Internal Carbon Pricing: Impact or Greenwashing?

By Gianfranco Gianfrate, Research Director, EDHEC-Risk Climate Impact Institute; Professor of Finance, EDHEC Business School

- Internal Carbon Pricing (ICP) is a voluntary practice to manage firms’ carbon footprint.

- Understanding internal carbon pricing is thus becoming essential to corporates and investors alike.

- Disclosing corporate ICP can result in a mere greenwashing exercise.

- Only the actual integration of ICPs in firms’ strategy is associated with a carbon footprint reduction.

1. Introduction

Companies are increasingly called to collaborate in the fight against climate change in a context of rising public awareness for the need to accelerate decarbonisation and of an emerging global climate governance (Calvet, Gianfrate and Uppal, 2022). Their involvement is crucial as more than two thirds of the world’s emissions since the beginning of the industrial revolution have been emitted by large companies. New tools for climate mitigation are emerging to assist with the delivery of corporate greenhouse gas (GHG) emissions objectives, with internal carbon pricing (ICP) becoming a widespread practice globally (Aldy and Gianfrate, 2019; Bento et al., 2021). ICP is a voluntary method for companies to internalise the social cost of their GHG emissions, even when all or part of their operations are out of the scope of external carbon regulations.

Companies adopt ICP in various settings and for many reasons. ICP can be used for risk-management purposes, strategic planning activities and decisions about capital investments. Such voluntary practices are particularly important as mandatory emissions trading and carbon taxing schemes cover less than a quarter of global emissions and less than 5% of emissions are covered by a direct carbon price that is consistent with the goals of the Paris Agreement (World Bank, 2023). Disclosure of ICP usage may also help persuade investors to reduce the premium required to compensate for poor current performance in terms of GHG emissions. As for measuring the impact of such disclosure on climate performance, further investigation is required.

Understanding ICP becomes even more relevant for corporates and investors alike with the recent inclusion of ICP in the cross-industry metrics whose disclosure is required for compliance with the updated guidance of the Task Force on Climate-related Financial Disclosures (TCFD, 2021).[1]

2. Evidence About ICP Around the World

Data about ICP adoption from companies comes from The Carbon Disclosure Project (CDP) which is a global initiative that surveys the carbon strategies of large global companies. The CDP started in 2002 at the request of 35 institutional investors managing more than $4.5 trillion of assets because of the growing need to obtain information about the financial impacts of climate change in firms’ operations. The CDP inquiries information about the business threats and strategies related to climate change including internal carbon prices of the world’s largest companies, organizes the responses into a large dataset and publishes an annual report that presents the results of the inquiry. The CDP has been reported to be the largest effort to assemble standardized data on carbon emissions as well as information on companies’ risks, opportunities, and strategies to manage the effects of climate change.

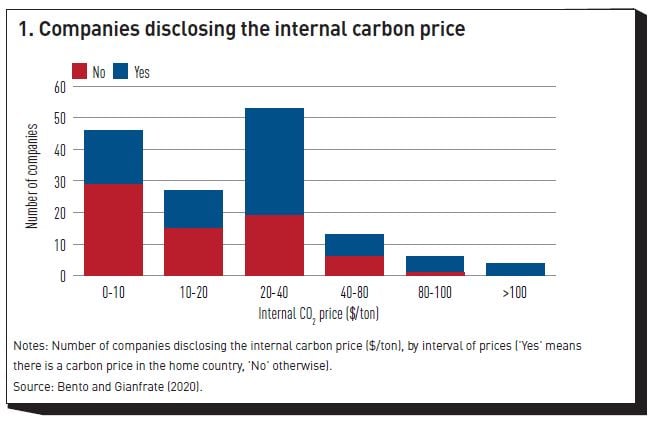

Figure 1 presents the proportion of companies disclosing the internal carbon price from countries that have put in place a carbon policy, according to data from World Bank (2016). This proportion tends to increase with the level of prices, suggesting a possible relationship between local carbon policies and the strategy of companies to price carbon internally.

The firms’ internal carbon prices are higher than explicit carbon prices (Bento and Gianfrate, 2020). This observation could reflect several situations:

- Firms price carbon at the level of effective carbon prices (command-and-control regulation, technology mandates and subsidies, etc.) which are greater than prices in cap-and-trade markets or carbon taxes;

- Firms expect carbon prices to increase over the economic lifetime of the investments; and

- Firms do not implement the disclosed carbon prices in their investment decisions.

