DY) stocks, selecting the 100 lowest volatility stocks amongst them, and subsequently performing a minimum variance optimisation, is found to lead to further improvements in the liability-friendliness of the selected portfolios.

Addressing the focus on liability hedging through a double-sort procedure, starting with the 200 highest dividend yield (DY) stocks, selecting the 100 lowest volatility stocks amongst them, and subsequently performing a minimum variance optimisation, is found to lead to further improvements in the liability-friendliness of the selected portfolios.

Hence, combining the double-sort selection procedure with the minimum-variance weighting scheme with norm constraints (MV-C), leads to improvements in all indicators with respect to the base case results, and reaches the following attractive levels – 14.1% tracking error, 12.5% volatility, 8.2% correlation and 5.4% average dividend yield. Overall, double sorts starting with DY and then low volatility generate comparable levels of factor matching liability-friendliness (tracking error at 14.1%) with improved cash-flow matching properties (average DY at 5.40% compared to selection purely based on volatility. The Sharpe ratio further increases to 0.79, even though this comes at the cost of a higher turnover, which should deserve dedicated attention at the implementation stage.

Measuring the Impact on Investor Welfare

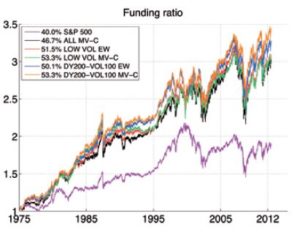

Due to the resulting improvement in liability-hedging benefits, liability-driven investors can allocate a higher fraction of their portfolios to equities without a corresponding increase in funding ratio volatility. For example, we find that a pension fund allocating 40% to equities on the basis of a cap-weighted equity benchmark can allocate as much as 53.3% to a minimum variance portfolio of selected stocks from the aforementioned double-sort procedure for the same volatility of the funding ratio. This substantial increase in equity allocation without a corresponding increase in ALM risk budgets confirms that the aforementioned improvements obtained in terms of improved liability-friendliness are economically significant.

The resulting increase in equity allocation for the same ALM risk budget, combined with an improved risk-adjusted performance of the dedicated equity benchmark with respect to the S&P500 index, leads to an improvement in performance, reaching 158 basis points annualised over the 1975-2012 sample period. This improvement can be decomposed into a contribution purely emanating from the increase in equity allocation assuming no impact on performance (39 basis points) and a contribution purely emanating from the improved performance of the equity benchmark assuming no increase in allocation (119 basis points).

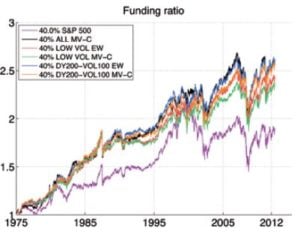

In terms of historical trajectories, we plot the evolution of the funding ratio over the sample period assuming an initial funding ratio normalised at 100%, and compute the corresponding risk and return indicators.

We find that LDI strategies based on all improved liability-friendly portfolios strongly outperform LDI strategies based on the S&P 500 over the sample period, and Exhibit 1 shows that the outperformance is even more spectacular when the allocation to the improved equity benchmark is adjusted to generate the same volatility of the funding ratio as when investing 40% in the S&P 500 index. Moreover, the volatility of the funding ratio lies between 1.1% and 1.9% lower in absolute value when the equity benchmark is the liability-friendly portfolio compared to the use of the S&P 500.

With the exception of the MV-C portfolio of all stocks, the reduction of the maximum drawdown reaches at least 10% in absolute value, or 30% in relative value.

Exhibit 1 – Historical Trajectories for the Funding Ratio

Furthermore, we observe that even after controlling for the volatility LDI strategies with liability friendly portfolios dominate those with S&P500 in terms of extreme risk measures (funding ratio maximum drawdown).

Increasing Equity Allocation without a Corresponding Increase in Risk Budgets

The LDI paradigm advocates that pension plans divide their investments between fixed-income securities matching the investor’s liabilities, and a riskier performance-seeking portfolio that is heavily invested in global equities. However, asset managers can actually provide more value to LDI clients by incorporating low volatility and high-yielding equities as part of a broader LDI solution.

While separating performance from liability matching makes theoretical sense, in practice, pension funds cannot use as much leverage as necessary to fully hedge their liabilities. If a manager places the majority of a pension fund’s money into equities, the portfolio could run the risk of high levels of short-term funding volatility. On the other hand, a more moderate equity allocation would require lower risk budgets but less upside potential. For underfunded pension funds, this type of allocation would have a lower chance of solving the funding problem without substantial levels of additional contributions.

While separating performance from liability matching makes theoretical sense, in practice, pension funds cannot use as much leverage as necessary to fully hedge their liabilities. If a manager places the majority of a pension fund’s money into equities, the portfolio could run the risk of high levels of short-term funding volatility. On the other hand, a more moderate equity allocation would require lower risk budgets but less upside potential. For underfunded pension funds, this type of allocation would have a lower chance of solving the funding problem without substantial levels of additional contributions.

We have found that it is possible to construct a customised "liability-friendly" equity portfolio with better liability-hedging properties than an off-the-shelf broad equity index. Customisation can allow for an increased allocation to stocks for the same level of funding ratio volatility, which could result in higher overall performance, barring the improvement in liability-hedging benefits coming at an exceedingly large opportunity cost in terms of risk-adjusted performance.

This article is one of many articles in Investment Management Review (IMR) special edition Autumn 2017 which covers important recent insights into the asset management industry. To access the full edition please click on http://www.imrmagazine.com/edhec-special-edition.php.

This article is one of many articles in Investment Management Review (IMR) special edition Autumn 2017 which covers important recent insights into the asset management industry. To access the full edition please click on http://www.imrmagazine.com/edhec-special-edition.php.

[1] Coqueret, G., L. Martellini and V. Milhau. 2017. Equity Portfolios with Improved Liability-Hedging Benefits. Journal of Portfolio Management 43(2): 37-49.