Physical climate risk survey

By Noël Amenc, Director, EDHECInfra & Private Assets Research Institute, Affiliate Member, EDHEC-Risk Climate Impact Institute; Frédéric BlancBrude, Founding Director, EDHECInfra & Private Assets Research Institute; Alice James, Writer, EDHECInfra & Private Assets Research Institute

Physical climate risk survey: Those in the infrastructure investment industry are concerned and lack data

- These risks could be huge, and investors have no certainty on how they will affect global infrastructure.

- