EDHEC experts invited to discuss important issues relating to Sustainable Investing & Climate Finance

Written on 18 Oct 2021.

In the autumn of 2021, edhec experts have been invited to participate in over 10 events, a clear recognition of the school’s globally acknowledged expertise in sustainable investing and climate finance by the investment management industry. Here is a short selection:

WEBINAR – THE CLIMATE DESERVES BETTER THAN 12%!

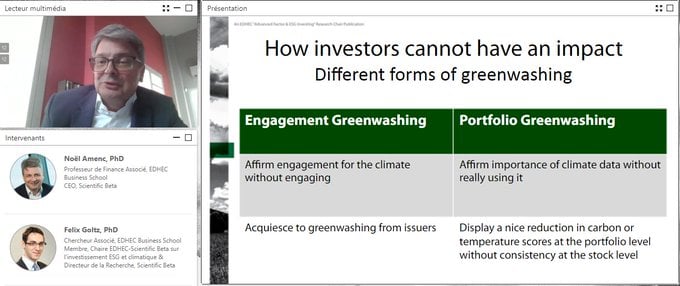

However, the recent study "Doing Good or Feeling Good? Detecting Greenwashing in Climate Investing", conducted as part of the EDHEC–Scientific Beta Advanced ESG and Climate Investing research chair, shows that the reality of traditional climate investing strategies does not live up to the promises and communication from their promoters. Speaking of climate investment when the companies' climate performance only accounts on average for 12% of the weight of their stocks in the portfolios is at best a misnomer and at worst misinformation with regard to responsible investors committed to addressing climate issues.

This greenwashing also has negative consequences for the potential impact of investment strategies on combatting climate change.

On 21 September, during a webinar that saw participation by over 1,500 professionals, Noël Amenc, Associate Professor of Finance at EDHEC Business School, CEO of Scientific Beta, and Felix Goltz, a Member of the EDHEC–Scientific Beta Advanced ESG and Climate Investing research chair, presented the main results of the study on greenwashing in portfolio construction, which shed light on the greenwashing risks of traditional climate investing strategies, and promoted new practices.

FORESIGHT AND SUSTAINABILITY SUMMIT

Everyone is talking about it – but what is actually behind the big buzzword "Sustainability"? January 2020 kicked off what environmentalists are referring to as the "Decade of Action". In concrete terms, this means that we have just 10 more years to meet the goals set out in the UN's Agenda for Sustainable Development to limit global warming to 1.5 degrees Celsius above pre-industrial levels by 2030. Against the backdrop of this development, prioritizing sustainable action is not only of ever-increasing importance, but at the same time creates new opportunities in the development of new markets and technologies.

Everyone is talking about it – but what is actually behind the big buzzword "Sustainability"? January 2020 kicked off what environmentalists are referring to as the "Decade of Action". In concrete terms, this means that we have just 10 more years to meet the goals set out in the UN's Agenda for Sustainable Development to limit global warming to 1.5 degrees Celsius above pre-industrial levels by 2030. Against the backdrop of this development, prioritizing sustainable action is not only of ever-increasing importance, but at the same time creates new opportunities in the development of new markets and technologies.

On 23 September, Gianfranco Gianfrate, Professor of Finance at EDHEC-Risk Institute, participated in a plenary session, together with Stéphanie Hubold, Head of ESG at Altor Equity Partners, Leoni Gros, part of the Innovation and Strategy team at Berlin Hyp, and René Rohrbeck, Professor of Strategy and Director of the Foresight, Innovation and Transformation chair at EDHEC Business School.

Hosted by ITONICS, Rohrbeck Heger and the EDHEC Foresight, Innovation and Transformation chair, the summit centred around emerging trends and technologies, as well as new action ethics that we will inevitably have to confront in the context of shaping a more sustainable future.

The session entitled "EU Green Deal & ESG" examined the following topics:

- The EU is opting to drive sustainability through a “silent revolution” in which the European central banks play a key role. In the quest to save the climate and biodiversity, the EU has introduced a comprehensive “Green Deal”. But what does it entail?

- "What is the ESG taxonomy?"

- "How will the EU commission leverage the European Central Bank to drive environmental behaviour and force businesses to go beyond greenwashing?"

ACCESS THE REPLAY – SESSION STARTS AT 2 HOURS 30 MINS

THE ECONOMIST'S SUSTAINABILITY WEEK: COUNTDOWN TO COP26

On 4 October, Gianfranco Gianfrate, Professor of Finance at EDHEC Business School and the Climate Change & Sustainable Finance Lead Expert at EDHEC-Risk Institute, participated in a plenary session, together with Gabriel Makhlouf, Governor of the Central Bank of Ireland, Alessandro d’Eri, Senior Policy Officer at ESMA, and Crystal Geng, Head of ESG at Ping An Group.

On 4 October, Gianfranco Gianfrate, Professor of Finance at EDHEC Business School and the Climate Change & Sustainable Finance Lead Expert at EDHEC-Risk Institute, participated in a plenary session, together with Gabriel Makhlouf, Governor of the Central Bank of Ireland, Alessandro d’Eri, Senior Policy Officer at ESMA, and Crystal Geng, Head of ESG at Ping An Group.

The Economist launched the Sustainability series of events in 2016 to foster dialogue between policymakers, business, scientists and investors around finding solutions to the problems of climate change, and wider sustainability issues. Of growing importance is the investment and finance part of the programme, both in terms of looking for opportunity for investors and scrutinising the claims of ESG investors.

The session entitled "How to Detect and Prevent Greenwashing" answered the following questions:

- In the decade for action, what can policymakers do to prevent greenwashing and speed up the transition to net zero?

- Company transparency and adequate reporting is critical. What metrics should ESG measurement be built around to drive positive outcomes at both financial and social levels?

- What questions do investors need to ask to be confident of the ESG credentials of their investments?

WEBINAR – UNPACKING THE UN IPCC CLIMATE REPORT: IMPLICATIONS FOR PROFESSIONAL INVESTORS

While sustainable investing has seen rapidly increasing popularity over the last couple of years, the “code red” report released this summer has added renewed urgency to this shift. Net-zero commitments may no longer be enough as professional investors are facing calls for a more stringent approach to achieve greater impact and asset managers must counter accusations of greenwashing.

While sustainable investing has seen rapidly increasing popularity over the last couple of years, the “code red” report released this summer has added renewed urgency to this shift. Net-zero commitments may no longer be enough as professional investors are facing calls for a more stringent approach to achieve greater impact and asset managers must counter accusations of greenwashing.

As the findings of the report bed in and we approach COP26, the webinar explored how professional investors are interpreting and responding to these warnings.

On 28 October, Irene Monasterolo, Professor of Climate Finance at EDHEC-Risk Institute, was invited to participate in the debate together with Tommy Wilkes, Finance & Markets Correspondent at Reuters, Glen Yelton, Head of ESG Client Strategies at Invesco, Birgit Puck, Head of Securities Supervision at the Financial Market Authority (FMA), and Eléonore Bedel, Head of SRI & Impact Investing at, BNP Paribas Wealth Management.

The webinar entitled "Unpacking the UN IPCC Climate Report: Implications for professional investors" explored the following topics:

- Delving into the detail – deciphering the key takeaways and overlooked messages this colossal document

- Assessing the different climate change scenarios and projections, what adaptation will look like and how it will impact asset allocation

- Understanding the actions investors are already taking and what more can be done

- Discussing how asset managers can help professional investors achieve greater impact