New policy brief by Irene Monasterolo on NGFS climate scenarios

Written on 02 Jun 2023.

Irene Monasterolo, Research Programme Director at EDHEC-Risk Climate Impact Institute and Professor of Finance at EDHEC Business School published a policy brief “Assessing the “Tragedy of the Horizons”: Conceptual underpinnings of the NGFS scenarios and suggestions for improvement”.

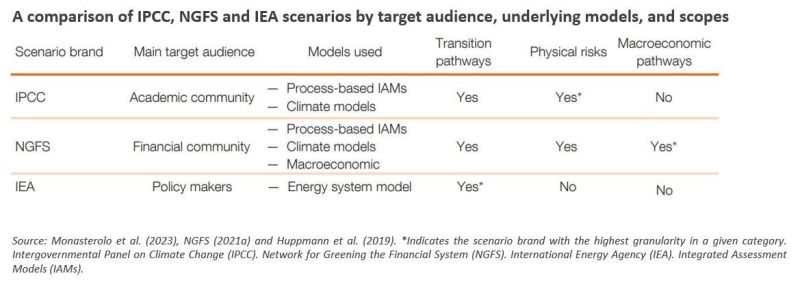

In the SUERF policy brief, Irene and her co-authors Maria J Nieto (Banco de España) and Edo Schets (Bloomberg) provide an analysis and discussion of the main characteristics and limitations of the climate mitigation scenarios co-developed by the Central Banks and Financial Regulators’ Network for Greening the Financial System (NGFS) for climate-financial risk assessment.

Their analysis focuses on the following key elements:

- key uncertainties in NGFS scenarios;

- the role of Representative Concentration Pathways (RCPs) and Shared Socioeconomic Pathways (SSPs) in shaping the scenario narratives, and their shortcomings;

- the interpretation and sensitivities of carbon price pathways;

- the comparison of the results of process-based Integrated Assessment Models (IAM) across NGFS scenarios; and the comparison with other climate mitigation scenario providers (e.g. those of the International Energy Agency).

Then, the authors draw lessons on how to increase the relevance of the NGFS scenarios for climate finance. Their recommendations include:

- updating the SSP narratives by embedding finance and technology;

- considering the potential trade-offs between different types of climate policies;

- strengthening the assessment of physical risks and their compounding;

- integrating physical risks within transition scenarios; and,

- embedding the role of investors’ expectations and climate sentiments in the scenarios’ trajectories.

SUERF Policy Briefs (SPBs) serve to promote SUERF Members’ economic views and research findings as well as economic policy-oriented analyses. They address topical issues and propose solutions to current economic and financial challenges. SPBs serve to increase the international visibility of SUERF Members’ analyses and research. The views expressed are those of the author(s) and not necessarily those of the institution(s) with which the author(s) is/are affiliated.