A great success for the webinar ‘How to Enhance Climate Scenarios for Investors’

Written on 20 Mar 2024.

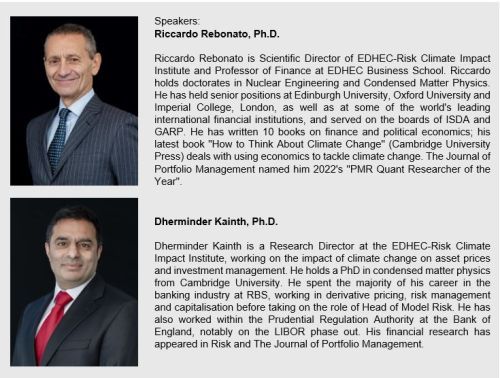

A great success for the webinar ‘How to Enhance Climate Scenarios for Investors’ held on March 14, with nearly 700 professionals registered from 55 countries, to gain insight from Scientific Director Riccardo Rebonato and Research Director Dherminder Kainth at EDHEC-Risk Climate Impact Institute.

Existing climate scenarios, inspired by the IPCC framework, provide invaluable insights but were not designed for financial uses.

New research by EDHEC-Risk Climate Impact Institute explores approaches to enrich the existing framework with probabilistic information. This allows finance practitioners to both understand which outcomes are more likely and should therefore attract greater attention; and to get a better appreciation of what lies in the tails of the damage distribution. This has important practical investment implications for portfolio allocation and could also be used to refine valuation models to quantify and manage climate risks at a granular level.

At the event, Professor Riccardo Rebonato, Scientific Director and Doctor Dherminder Kainth, Research Director at EDHEC-Risk Climate Impact Institute, presented findings from their latest foundational white paper titled “Climate Scenario Analysis and Stress Testing for Investors: A Probabilistic Approach", and answered the audience’s questions.

The webinar addressed the following issues:

- Why climate scenarios are important, and why they differ from market-risk scenarios

- Do current industry scenarios meet the needs of investors?

- Putting uncertainty centre stage: how to create probability distributions of economic damages

- Giving investors what they need: from probability distributions to probability-aware scenarios

- Reverse stress testing with climate damages

To watch the replay of the webinar, follow this link or see the video below:

Click here to access the written Q&A.

Contact us at [email protected] to access the slides of the presentation.

For practioners you wish to gain more insight into the research led by Professor Rebonato and Doctor Kainth, we invite you to read some of their recent contributions:

- the foundational White Paper titled "Climate Scenario Analysis and Stress Testing for Investors: A Probabilistic Approach", showing how to create probability distributions of climate outcomes, that allow finance practitioners to both understand which outcomes are more likely and should therefore attract greater attention; and to get a better appreciation of what lies in the tails of the damage distribution.

- an op-ed in Investment & Pensions Europe titled “Viewpoint: Investor climate scenarios need to be probability-aware"

- an article "Bridging the Gap: Making Climate Scenarios Fit for Investors", delving into the crucial role of scenario analysis and stress testing in grasping the economic consequences of climate change on asset valuation., that appeared in our February newsletter.

About the speakers