MERRILL LYNCH “RISK ALLOCATION FRAMEWORK FOR GBI STRATEGIES”

MERRILL LYNCH WEALTH MANAGEMENT “RISK ALLOCATION FRAMEWORK FOR GOAL-DRIVEN INVESTING STRATEGIES

Presentation of the Partner

Merrill Lynch Global Wealth Management is a leading provider of comprehensive wealth management and investment services for individuals and businesses globally. With over 13, 700 Financial Advisors and $1.9 trillion in client balances as of December 31, 2013, it is among the largest businesses of its kind in the world. Within Merrill Lynch Global Wealth Management, the Private Banking and Investment Group provides tailored solutions to ultra affluent clients, offering both the intimacy of a boutique and the resources of a premier global financial services company. These clients are served by more than 150 Private Wealth Advisor teams, along with experts in areas such as investment management, concentrated stock management and intergenerational wealth transfer strategies. Merrill Lynch Global Wealth Management is part of Bank of America Corporation.

Source: Bank of America. Merrill Lynch Global Wealth Management (MLGWM) represents multiple business areas within Bank of America’s wealth and investment management division including Merrill Lynch Wealth Management (North America and International), Merrill Lynch Trust Company, and Private Banking and Investments Group. As of December 31, 2013, MLGWM entities had approximately $1.9 trillion in client balances. Client Balances consists of the following assets of clients held in their MLGWM accounts: assets under management (AUM) of MLGWM entities, client brokerage assets, assets in custody of MLGWM entities, loan balances and deposits of MLGWM clients held at Bank of America, N.A. and affiliated banks.

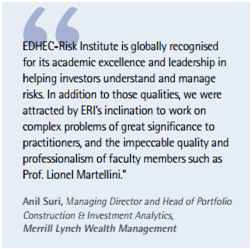

Presentation of the Partnership

Objectives

The purpose of the Merrill Lynch Wealth Management “Risk Allocation Framework for Goal-Driven Investing Strategies” research chair is to develop new research on risk allocation and goals-based investing. The initiative involves the pursuit of fundamental research on risk allocation and goals-based wealth management.

The aim of the research project is to deliver a mathematically rigorous approach to investing for goals such as capital preservation, retirement income, maintenance of minimum wealth levels and preferences regarding risk and liquidity.

The chair is under the scientific responsbility of Professor Lionel Martellini, Director of EDHEC-Risk Institute.

[Press release announcing the creation of the research chair (20/03/14)]

Research Outputs:

Introducing a Comprehensive Investment Framework for Goals-Based Wealth Management

March 2015

Romain Deguest, Lionel Martellini, Vincent Milhau, Anil Suri, Hungjen Wang

Any investment process should start with a thorough understanding of the investor problem. Individual investors do not need investment products with alleged superior performance; they need investment solutions that can help them meet their goals subject to prevailing dollar and risk budget constraints. This paper develops a general operational framework that can be used by financial advisors to allow individual investors to optimally allocate to categories of risks they face across all life stages and wealth segments so as to achieve personally meaningful financial goals. One key feature in developing the investment framework for goals-based wealth management is the introduction of systematic rule-based multi-period portfolio construction methodologies, which is a required element given that risks and goals typically persist across multiple time frames.

[Press release announcing the publication of the research: 09/11/15]