Introducing “Flexicure” Goal-Based Investing Retirement Solutions

Feature

Introducing “Flexicure” Goal-Based Investing Retirement Solutions

1. The Pension System Crisis

A major crisis is threatening the sustainability of pension systems across the globe.

In most developed countries, pension arrangements are organized on the basis of a three-pillar system. The first pillar, which is key for social coherence, is made of public social security benefits and aims at providing a universal core of pension coverage to address basic consumption needs in retirement through funded pub1 – Lionel Martellini is a Professor of Finance at EDHEC Business School and the Director of EDHEC-Risk Institute. Vincent Milhau is a Research Director at EDHEC-Risk Institute. John Mulvey is a Professor of Operations Research and Financial Engineering at Princeton University and a founding member of the Bendheim Center for Finance. lic pension systems or unfunded pay-as-you-go systems. Most countries that have opted for a funded system, as is the case in United Kingdom, are faced with a systemic deficit that is getting worse. The situation is unfortunately no better in countries like France that have adopted an unfunded pay-as-you-go system, which sustainability is deeply threatened by rising life expectancy and the coming of retirement age of baby boomers, as well as low population and productivity growth.

The second pillar of pension systems, made of public or private occupational pensions which are expected to provide additional replacement income for retirees, is also weakening. In particular, private pension funds have been strongly impacted by the shift in accounting standards towards the valuation of pension liabilities at market rates, instead of fixed discount rates, which have resulted in increased volatility for pension liabilities. This new constraint has been reinforced in parallel by stricter solvency requirements following the 2000-2003 pension fund crisis. The evolution of accounting and prudential regulations have subsequently led a large number of corporations to close their defined-benefit pension schemes to new members and increasingly to further accrual of benefits so as to reduce the impact of pension liability risk on their balance sheets and income statements. Overall, a massive shift from defined-benefit pension to definedcontribution pension schemes is taking place across the world, implying a transfer of retirement risks from corporations to individuals.

As a result of these evolutions, public and private pension schemes deliver replacement income levels that are significantly lower than labor income. According to the OECD report Pensions at a Glance 2017, pension replacement rates range from a mere 42.4% to 52.9% in the US as a function of the income level. The need to supplement retirement savings via voluntary contributions in individual retirement accounts, the so-called third pillar of pension systems, makes individuals even more increasingly responsible for their own saving and investment decisions. This global trend poses substantial challenges as individual investors not only suffer from behavioral limitations but also typically lack the expertise needed to make educated investment decisions

2. Retirement Product Landscape

Existing retirement products fail to provide a satisfactory answer to the retirement problem

In response to these concerns, a number of so-called retirement products have been proposed by insurance companies and asset management firms. There are reasons to believe, however, that these products, fall short of providing satisfactory solutions to the problems faced by individuals when approaching investment saving decisions.

The most natural way to frame an investor’s retirement goal is in terms of how much lifetime guaranteed replacement income they will be able to afford purchasing at retirement. Given that the biggest risk in retirement is the risk of outliving one’s retirement assets, securing replacement income within the decumulation period can be best achieved with annuities (possibly inflation-linked or cost-of-living-adjusted), which are the true risk-free assets for individuals preparing for retirement. Annuity products, however, are cost inefficient, irreversible, and do not contribute to bequest objectives. These elements undoubtedly explain the extremely low demand for annuities, a.k.a. the “annuity puzzle”, that is of course when annuitization is not incentivized or mandatory.

Turning to asset management products, available retirement products suffer from a critical lack of focus on replacement income needs in retirement. Life-cycle funds (also known as target date funds), which are often used as the default option in retirement plans, may seem attractive solutions due to the fact that these are positioned as one-stop solutions to provide long-term investors with a diversified investment and an allocation strategy that favors wealth accumulation in early years and gradually switches towards safety as retirement date approaches. Target date funds, however, generally focus on reducing uncertainty over capital value near the retirement date, regardless of the beneficiaries’ objectives in terms of replacement income in retirement. The socalled “safe” bond portfolio used in these strategies is actually unsafe when it comes to securing a replacement income because it is not explicitly designed to deliver a stable income during the decumulation period. As a result of this duration mismatch, they offer no protection to investors with respect to unexpected changes in retirement risk factors

In brief, individuals are left with a unsatisfactory choice between on the one hand insurance products (annuities), which provide security but lack flexibility and upside potential, and on the other hand investment products (target date funds), which provide flexibility but no security because of their lack of focus on generating minimum levels of replacement income in retirement.