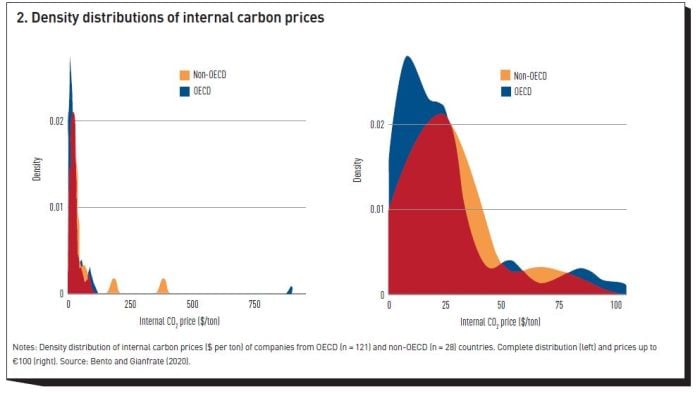

Figure 2 shows the distribution of internal carbon prices of companies in OECD and non-OECD countries. More than four-fifths of the internal carbon prices reported in the sample are from companies with headquarters in OECD countries. The companies in this area show a more fragmented distribution of prices with a concentration in low levels and in high levels (right-hand graph) compared to companies from non-OECD countries, even if the low number of observations in the latter tends to concentrate the values.

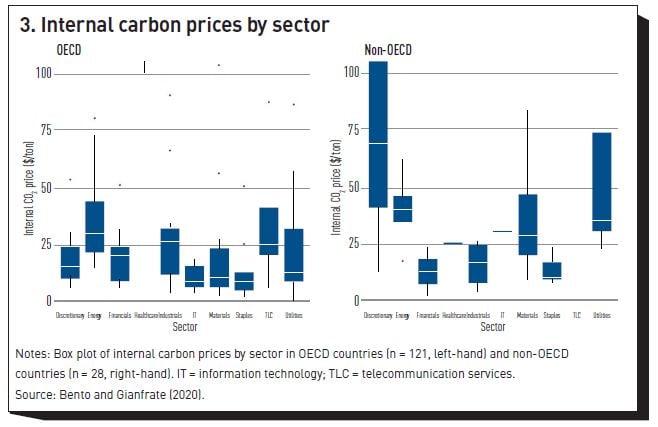

Figure 3 shows a breakdown of internal carbon prices by sectors grouped according to the Global Industry Classification Standard – GICS (Utilities, Energy, Financials, Telecommunication Services, Materials Sectors, Health Care, Consumer Discretionary, Information Technology, Consumer Staples and Industrials). The shadow prices are more dispersed among the sectors in non-OECD countries (but a low number of observations). Energy, a traditionally highly emitting sector, has the highest prices in companies reporting from OECD countries (the second highest in companies from non-OECD). In addition, Energy and Utilities have the highest proportion of companies planning to price carbon or that currently price it (52% and 63%, respectively) among the disclosing companies (not shown, cf. CDP, 2016).

Despite the growing importance of internal carbon pricing, the consequences of such practice remain generally unexplored.

3. ICP Adoption and Carbon Footprint

We study the relationship between internal carbon price reporting and carbon footprint, as a measure of the credibility of corporates’ disclosures. Specifically, we study whether ICP adoption helps companies delivering on carbon footprint reduction or whether it is just a greenwashing exercise. In general, firms adopt and disclose ICP for several reasons:

- to gain social acceptance (Ghitti, Gianfrate and Palma, 2023);

- to improve the dissemination of shadow prices; and

- to gain a comparative advantage in the future through an early adoption of carbon pricing.

On the other hand, companies may also disclose ICP as a communication strategy to improve reputation and/or to avoid more stringent climate policy, without integrating them in their operations (“greenwashing”) (Ghitti, Gianfrate and Palma, 2023). This would improve the companies’ reputation in the short run at the price of undermining the legitimacy around this environmental practice in the medium term, and worse, contributing to delaying the action against climate change. Despite the growing importance of ICP, the effectiveness of this practice remains mostly unexplored.

