Three EDHEC Experts to Discuss Climate Risk, Biodiversity, and Green Finance Insights

Written on 04 Dec 2024.

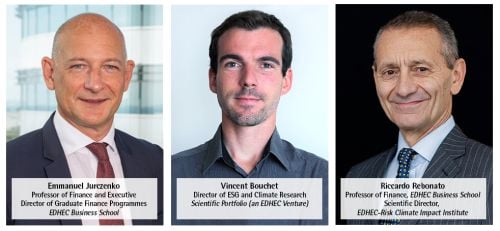

On December 11 and 12, EDHEC professors Riccardo Rebonato and Emmanuel Jurczenko, along with Vincent Bouchet, ESG Director at Scientific Portfolio (an EDHEC Venture), will participate in the Green Finance Research Advances event co-organised by the Banque de France and the Institut Louis Bachelier. The event will take place both online and in Paris.

The Green Finance Research Advances (GFRA) is an international research conference for academics and professionals, co-organised by the Banque de France and the Institut Louis Bachelier, with the participation of the Institut de la Finance Durable and the Institute for Climate Economics-I4CE.

The 9th edition takes place on 11 and 12 December 2024 in Paris and online, entirely in English.

The interventions of EDHEC Business School experts

Emmanuel Jurczenko, Professor of Finance and Director of Graduate Finance Programmes at EDHEC

- December 11, 12:00-13:00

- Biodiversity and Climate: Friends or Foes?

- This paper has been co-written with Eric Bouyé, Romain Deguest and Jerome Teiletche (World Bank).

Vincent Bouchet, Director of ESG and Climate Research at Scientific Portfolio (an EDHEC Venture)

- December 11, 14:00-15:15

- Implied Temperature Rise of Equity Portfolios: a Sensitivity Analysis Framework

- This report is part of the Consolidated Alignment Performance Analytics research project, developed and led by the Institut Louis Bachelier Labs in partnership with Scientific Portfolio (an EDHEC venture), and financed by the French environmental agency ADEME.

Riccardo Rebonato, Professor of Finance at EDHEC and Scientific Director of the EDHEC-Risk Climate Impact Institute

- December 12, 10:00-11:30

- The Impact of Climate Risk on Global Equity Valuation

- This paper has been co-written with Dherminder Kainth, Research Director and Lionel Melin, Associate Research, EDHEC-Risk Climate Impact Institute

Objective of the conference

This event brings together academics, finance practitioners and regulators, to discuss together research issues related to the integration of climate risks into macro-economic modelling/forecasting and into the risk assessment of the financial sector.

The special emphasis of this 9th edition will be on transition and adaptation finance and in particular on metrics, data, models and assessment tools specifically designed to evaluate and enhance the efficacy of transition and adaptation finance.

- Day 1: Discussions around transition risks, banking stability in the face of climate risks, and strategies to avoid carbon lock-in. Green tax issues and the carbon commitments of financial institutions will also be explored.

- Day 2: Adaptation finance, the challenges of carbon markets and greenwashing will be at the centre of discussions, as well as the use of data and artificial intelligence for sustainable finance. The day will close with the presentation of the Banque de France prize for young researchers.

Practical Information

- To see the full programme: https://green-finance-research-advances-2024.org/

- To register (compulsory), follow this link

- Venue: Auditorium Banque de France, 31 rue Croix-des-petits-champs - 75001 Paris