3. Goal-Based Investing for Retirement

Goal-based investing principles can be usefully applied to the retirement problem

In what follows, we use the concept of “flexicurity” borrowed from job market reforms to argue that individual need both security and flexibility when approaching retirement investment decisions, and we argue that goal-based investing principles provide a way out of the impasse of a choice between annuities, which offer security with no flexibility, and target date funds, which offer flexibility with no security

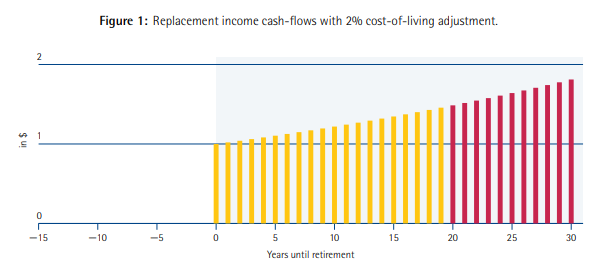

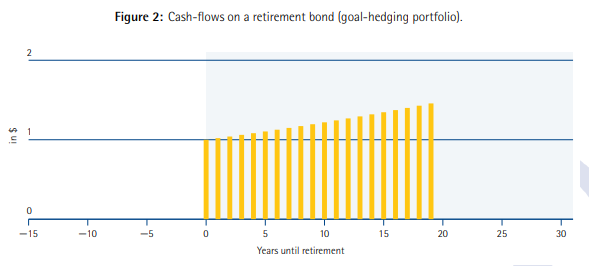

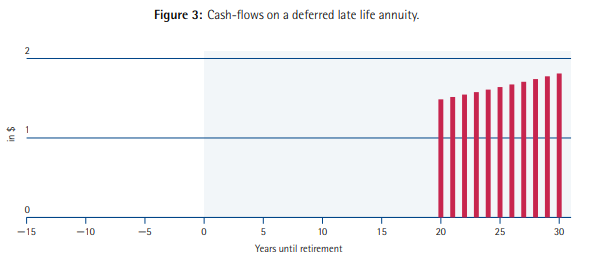

In a nutshell, the key insight behind “flexicure” retirement solutions is that one does not have to use costly and irreversible annuity products to generate replacement income for the first 20 years in retirement. One can use instead a suitably-designed cash-flow matching liquid bond portfolio. Cost-of-living-adjusted replacement income cash-flows can thus be split into two components (see Figures 1, 2 and 3).

The first component, which aims at generating replacement income for 20 years after the retirement date, can be replicated by a retirement goal-hedging bond portfolio, or retirement bond in short.[1] In parallel, protection against extreme longevity risk, say beyond age 85, can be achieved by purchasing a deferred late life annuity at retirement date.

