Irene Monasterolo invited to discuss macroprudential challenge of climate change

Written on 22 Sep 2022.

On September 27, Irene Monasterolo, Professor of Climate Finance at EDHEC Business School and Programme Director at EDHEC-Risk Climate Impact Institute has been invited by SUERF, the European Money and Finance Forum, to participate in a debate to discuss macroprudential challenge of climate change.

Despite many strides in climate risk mapping over the last years, considerable uncertainty remains about how climate change could imply systemic risk – and implications for macroprudential policies. The latest publication of the ESRB/ECB project team on climate risk has sought to address these knowledge gaps, and the case for macroprudential policies in the European Union. The report has outlined how climate-related financial vulnerabilities in the European financial system might harbour correlated shocks, hazard interdependence, as well as significant portfolio overlaps. System-wide scenario analysis suggests climate change risks could initially manifest themselves through abrupt market repricing (mainly impacting institutional investors) seeping into firm defaults with time (implying credit losses for exposed banks). Macroprudential policies have a role to play in addressing associated systemic risk, as part of a broader policy response to address the financial impacts of climate change.

The aim of the workshop was to address the financial impact of climate change with a team of top experts speakers:

Ernest Gnan, Head, Monetary Policy Section, Oesterreichische Nationalbank and SUERF Secretary General opened the session and introduced experts speakers. Paul Hiebert, Head of Systemic Risk and Financial Institutions Division, European Central Bank presented to the audience the key findings of the ESRB/ECB report "The macroprudential challenge of climate change".

Two top experts complemented this presentation with their own perspectives: Fabio M Natalucci, Deputy Director, Monetary and Capital Markets Department, IMF and Professor Irene Monasterolo, Professor of Climate Finance, EDHEC Business School.

Irene started her presentation with comments on the presentation made by Paul: what the presentation does and why it matters? The report documents progress in the measurement and modelling of climate risks to EU financial stability, and discusses potential policy response

The main message is very powerful because so far we still missed from ECB and overall financial authority point of view, an assessment of the relevance of climate, physical and transition risk on the financial system, in particular the conditions and drivers of systemic risk. So this really fills a gap because in the research and in the literature we started to address the systemic risk of climate change years ago. But this is really a step ahead from ECB and ESRB and really fills the gap.

Main take home messages from the report:

- A disorderly transition (carbon price) can trigger systemic financial risk

- Interdependent hazards (water stress, heat stress and wildfires) can amplify physical climate risk -> multiform and compound risks

- Default cascades across firms (not only to fossil but high carbon activities whose business is connected to fossil fuel firms) and banks

- Financial market dynamics can amplify losses: abrupt repricing of assets could trigger corporate defaults and credit losses for bank

- Role for prudential policies to mitigate such risks

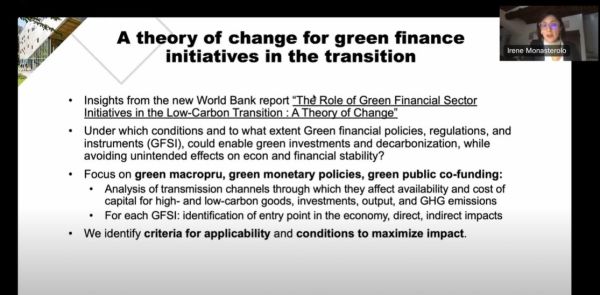

Amongst other important topics, Irene focused on the role of green financial sector initiatives. Recently with the World Bank and colleagues she developed a report about the role of green financial sector initiatives in the local bond transition in particular for different types of green macro potential regulation, green monetary policies and green public funding. She analyses the transmission channels through which they affect the availability and cost of capital for high and low carbon goods, investments, outputs and emissions. Shes identifies for each policy the entry point in the economy as well as the direct and indirect impacts.

Overall we introduce a theory of change which is structured in challenges which includes for instance carbon intensive structure of our economies, low liquidity, limited development of capital markets in some countries and low attractiveness of low carbon investments such as in terms of cost of capital. It identifies the opportunities for the role of individual green financial sector initiatives including brown penalizing factor, green supporting factor, green portfolio rewards, green collateral framework, green quantitative easing and public funding and cofounding. So, the most debated green finance policy initiative so far.

Access the replay of the e-lecture

Further information on the conference can be found on the SUERF website.