We explore the integration of these shadow prices in the firms’ strategies. Empirically, we analyse the information about the ICP collected by the Carbon Disclosure Project. The Carbon Disclosure Project (CDP) surveys the business threats and strategies related to climate change to the world’s largest companies, organises the responses into a large dataset and publishes an annual report that presents the results of the inquiry. We use the ICP collected in the 2016 report (CDP, 2016). That is the only one published so far in which surveyed companies with an ICP were specifically asked:

- whether ICP had had an impact on business decisions, i.e. has resulted in tangible changes in the operational activities and/or investments such as the development of low-carbon products or the investment in improving the energy efficiency in production; and

- whether ICP were expected to be embedded in corporate business targets, i.e. they are part of a strategy to achieve a certain climate-related goal or target such as being aligned with the needs of a 1.5ºC scenario.

Because these items of the survey are only available for 2016, we restrict this analysis only to companies reported as having an ICP price for that year.

To understand how the adoption of ICP impacts the carbon footprint of the companies, we test to what extent disclosure about ICP is associated with any actual reduction in emissions. We specifically investigate which ICP reporting behaviours are associated with a reduction of carbon intensity in 2019 versus the previous two years.

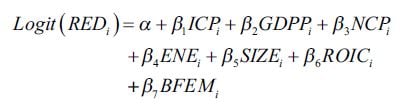

We use a logit model as follows:

where REDi is an indicator equal to 1 if the carbon intensity (Direct CO2 Emissions/Revenues) in 2018 is lower than in 2016 for firm i and 0 otherwise, ICPi is a dummy variable related to equal to 1 if companies have adopted a specific ICP-related reporting behaviour (alternatively, disclosing the level of ICP, actual use in the past of ICP for business decision making, or committed integration of ICP in corporate strategy targets) and 0 otherwise. The remaining independent variables are: SIZEi which is the natural logarithm of revenues for firm i, ROICi which is the average Return on Invested Capital, BFEMi that is the ratio of female board directors to total directors, GDPPi that is the logarithmic value of the GDP per capita of home country of firm i, NCPi which is a dummy variable with value 1 if the home country of firm i has a national carbon pricing policy (climate tax or equivalent) and value 0 otherwise, finally ENEi is a dummy variable with value 1 if firm i is from the energy sector and 0 otherwise.

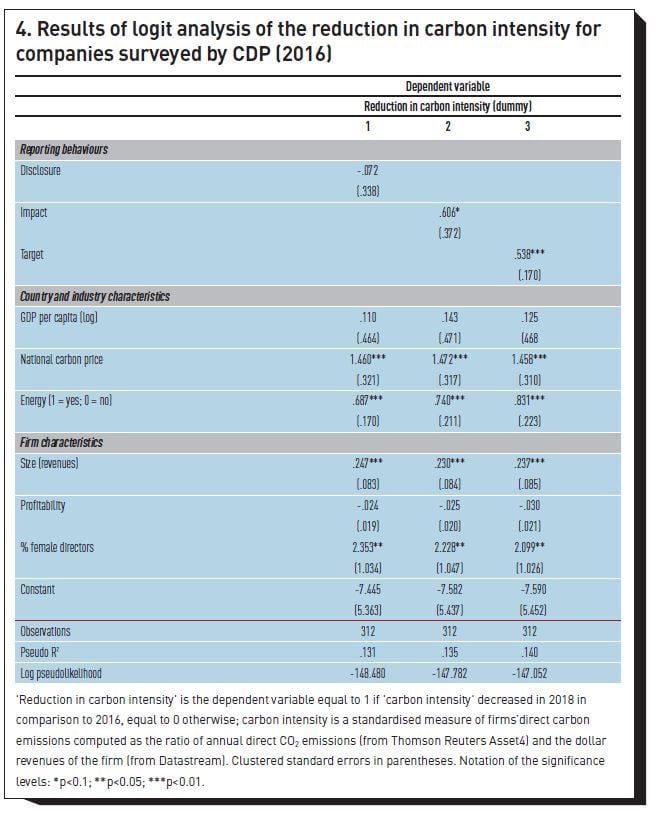

We analyse whether reporting behaviours related to ICP are associated with an actual reduction in standardised carbon reduction for companies reporting to the CDP in 2016 (see figure 4).

For the three models reported in Figure 4, the dependent variable is a dummy equal to 1 if carbon intensity has decreased in 2019 versus 2016, and equal to 0 otherwise. Consistently across the models, while GDP per capita is not statistically significantly related to the likelihood of carbon intensity reduction, the existence of a national climate policy in the country of reference and the affiliation to the energy sector are positively associated to the likelihood of achieving a carbon intensity reduction. Size is also positively associated to a carbon intensity reduction likelihood (at 1%) as the ratio of female directors in the board (at 5%).