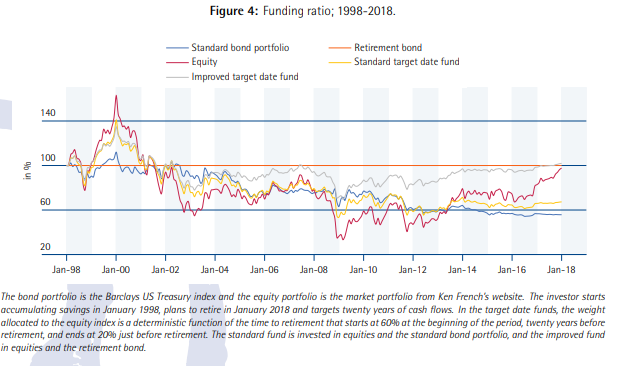

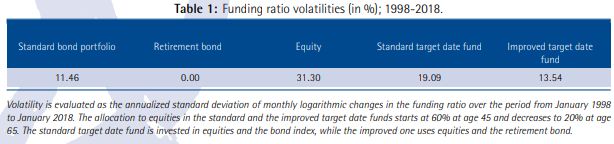

To obtain a more precise estimate for how much risk budget is wasted when an improper safe asset is used in a retirement context, let us consider a standard shortduration bond portfolio and measure the volatility of its purchasing power in terms of replacement income (see Figure 4 and Table 1). The bond portfolio is the Barclays US Treasury Index with coupons reinvested. The volatility of the funding ratio for this standard bond portfolio is measured to be 11.46% over the period ranging from January 1998 to December 2017, where the funding ratio is defined as the ratio of asset value to the present value of replacement income needs for the first 20 years in retirement. This suggests that this standard bond portfolio is not safe with respect to the replacement income generating goal due to a severe duration mismatch. Of course the equity index, taken here to be the market portfolio from Ken French’s website[2], generates an even higher funding ratio volatility at 31.30% over the period, but this was to be expected from a risky performanceseeking portfolio. In contrast, the dedicated retirement goal hedging bond portfolio, which is the true safe asset in a retirement context, generates by construction a 0% funding ratio volatility.

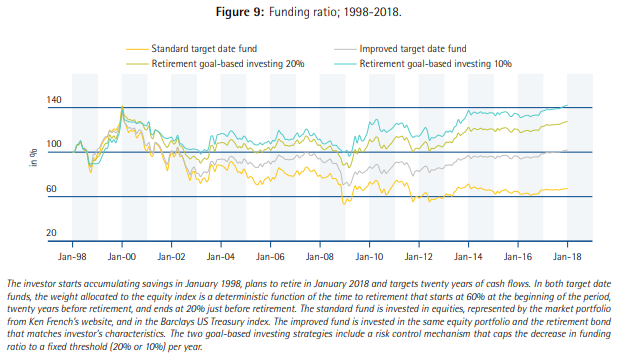

Using a dedicated retirement goal hedging bond portfolio versus a standard short duration bond portfolio in retirement investing strategies generates substantial benefits. Consider for example a standard target date fund with an equity allocation starting at 60% at age 45 and decreasing to 20% at retirement, supposed to take place at age 65, while the remainder is invested in the standard bond portfolio. The historical funding ratio volatility for this standard target date fund strategy is 19.09% over the sample period, while it is reduced to 13.54% when the truly safe retirement goal hedging portfolio is instead used according to the same glide path.

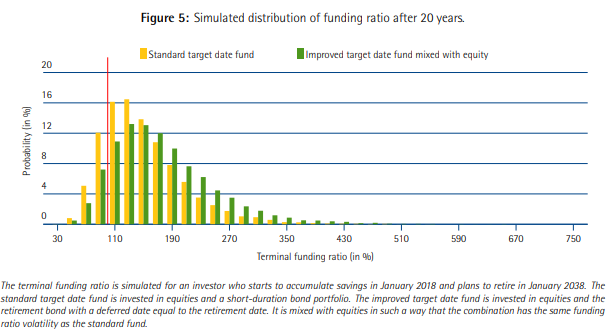

Such a reduction in risk can obviously be translated into an improvement in performance. A higher allocation to equities can indeed be added to the improved balanced fund so as to match the funding ratio volatility of the standard balanced fund. In Figure 5, we present the results of a Monte-Carlo simulation analysis, where we show the distribution at retirement date of the funding ratio for the standard target date fund (improperly using the standard bond portfolio as a safe building block), the improved target date fund (using the proper safe retirement goal hedging portfolio as a safe building block) and a mixture of the improved target date fund and the equity portfolio chosen to generate the same funding ratio volatility as the standard target date fund. The stochastic model and the parameter values are described in detail in Giron et al. (2018).

