Green finance sector initiative for decarbonization: new paper out by Irene Monasterolo with The World Bank

Written on 23 Sep 2022.

Does greening the financial sector have real world impact?

Green financial sector initiatives, including financial policies, regulations, and instruments, could play an important role in the low-carbon transition by supporting countries in the implementation of economic policies aimed to decarbonize their economy.

We are very pleased to share with you new World Bank paper by Irene Monasterolo Professor of Finance EDHEC Business School, and Programme Director at EDHEC-Risk Cimate Impact Institute entitled "The Role of Green Financial Sector Initiatives in the Low-Carbon Transition : A Theory of Change" with Antoine Mandel (Paris School of Economics), Stefano Battiston (Ca' Foscari University of Venice, University of Zurich), Andrea Mazzocchetti (Ca' Foscari University of Venice), Klaus Oppermann, Jonathan Coony, Stephen Stretton, Fiona Stewart, Nepomuk Dunz from (The World Bank) on green finance sector initiative for decarbonization.

Green financial sector initiatives (GFSI) are expected to play a main role in climate mitigation. However, the conditions under which GFSI could enable the scaling up of green investments and the achievement of national climate mitigation objectives, while avoiding unintended effects on macroeconomic and financial stability, have still to be understood.

We contribute to fill this gap by developing a theory of change for GFSI focusing on green macroprudential policies, green monetary policies, and green public co-funding and identifying the criteria for applicability and conditions to maximize impact, says Irene Monasterolo

The theory of change (ToC) provides an operative framework for delivering the transformational change in climate finance needed to achieve ambitious climate mitigation objectives in EMDES, in the short time available.

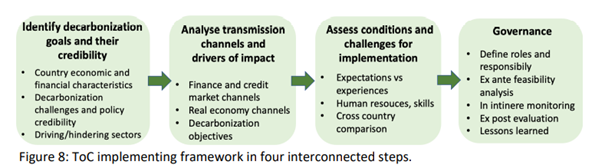

It’s implementation framework is composed of four steps:

- the identification of a country’s decarbonization goals and relevant GFSI,

- the analysis of the transmission channels to the economy and finance, considering the country-specific socio-economic and financial characteristics,

- the identification of the conditions and challenges for GFSI introduction,

- the design of the governance framework for successful implementation.

In principle, the ToC and its implementing framework can be tailored and applied to any country

TOPICS: Green Finance, Greenhouse Gas Accounting, Green Finance, Mechanisms, Macroprudential Policy, Monetary Policy

This paper is a product of the Climate Change Group and the Finance, Competitiveness and Innovation Global Practice. It is part of a larger effort by the World Bank to provide open access to its research and make a contribution to development policy discussions around the world.