As for the reporting behaviours, Model 1 in Figure 4 shows that the disclosure of the ICPs does not appear to be associated with a carbon intensity reduction. In Model 2, the reported Impact of ICPs in decision-making is positively related to a carbon intensity reduction, with moderate statistical significance (10% level). On the contrary, Model 3 shows that companies indicating in the 2016 CDP survey that they were integrating ICPs in the business operational targets are positively associated to the likelihood of delivering a reduction of carbon intensity.

Overall, these results help disentangling the role of greenwashing in the legitimacy creation for new climate accounting practices: for ICPs, it is not the price disclosure per se that predicts virtuous environmental behaviours, but rather the actual experience of ICPs in the past, and, more importantly, the declared commitment to use them in future strategy targets.

5. Conclusion

Action against climate change is urgent and requires the widespread participation of firms (Ducoulombier, 2021). Whether ICP adoption helps reducing firms’ carbon intensity is an important question to answer given the rapid decarbonisation needed to deliver on the Paris Agreement targets, as global policymakers are converging on implementing carbon pricing across economies starting with the larger firms. We show that the actual experience of ICP in the past, and the commitment to use it in future strategic targets, are more important when it comes to predict virtuous environmental behaviours than the price disclosure per se.

This analysis has several limitations, including the reliance on a secondary data source. It focuses on reductions in carbon intensity, rather than total emissions. One could argue that only reductions in carbon intensity are feasible in the short term. Others may assert that some emission reductions could be “low-hanging fruits” or even “relabelling” of climate action for activities that companies were already planning to undertake anyway.

However, internal carbon prices are likely to enhance decision making for internal projects with cash flows impacted by carbon risks and enable better interactions between companies and their stakeholders, especially investors, concerned with carbon risks. Carbon risks are impacting the cash flows of companies, especially the large emitters. Carbon-abatement efforts will put dramatically different levels of stress on the cash flows of different industries. The immediate impact on cash flows might be limited for now, but it will eventually be relevant in many industries. As carbon pricing influences current and future cash flows, firm valuations (McKinsey, 2008) are affected as well. Therefore, effectively accounting for carbon pricing risk when measuring corporate value becomes of paramount importance for both executives and investors.

Footnotes

[1] The TCFD explains that: “Internal carbon prices provide users with an understanding of the reasonableness of an organisation’s risk and opportunity assessment and strategy resilience. The disclosure of internal carbon prices can help users identify which organizations have business models that are vulnerable to future policy responses to climate change and which are adapting their business models to ensure resilience to transition risks.” For futher information on the updated TCFD guidance, the reader is referred to Ducoulombier (2021).

References

Aldy, J.E. and G. Gianfrate (2019). Future-proof your climate strategy. Harvard Business Review, May-June: 91–101.

Bento, N. and G. Gianfrate (2020). Determinants of internal carbon pricing. Energy Policy 143: 111499. Available at: https://doi.org/10.1016/j.enpol.2020.111499

Bento, N., G. Gianfrate and J.E. Aldy (2021). National Climate Policies and Corporate Internal Carbon Pricing. The Energy Journal 42(5). DOI: 10.5547/01956574.42.5.nben

Calvet, L.E., G. Gianfrate and R. Uppal (2022). The finance of climate change. Journal of Corporate Finance, 73: 102162.

CDP (2016). Embedding a carbon price into business strategy. Report. Carbon Disclosure Project, September. Available at: https://www.cdp.net

Ducoulombier, F. (2021). TCFD Recommendations and 2021 Guidance. Scientific Beta white paper, November. Available at: https://www.scientificbeta.com/factor/download/file/tcfd-recommendations...

Ghitti, M., G, Gianfrate and L. Palma (2023). The Agency of Greenwashing. Journal of Management and Governance. Available at: https://doi.org/10.1007/s10997-023-09683-8

McKinsey (2008). How climate change could affect corporate valuations. Available at: https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our...

TCFD (2021). Guidance on Metrics, Targets, and Transition Plans, Taskforce on Climate-Related Financial Disclosure. Available at: https://assets.bbhub.io/company/sites/60/2021/07/2021-Metrics_Targets_Gu...

World Bank (2016). Carbon Pricing Watch 2016. World Bank and Ecofys, May, Washington, DC.

World Bank (2022). Carbon Pricing Dashboard. Accessed on 30 June 2022. Available at: https://carbonpricingdashboard.worldbank.org/