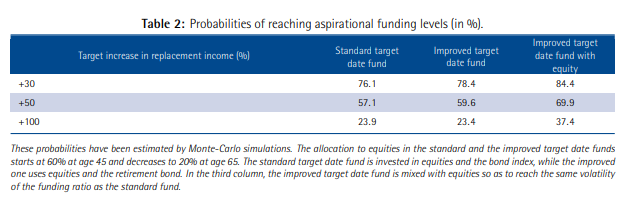

In Table 2, we obtain for the same funding ratio volatility a 22% improvement in the probability to generate a 50% increase in replacement income and a 56% improvement in the probability to generate a 100% increase in replacement income when the retirement goal hedging bond portfolio is used!

4. Introducing Short-Term Risk Control

Dynamic risk control mechanisms can be used to cap the annual loss in replacement income to a fixed threshold

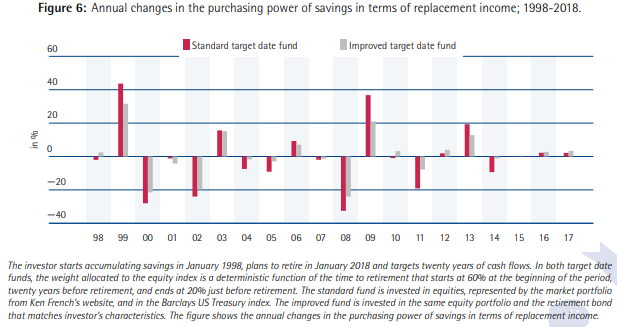

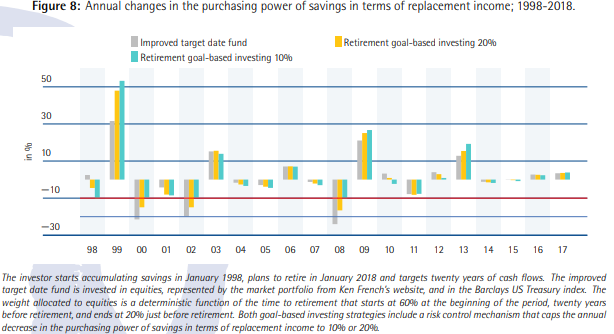

Using the proper safe asset allows for a substantial reduction in downside risk, measured here by the maximum annual loss in funding ratio. The key benefit of the glide path in target date fund strategies is that downside risk decreases as one approaches retirement. Maximum annual losses, however, can exceed 20% in some years with severe equity bear markets, as can be seen in Figure 6: examples of such years include 2000, 2002 and 2008.

To cap the annual loss in replacement income to a fixed threshold, we may introduce a suitable class of dynamic goal-based investing strategy. Let us consider for concreteness an investor preparing for retirement who seeks to protect 80% of the purchasing power in terms of replacement income of any dollar invested during the accumulation or the transition phase. This protection must take place on a yearly basis, that is if contributions take place in January, the strategy must protect 80% of the purchasing power of invested contributions over each calendar year. This short-term essential goal commands a floor that the strategy should respect at all times, and is equal to 80% of the price of the retirement bond that pays the replacement income that was affordable at the beginning of the year. This floor is reset every year to be equal to 80% of current savings, including the annual contribution

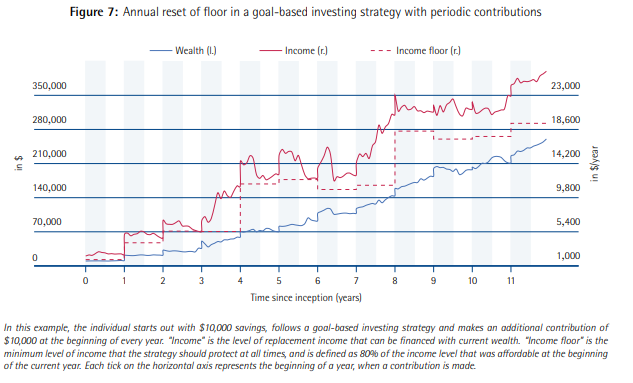

This mechanism is depicted in Figure 7, where we plot the value of accumulated savings and the level of affordable income for an investor who starts with $10,000 in January 2010 and adds another $10,000 every year to his/her account. The floor expressed in terms of affordable income is by definition equal to 80% of the income level that was affordable in January, so it is constant within a year. The cap on annual loss can be set to any value between 0 and 100%, e.g. 10% instead of 20%.

