Main results from the EDHEC European ETF & Smart Beta Survey 2018

By Véronique Le Sourd, Senior Research Engineer, EDHEC-Risk Institute

Main results from the EDHEC European ETF and Smart Beta and Factor Investing Survey 2018

EDHEC-Risk Institute conducted its 11th survey of European investment professionals on the usage and perceptions of exchange-traded funds (ETFs) at the beginning of 2018.1 This annual survey, introduced in 2006, and initially entirely devoted to ETFs, now also dedicates a large group of questions to investors’ general use and opinion of smart beta and factor investing strategies, with a special focus on fixed income.

Our results are based on the responses of 163 European decision-makers (37% belong to executive management and 33% are portfolio managers). The survey respondents were from 25 countries, with 17% from the UK, 69% from other EU member states, 13% from Switzerland and 1% from other countries outside the EU. Institutional investment managers made up the majority of respondents in the study (72%), and participating organisations together have assets under management of at least €3.1trn.

In the present article, we sum up the main results of the survey. We first turn to key results concerning ETF usage and selection, and then address results relating to the use of smart beta and factor investing strategies. We conclude with investor perspectives for future developments.

How do investors select and use ETFs?

It appears that, while ETFs indeed offer numerous possibilities to move beyond traditional passive investing, the principal use of ETFs for traditional asset classes remains long-term investing in broad market indices. Some 61% of respondents use ETFs for buy-and-hold investments, while only 45% of them use ETFs for tactical bets. Looking at trends on ETF usage in our successive surveys, it appears that the use of ETFs for buy-and-hold investments has remained quite stable at over 60% since 2012. Moreover, despite the intense product development for a multitude of sub-segments of the markets (sectors, styles etc), gaining broad market exposure remains the main focus of ETF users (71% of respondents), to be compared with 45% who use ETFs to obtain specific sub-segment exposure (sector, style). While some variations were observed for those figures over the period from 2009 to 2018, the values obtained in 2018 are equal to the long-term mean.

Consistent with this desire to use ETFs for passive exposure to broad market indices, respondents show little appetite for seeing discretionary active strategies delivered in an ETF wrapper. In fact, with 15% of respondents mentioning it, actively-managed strategies are one of the least desired categories when we asked about their wishes for future product development in the ETF space. It can also be noted that investors are largely satisfied by ETFs in traditional asset classes, but more reserved about ETFs for alternative asset classes. While 97% and 92% of respondents are satisfied with their use of ETFs to invest in equities and government bonds, respectively, only 17% are satisfied with their use of ETFs for hedge funds.

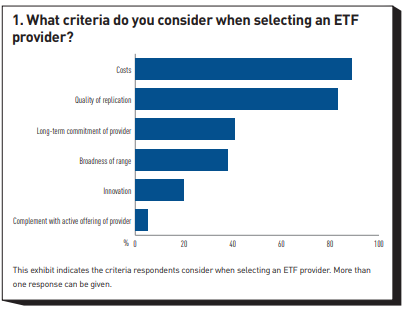

When selecting an ETF provider, two criteria dominate investors’ preoccupations. The first one is costs, and the second one is the quality of replication, with respectively 89% and 83% of respondents, considering these criteria. These results are not surprising as these two criteria are related to the main motivations for using ETFs, namely reducing investment costs, while tracking the performance of the underlying index. It is worth noting that such measureable product qualities are in the foreground of investor preoccupations. On the other hand, more potentially subjective quality criteria associated with a provider play a lesser role. With 41% and 38% of respondents, Main results from the EDHEC European ETF and Smart Beta and Factor Investing Survey 2018 Véronique Le Sourd, Senior Research Engineer, EDHEC-Risk Institute respectively, long-term commitment of the provider and broadness of the range are two criteria that still play a reasonable role for respondents when choosing an ETF provider. However, with only 20% of respondents mentioning it, innovation seems to be of less importance. Finally, complementing the active offering of the provider appears to be important for only 5% of respondents (see figure 1).

