Insights from the 12th EDHEC Eur ETF, Smart Beta & Factor Investing Survey

by Véronique Le Sourd, Senior Research Engineer, EDHEC-Risk Institute

Insights from the 12th EDHEC European ETF, Smart Beta and Factor Investing Survey

EDHEC-Risk Institute conducted its 12th survey as part of the Amundi “ETF, Indexing and Smart Beta Investment Strategies” research chair at EDHEC-Risk Institute. The aim of this study is to analyse current European investor practices and perceptions with respect to ETFs, smart beta and factor investing strategies, as well as future plans in these domains. By comparing our results to those of our previous surveys, over more than a decade, we aim to shed light on trends within the ETF market and within the smart beta and factor investing strategy offer.

Since 2006, EDHEC has annually surveyed European investors about their views and uses of ETFs. Since 2013, when we first considered smart beta in the survey, complementary questions about smart beta and factor investing strategies have been added each year, allowing participants to describe their general use of and opinions on products that track smart beta indices, and more generally on alternative equity beta strategies. Beginning in 2016, a section of the survey was fully dedicated to smart beta and factor investing strategies. In 2018, we introduced a special group of questions dedicated to smart beta and factor investing for fixed income, and these are a particular focus of this year’s edition. This survey brings together the main vehicles of passive investment, namely ETFs – standard and very liquid products that track indices – and strategies based on the new forms of indices.

Our 182 survey respondents are high-ranking professionals within their organisations (34% belong to executive management and 42% are portfolio managers), with large assets under management (42% of respondents represent firms with AUM exceeding €10bn). They are distributed across different European countries, with 12% from the United Kingdom, 70% from other European Union member states, 14% from Switzerland and 4% from other non-EU countries.

Key findings of the latest survey include the following:

HOW DO INVESTORS SELECT AND USE ETFS?

- Satisfaction has remained at high levels especially for traditional asset classes with a satisfaction rate of 95%, both for equity and government bond ETFs. Investors are more reserved about ETFs for alternative asset classes (20% satisfaction for the hedge fund asset class).

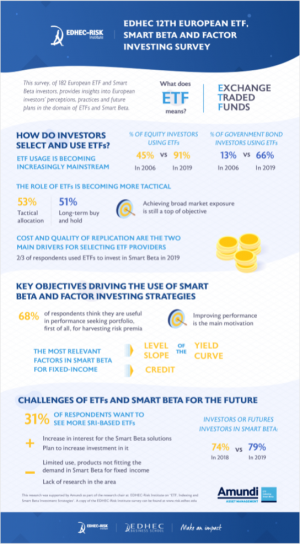

- ETF usage is becoming increasingly mainstream. In 2006 45% of respondents used ETFs to invest in equities, compared with 91% in 2019. As for governments and corporate bonds, the figures rose from 13% and 6% in 2006 to 66% and 68% respectively in 2019.

- ETF usage is becoming more tactical. For the first time, the use of ETFs for tactical allocation was higher (53%) than for long-term buy and hold (51%). This more balanced usage suggests that the ETF market is maturing and users are becoming more proactive.

- Achieving broad market exposure still tops the list, with 73% of respondents using ETFs frequently for this purpose. However, sub-segment usage has risen, probably reflecting the increasingly tactical role of ETFs in portfolios.

- Cost and quality of replication are the two main drivers for selecting ETF providers (88% and 83% of respondents, respectively), related to the main motivations for using ETFs, namely reducing investment costs while tracking index performance. Qualitative criteria considered by investors are broadness of the range and the provider’s long-term commitment (44% and 28% of respondents, respectively).

- About two-thirds of respondents (66%) used ETFs to invest in Smart Beta in 2019, a considerable increase since 2014 (49%).

KEY OBJECTIVES DRIVING THE USE OF SMART BETA AND FACTOR INVESTING STRATEGIES

- Improving performance is the main motivation for using Smart Beta and Factor Investing strategies. Managing risk is also considered an important criterion. Despite this strong motivation, for 70% of respondents, less than 20% of their total investments relates to smart beta and factor investing strategies.

- In terms of the actual product wrapper, respondents currently favour active solutions, i.e. approaches including a significant amount of discretion (61%), not far ahead of passive funds that replicate smart beta and factor investing indices (55%). The biggest advantage of using discretionary strategies over replicating indices is the possibility of creating alignment with investor beliefs.

- Respondents most frequently use smart beta /factor-based exposures to harvest long-term premia (as opposed to tactical use).

- There is an important gap between required information about smart beta and factor investing products and ease of access to this information: transparency of portfolio holdings and liquidity and capacity are considered crucial information for respondents when it comes to assessing smart beta products, but also appear to be among the most difficult to obtain, while relatively basic information such as the index construction methodology also appears not to be readily available.

- Respondents show a significant interest in smart beta and factor investing for fixed income and plan to increase such investments but consider that there is not enough research in the area.

- 68% of respondents feel that smart beta and factor investing bond solutions are especially useful in performance-seeking portfolios, primarily to harvest risk premia.

- About three-fifths of respondents believe that the three typical factors of the credit risk market, namely carry/level of the yield curve, credit and slope of the yield curve, are the most relevant in fixed-income markets (63%, 60% and 58% respectively).

FUTURE DEVELOPMENTS ON ETF, SMART BETA & FACTOR INVESTING PRODUCTS

46% of investors still plan to increase their use of ETFs in the future despite the already high maturity of this market and high current adoption rates.

Lowering investment cost is the primary driver behind future take-up of ETFs for 74% of respondents in 2019.

31% of respondents want to see more SRI-based ETFs, while similar proportions are interested in ETFs related to multi-factor and smart beta indices (30% and 28% respectively).

The cumulative percentage of those that already invest or are considering investing in smart beta and factor investing in the near future is still higher in 2019 (79%) than in 2018 (74%), which leaves room for further development of this investment in the near future.

When asked about the smart beta solutions they think require further development by providers, respondents cited fixed income, ESG, and alternative asset classes. There is particularly critical room for development in the fixed income asset class that is largely used by investors. They would also like more customised solutions to be developed. The development of new products corresponding to these demands may lead to an even wider adoption of smart beta solutions.

The research from which this study is drawn was produced as part of the Amundi “ETF, Indexing and Smart Beta Investment Strategies” research chair at EDHEC-Risk Institute.