Paper on sustainable investing and climate transition risk by Irene Monasterolo accepted in The Journal of Portfolio Management

Written on 23 Aug 2022.

We are pleased to enclose new research by Irene Monasterolo, Professor of Climate Finance, EDHEC Business School and Director of the Programme "Impact of Finance on Climate Change Mitigation and Adaptation" at EDHEC-Risk Institute, published in the 2022 Novel Risks Special Issue of the Journal of Portfolio Management.

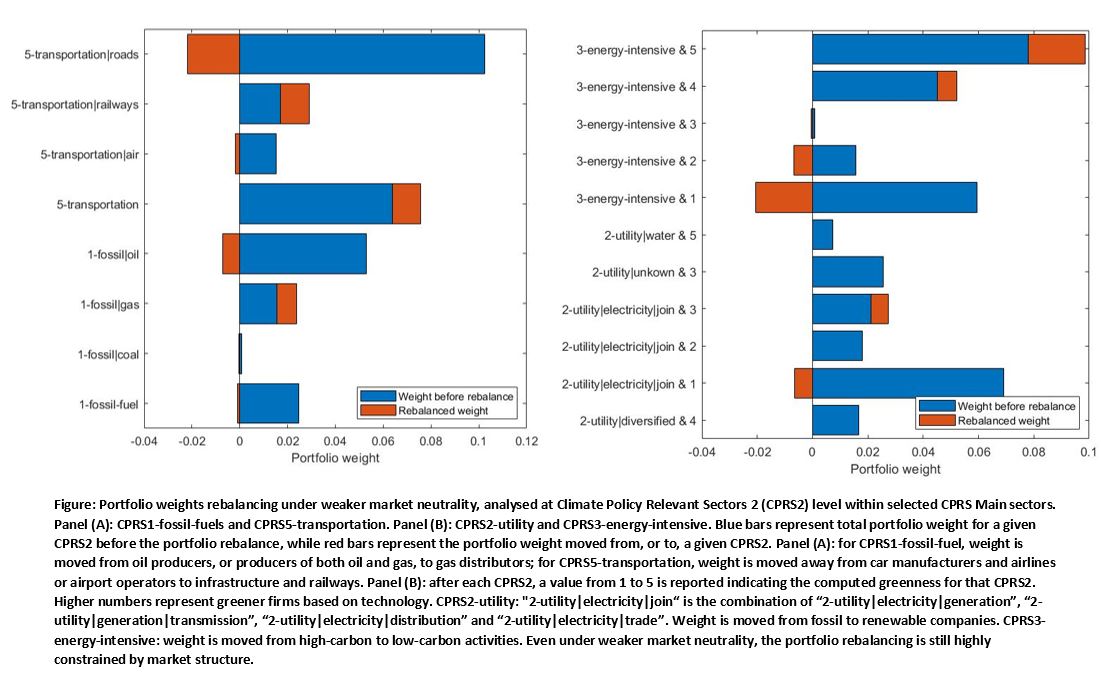

In this article "Sustainable investing and climate transition risk: a portfolio rebalancing approach", authors Giacomo Bressan, Irene Monasterolo and Stefano Battiston, analyse how limits of standards for emissions disclosure and transition plans could lead the European Central Bank (ECB) to increase exposure to transition risk in its corp bonds portfolio. To overcome such limitations, authors introduce a greeness measure for climate portfolio rebalancing based on firms' en technology (capacity and revenues). The new measure leads to -10% exposure to transition risk with minimal market impact.

KEY FINDINGS

- Under a strong market neutrality approach, it is not possible for central banks, includingthe European Central Bank, to reduce climate transition risk in their portfolios.

- The authors propose a weaker market-neutrality approach that enables the constructionof portfolios with lower climate transition risk and yet limited market impact.

- They show that GHG emissions or ESG scores alone are not sufficient to inform climate-aware portfolio rebalancing and that complementary measures of greenness areneeded.

ABSTRACT

The authors study how greenness can be combined with other investment criteria to construct sets of corporate bonds portfolios with decreasing exposure to climate transition risk. They apply the methodology to the European Central Bank’s asset purchase program. They define a weaker market neutrality principle as investing proportionally to the bonds’ amount outstanding within Climate Policy Relevant Sectors. The portfolio rebalancing leads to a 10% reduction of exposure to climate transition risk.

Then, the authors study the relation between bonds’ rebalancing and issuers’ Environmental, Social and Governance (ESG) characteristics and Greenhouse Gas (GHG) emissions. Bonds issued by firms with low (high) ESG risk and GHG emissions are more likely to be bought (sold) in the rebalancing.

Finally, they analyse implications of portfolio rebalancing on financial markets finding that changes in yields would be limited to less than 80 basis points on individual bonds. The approach can contribute to inform climate-aware portfolio rebalancing and sustainable investment strategies.

Results about conditions for a successful portfolio rebalancing approach have been coverage in Natixis Investment Managers' report on "ECB to decarbonize its corporate bond purchasing and collateral framework: from intent to almost immediate action".

Giacomo Bressan is a PhD student at Vienna University of Economics and Business in Austria.

Irene Monasterolo is a professor of climate finance at EDHEC Business School and EDHEC-Risk Climate Impact Institute in Nice, France.

Stefano Battiston is an associate professor in sustainable finance and networks at the University of Zurich in Switzerland and an associate professor at Ca’ Foscari, University of Venice in Italy.