Given that the key decision criteria are more product-specific and are actually ‘hard’ measurable criteria, while ‘soft’ criteria that may be more provider-specific have less importance, competition for offering the best products can be expected to remain strong in the ETF market. This implies that it will be difficult to build barriers of entry for existing providers unless they are related to hurdles associated with an ability to offer products with low cost and high replication quality.

Future growth drivers for ETFs

The European ETF market has seen tremendous growth over the past decade or so. While such growth can be observed ex post from market data, our survey allows us to assess the drivers of such growth and the intentions of future ETF adoption by respondents. A remarkable finding from our survey is that a high percentage of investors (50%) still plan to increase their use of ETFs in the future, despite the already high maturity of this market and high current adoption rates. We thus observe a remarkably persistent tendency for future growth. First, a clear finding is that lowering investment cost is the primary driver behind investors’ future adoption of ETFs for 86% of respondents in 2018. However, investors are not only planning to increase their ETF allocation to replace active managers (70% of respondents in 2018), but are also seeking to replace other passive investing products through ETFs (45% of respondents in 2018).

Motivations and growth prospects for smart beta and factor investing strategies

Smart beta and factor investing strategies have continuously been in the spotlight in recent years and the increasing investor interest is obvious. Our survey allows some light to be shed on the drivers behind this interest and the actual usage of smart beta and factor investing strategies among investors. A first important result is that the quest for outperformance is the main driver of interest in smart beta and factor investing. In fact, 73% of respondents agree that smart beta and factor investing indices offers significant potential for outperformance, and indicate that the most important motivation behind adopting such strategies is to improve performance, far ahead of other such as ‘Address regulatory constraints’ or ‘Manage risk’.

However, despite this strong motivation to use smart beta and factor investing strategies to seek performance improvements, the actual implementation of such strategies is still at an early stage, according to information from our respondents on their current and future usage. In fact, while 46% of respondents currently invest in smart beta and factor investing strategies, another 28% do not but are considering adopting such strategies in the future. Moreover, among those respondents who have made investments in smart beta and factor investing strategies, these investments typically make up only a small fraction of portfolio holdings. 83% of respondents invest less than 20% of their total investments in smart beta and factor investing strategies and only 11% of respondents invest more than 40% of their total investments in those strategies. This low intensity of usage of factor indexing ultimately means that investors – even if they have adopted factor investing – do not fully capture the benefits as of today. It is perhaps surprising that almost a decade after the influential report on Norway’s Sovereign Wealth Fund (see Ang, Goetzmann and Schaefer [2009]), which emphasised the benefits of factor investing for investors, adoption of such an approach remains partial at best. However, the growth trend in adoption of such strategies is intact. When asked about their use of smart beta and factor-based investment products in terms of assets over the near future, 48% of respondents indicate an increase of more than 10% while only 3% indicate a decrease.

Investor expectations for further development of ETF products

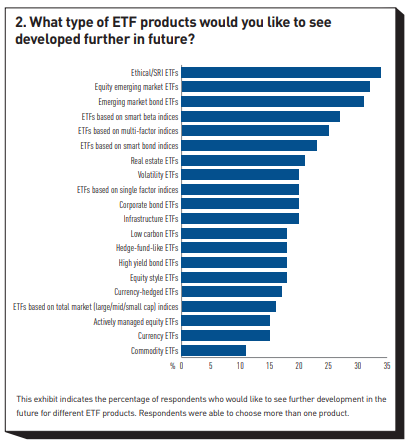

Our survey allows us to define a bit more clearly the type of niche markets where investors would like to see further ETF product development. As shown in figure 2, the top concerns for respondents are the further development of ethical/socially responsible investing (SRI) ETFs, with 34%, as well as emerging market equity ETFs and emerging market bond ETFs, with 32% and 31%, respectively. Additionally, for ETFs related to advanced forms of equity indices – those based on smart beta and on multi-factor indices – 27% and 25% of respondents, respectively, wished for further developments in these two areas. Moreover, if we aggregate the responses concerning smart beta indices, single-factor indices and multi-factor indices, we note that 42% of the respondents want further developments in at least one of these categories. This shows that the development of ETFs based on advanced forms of equity indices is now by far the highest priority for respondents. Alternatively, if we use our survey results to look at trends over time concerning the demand for ETFs based on emerging market equity, we see that a strong decline began in 2012, when 49% of respondents were demanding additional developments in this area – a percentage that had been relatively stable since 2006. Now that it lies at 32% in 2018, it seems that a share of respondents have shifted their demands from developments in emerging market equities to new forms of indices.