Protection of the floor can be achieved by the means of a dynamic insurance strategy, in which the dollar allocation to the equity portfolio is taken to be a multiple of the risk budget or margin for error, defined as the distance between current wealth and floor levels, while the remainder of the wealth is invested in the dedicated retirement goal-hedging bond portfolio.

In order to anchor the design of the retirement solutions with respect to existing target date fund, we further set the value of the multiplier at the beginning of every year in such a way that the percentage allocation to the equity portfolio matches the equity allocation of a deterministic target date fund. With this rule, the multiplier is a deterministic function of time, and the strategy has exactly the same equity allocation as the corresponding target date fund at the beginning of each year. Within any given year, however, the allocation to equities does not stay constant and instead reacts to changes in the distance between current wealth and the floor, so as to protect the 80% essential goal.

Figure 8 shows that the introduction of such risk control mechanisms effectively allows us to cap the losses in terms of purchasing power of replacement income at the target level, chosen to be for example 10% or 20% within a given year.

Implementing the strategy over the last 20 years generates strong improvements in funding ratio with respect to the standard target date fund, and also with respect to the target date fund using the retirement goal-hedging portfolio but no dynamic risk control mechanisms, as can be seen in Figure 9.

Given the presence of two severe bear markets in the sample period (2000-2003 and 2008), a smaller risk budget (10% versus 20%) would have led to the best outcome in this particular case. In general, a formal analysis of the opportunity cost in terms of the decrease in the probability to reach attractive aspirational levels of replacement income can be conducted within the framework of the Monte-Carlo simulations so as to set risk budgets at the appropriate level.

5. Expected Benefits for Individual Investors

Individuals would benefit from goal-based investing techniques similar to liability-driven investing techniques used in institutional money manageme

Individuals need “flexicurity” in retirement solutions, and should not have to choose between security and flexibility. In this context, we propose to apply the principles of goal-based investing to the design of a new generation of retirement goal-based investing strategies, which can be regarded as risk-controlled target date funds that strike a balance between security and performance with respect to the objective of generating replacement income. These simple retirement goal-based investing strategies can be used to help individuals and households secure minimum levels of replacement income while generating upside exposure in the context of liquid and reversible investment products. Recent advances in financial engineering and digital technologies make it possible to apply goal-based investing principles to a much broader population of investors than the few traditional clients who can afford customized mandates or private banking services. In a nutshell, this context creates an opportunity to provide genuine investment solutions, as opposed to off-the-shelf products, to individuals preparing for retirement.

In a recent joint initiative, EDHEC-Risk Institute and the department of Operations Research and Financial Egineering at Princeton University have teamed up to design a series of indices, the EDHEC-Princeton Retirement Goal-Based Investing Index series. It is our hope and ambition that the launch of these indices can facilitate the introduction of second generation flexicure target date funds that can be used as part of the solution to the global pension crisis.[3]

Notes

[1] – In a series of recent independent and joint articles published in the international financial press, Professors Martellini, Merton and Muralidhar have suggested that governments and other public or semi-public institutions could start issuing such “retirement bond” that would have two main characteristics: (1) payments would be deferred to the retirement date, and (2) interest payment and capital amortization would be spread over time in such a way that the annual income paid by the bond is constant or preferably cost-of-living adjusted. In parallel, asset managers can already use standard duration and/or cash-flow matching techniques routinely deployed in the context of liability-driven investment solutions to manufacture proxies for the retirement goal-hedging portfolio to be used as the safe building block in retirement solutions.

[2] – Data is publicly available at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

[3] – For more details on EDHEC-Risk Institute and Princeton ORFE research in the area of retirement solutions, visit our websites https://risk.edhec.edu/indices-investment-solutions and https://orfe.princeton.edu/optlab/research/financial-mathematics and follow us on Twitter @EDHECRisk#MakeFinanceUsefulAgain.

References

Giron, K., L. Martellini, V. Milhau, J. Mulvey, and A. Suri. 2018. Applying Goal-Based Investing Principles to the Retirement Problem. EDHEC-Risk Institute Publication.