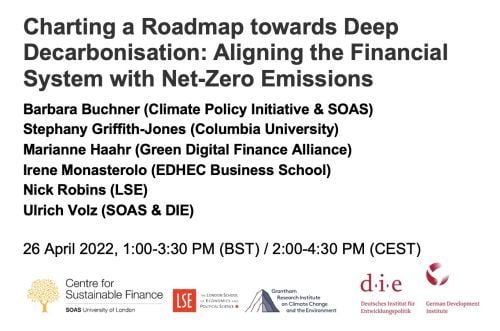

Charting A Roadmap towards Deep Decarbonisation: Aligning the Financial System with Net-Zero Emissions

Written on 06 Jul 2022.

PRESENTATION

Finance is critical to achieving deep decarbonisation by 2050. Article 2.i.c of the 2015 Paris Agreement sets out the goal of “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development”. Across the financial system, banks and investors need not only to analyse and mitigate physical and transition risks, they also need to align their portfolios with net-zero. Investment in and lending to carbon-intensive activities need to be rapidly phased out, while investment in new, low-carbon infrastructure – especially in the energy and transport sectors –, the retrofitting of the existing building stock, sustainable land use, and the development and deployment of low carbon technology needs to be scaled up. This will not happen by itself. Monetary and financial authorities need to set the framework conditions that will ensure that banks and financial markets integrate climate in all decision-making processes. Prudential supervisors should make net-zero a core element of supervisory practice at micro and macro levels, aligning supervisory expectations and prudential instruments with net-zero (Dikau, Robins, Volz 2021). Financial policymakers need to consider strategies for supporting a just transition to net-zero, harnessing the capacity of public as well as private financial institutions and of new financial technologies (Robins and Rydge, 2019; Robins et al., 2020; Volz et al., 2020). Last but not least, policies need to be devised to scale up international climate finance to support adaptation and a just transition in developing and emerging economies

The virtual discussions is organized by German Development Institute / Deutsches Institut für Entwicklungspolitik (DIE); Centre for Sustainable Finance, SOAS University of London; Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science.

On April 26, Irene Monasterolo, Professor of Climate Finance, EDHEC-Risk Institute, EDHEC Business School, will give the keynote entitled "Which actions should central banks and financial supervisors take to align financial flows with climate goals and support a scaling up of investment in the low-carbon economy?".

Other keynote speakers invited to share practitioners, policy and research's insights to align the financial system with net-zero emissions:

- Barbara Buchner, Climate Policy Initiative (CPI): "What policies are needed to boost climate finance?"

- Stephany Griffith-Jones, Columbia University: "What is the role of public financial institutions in accelerating the low-carbon transition?"

- Nick Robins, Grantham Research Institute on Climate Change & the Environment, London School of Economics (LSE): "How can the financial sector contribute to a just transition?"

- Marianne Haahr, Green Digital Finance Alliance (GDFA): "What is the role of FinTech in facilitating investment in the net-zero transition?"

Moderator

- Ulrich Volz, SOAS - University of London and German Development Institute / Deutsches Institut für Entwicklungspolitik (DIE)

Further information on the conference can be found on Deutsches Institut für Entwicklungspolitik (DIE) website.