Regarding the further demand for ETFs based on smart beta indices, which shows the strong interest of respondents in alternative indices, the result is interesting as there have been a considerable number of smart beta and factor investing ETF product launches. The fact that more than a quarter of investors still see room for further product development may be explained by the fact that product launches have focused on relatively few popular strategies thus accounting for a small number of risk premia, such as the value premium and defensive equity strategies.

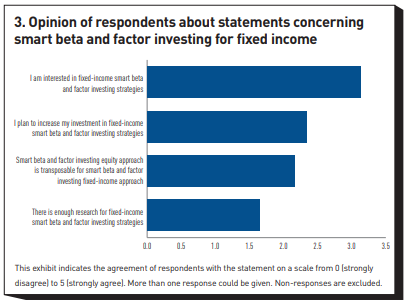

We also note that additional demand for ETFs based on smart bond indices is not so far behind, with 23% of respondents mentioning it. This should be put in perspective with the high interest of respondents in smart beta and factor investing for fixed income (see figure 3).

How do investors implement smart beta and factor investing strategies?

Our survey allows for several insights into how investors implement their smart beta and factor investing strategies and their exposure to desired factors. In terms of the actual product wrapper used for smart beta and factor investing exposure, respondents favour passive funds that replicate smart beta and factor investing indices (63% of respondents) but also use active solutions – ie, approaches including a significant amount of discretion – albeit to a lesser extent (49% of respondents).

Respondents were asked to compare passive replication of smart beta and factor investing indices to discretionary smart beta and factor investing strategies on a range of criteria. It appears that both of them obtain the same score for the possibility to create alignment with investment beliefs. Discretionary strategies are preferred for the reactivity/dynamism they offer, in terms of ease of use as building blocks in portfolio allocation – undoubtedly due to the fact that most indices available today are rather standardised – and ease in changing portfolio allocation over time. Replication of smart beta and factor investing strategies is essentially preferred for the following criteria: mitigating possible conflict of interest provider vs investor, the availability of information for assessing strategies, the broadness of the available solutions, the ease to change allocation over time and costs. While passive replication of indices is seen as more advantageous on a majority of criteria, the differences in perception across the two approaches are most notable in specific areas.

Our survey also allows us to differentiate between the types of uses respondents make of their factor exposure. It appears that the most frequent use respondents have for factor-based exposures is a strategic use to harvest long-term premia (score of 3.31 on a scale from 0, no use, to 5, highly frequent use). However, the least frequent approach in use today is a tactical use based on macroeconomic regimes (score of 1.98). These results suggest that the implementation of a factor-based strategy rarely aims at factor return timing and much more frequently targets the extraction of long-term premia.

How do investors implement smart beta and factor investing strategies?

This year, we introduce a special focus on smart beta and factor investing for fixed income. The results of our survey show that 17% of the whole sample of respondents already use smart beta and factor investing for fixed income. Some 80% of this sub-sample of respondents invest less than 20% of their total investment in smart beta and factor investing for fixed income.

It appears that respondents show significant interest in smart beta and factor investing for fixed-income (score of agreement of 3.13 on a scale from 0, strongly disagree, to 5, strongly agree). However, there is a significant gap between the interest in this investment and the forecast of an increase in it (score of agreement of 2.34). There are straightforward explanations for this gap. First, the average score of agreement with the statement that smart beta and factor investing approaches developed for equity investing are transposable to fixed income is only of 2.16; second, respondents do not consider there to be enough research in the area of smart beta and factor investing for fixed income (average score of 1.65 – see figure 3). Overall, it thus appears that investors are doubtful that research on factor investing in fixed income is sufficiently mature at this stage. Given the strong interest in such strategies indicated by investors, furthering research in fixed-income factor investing is a promising venture for the industry.

