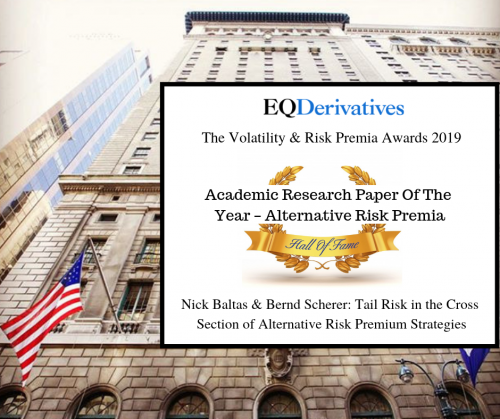

Bernd Scherer: Best Academic Research Paper Award in Alternative Risk Premia

Written on 19 Apr 2019.

Bernd Scherer, Research Associate at EDHEC-Risk, winner of the 2019 EQDerivatives Best Academic Research Paper Award in Alternative Risk Premia

A Journal of Portfolio Management article entitled, "Tail Risk in the Cross Section of Alternative Risk Premium Strategies" by Bernd Scherer, Research Associate at EDHEC-Risk Institute, Head of Private Wealth Portfolio Management, Head of Product Development, Bankhaus Lampe KG and Former Professor of Finance, EDHEC Business School, and, together with co-author Nick Baltas, Head of Research and Development for Systematic Trading Strategies at Goldman Sach, have been named the winners of of the 'Academic Research Paper of the Year - Alternative Risk Premia' in the EQDerivatives 2019 Volatility & Risk Premia Awards, recognizing buyside institutional and hedge fund performance in 2018.

In the paper, published in the Journal of Portfolio Management Multi-Asset Special Issue 2019, authors attempt to get a better understanding of the cross-section of alternative risk premiums using a multi-asset version of the downside risk capital asset pricing model (CAPM). In line with the empirical literature, they find that the cross-section of realized returns is much better explained when using the downside CAPM, rather than relying on the traditional CAPM. However, in contrast to the empirical literature, the authors cannot always recover the required signs in their cross-sectional regressions. In particular, they find that taking on downside risk is not always systematically rewarded. This might be due to the limited availability of time series that essentially overweight the exceptional events of 2008 or a direct result of creating backtests with attractive in-sample features that are impossible to repeat out-of-sample.

Bernd Scherer joined Bankhaus Lampe KG in 2017 as the Head of Product Development for its Asset Management unit. He has also been Chief Scientific Officer for First Private Asset Management. During his 21 years career he worked in senior positions for various hedge funds, asset management companies and banks in Frankfurt, London, New York and Vienna as well as Professor of Finance for EDHEC business school. His academic work has been published in Journals like the Journal of Banking and Finance, Journal of Financial Markets, Journal of Economics and Statistics, Quantitative Finance, Journal of Derivatives, Journal of Portfolio Management, Financial Analysts Journal, Journal of Investment Management, Risk, Financial Markets and Portfolio Management, Journal of Asset Management etc.. Bernd is author/editor of 8 books on quantitative asset management. He holds MBA and MSc degrees from the University of Augsburg and the University of London, as well as a PhD in finance from the University of Giessen.

Nick Baltas, Ph.D., is an executive director and head of R&D of the Systematic Trading Strategies (STS) Group at Goldman Sachs. He is responsible for providing thought leadership in the space of factor and risk premia investing, portfolio construction, and strategy design. Alongside, he additionally maintains a visiting academic position at Imperial College Business School. Prior to joining Goldman Sachs in 2017, Nick was an executive director in the quantitative research unit of UBS. Previously, he was a Lecturer in Finance at Imperial College Business School, a visiting Lecturer at Queen Mary University of London, as well as a risk manager in a London-based hedge fund. He has received several teaching awards and his research has been awarded with numerous grants and prizes, has been published in academic finance journals and practitioner books, and has been quoted by the financial press. Nick holds a DEng in electrical and computer engineering from the National Technical University of Athens, an MSc in communications & signal processing from Imperial College London and a PhD in financial economics from Imperial College Business School.