Do investors have the necessary information to evaluate smart beta and factor investing strategies?

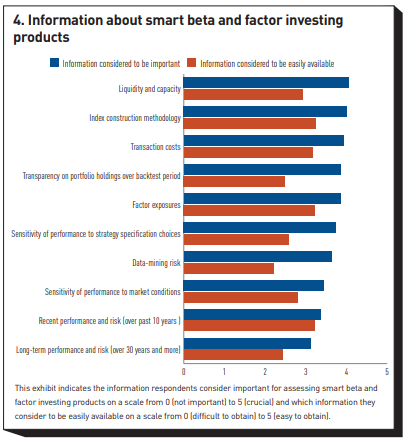

The results of our survey suggest that the transparency of smart beta and factor investing strategies is a key component of their appeal. Some 90% of our respondents declare that smart beta and factor investing indices require full transparency on methodology and risk analytics. However, they also cited a lack of transparency as the second most important hurdle to increasing smart beta and factor investing investments. To analyse the question of transparency and lack thereof in detail, we asked respondents about the information they consider important to assess smart beta and factor investing. At the same time, respondents were asked whether they considered this information to be easily available. Their responses thus allowed us to assess the gap between required information and ease of access to this information (see figure 4).

It is interesting to see the spread between the importance of and the accessibility of this information. It appears that the highest spread is observed for information respondents considered as crucial. For example, data-mining risk and information about transparency on portfolio holdings over a backtest period are two crucial pieces of information for respondents, with scores of 3.63 and 3.85 (on a scale from 0, not important, to 5, crucial), respectively. Data-mining risk is also the piece of information that appears to be the most difficult to obtain for respondents, with a score of 2.21 (on a scale from 0, difficult to obtain, to 5, easy to obtain), while information about transparency on portfolio holdings over a backtest period is among the three most difficult pieces of information to obtain, with a score of 2.49. Liquidity and capacity, which is the most important piece of information for respondents, with a score of 4.06, is also information relatively difficult to obtain, with a score of 2.92. Even relatively basic information such as the index construction methodology is not judged to be easily available (score of 3.25) relative to its importance (score of 4.01). On the contrary, information about recent performance and risk over the past 10 years is among the least important for respondents with a score of 3.36, but it is also one of the most easily available, exhibiting one of the highest scores (3.22) across the board in terms of availability.

The fact that information that is regarded as important is not considered to be easily available clearly calls into question the information provision practices of smart beta and factor investing providers. In fact, the only area in which no pronounced gap exists between the importance and the ease of accessibility scores is for recent performance numbers. Performance and risk information is judged to be moderately easily available and moderately important. All other areas show pronounced gaps between these two metrics. Two of the three items that are judged to be the least easily available are holdings over the backtest period and data-mining risks. Interestingly, both these items rank much higher on the importance score for investors than, for example, recent performance. Moreover, there is a pronounced gap of 0.87 between importance of information items and their ease of accessibility, as shown by the means of their respective scores (3.70 and 2.83, respectively). Overall, though the gap has narrowed compared to last year, these results suggest that there is still room for further improvement, as investors still do not believe that information considered important for assessing smart beta and factor investing strategies is made available to them with sufficient ease.

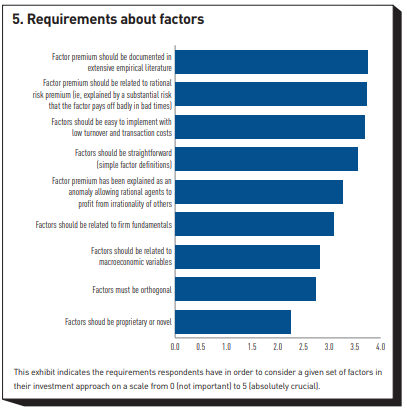

Investor requirements about smart beta and factor investing strategy factors

From the results of our survey, it appears that respondents are primarily concerned with the documentation of the factor premium in extensive empirical literature (with a score of 3.74, on a scale from 0, not important, to 5, absolutely crucial), closely followed by the existence of a rational risk premium (with a score of 3.73), and then by ease of implementation and low turnover and transaction costs (with a score of 3.68) – see figure 5 for details. The existence of a rational explanation for factor risk premia is of principal importance to investors as it is probably suggests that the premium will be persistent. Indeed, if the literature interprets the factor premia as compensation for risk, the existence of the factor premia could also be explained by investors making systematic errors due to behavioural biases such as over- or under-reactions to news on a stock. However, whether such behavioural biases can persistently affect asset prices in the presence of some smart investors who do not suffer from these biases is a point of contention. In fact, even if the average investor makes systematic errors due to behavioural biases, it is still possible that some rational investors who are not subject to such biases might exploit any small opportunity resulting from the irrationality of the average investor. The trading activity of such smart investors may then make the return opportunities disappear. Therefore, behavioural explanations of persistent factor premia often introduce so-called ‘limits to arbitrage’, which prevent smart investors from fully exploiting the opportunities arising from the irrational behaviour of other investors.

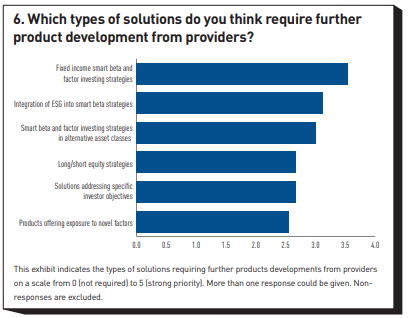

Expectations on future development for smart beta and factor investing products

Finally, respondents were asked about the smart beta and factor investing solutions they think required further product development from providers. Our survey results indicate that respondents desire further development in the area of fixed income, as well as in alternative asset classes, which is not surprising as smart beta and factor investing strategies were initially developed for equity investment (see figure 6). On a scale from 0 (no further developments required) to 5 (further developments required with strong priority), fixed-income smart beta and factor investing strategy solutions obtain a score of 3.54. This result should be considered in parallel with those displayed in figure 3, showing an increase in interest in these products but still with a limited share restricted to it. Integration of ESG in smart beta and factor investing, and strategies in alternative asset classes (currencies, commodities, etc), closely follow with scores of 3.12 and 3.01, respectively. The three other proposals – long/short equity strategies, solutions addressing specific investor objectives and products offering exposure to novel factors – obtained scores in a comparable range (2.68, 2.67 and 2.55, respectively). So, there is still a lack of products when it comes to asset classes other than equity, and this lack is particularly critical for the fixed-income asset class, which is largely used by investors. It is likely that the development of new products corresponding to these demands may lead to an even wider adoption of smart beta and factor investing solutions.

Conclusion

Responses to our survey provide interesting insights on benefits and challenges with smart beta and factor investing strategies. In fact, we find that adoption of such approaches is still partial despite a decade of discussion in the industry, with the vast majority of adopters investing less than 20% of their portfolio in such approaches. It was therefore interesting to better understand the challenges investors face when analysing such strategies. Our survey points to the important shortcomings of current smart beta offerings, which may explain the slow adoption by industry participants. For example, investors perceive a lack of transparency and difficulty in accessing information on such strategies, in particular on risk categories such as data-mining risks. In the case of fixed-income strategies, investors express doubts over the maturity of research results at this stage. Investors also see a need for further developments of long/short equity strategies based on factors, strategies that address client-specific risk objectives, and strategies that integrate environmental, social and governance (ESG) considerations. Smart beta researchers and product providers doubtlessly have to work on improving their solutions for smart beta and factor investing strategies to make it into the mainstream.

The research from which this article was drawn was produced as part of the Amundi ETF, Indexing and Smart Beta Investment Strategies research chair at EDHEC-Risk Institute.

References

- Ang, A., W. Goetzmann and S. Schaefer (2009). Evaluation of Active Management of the Norwegian Government Pension Fund – Global. Working paper.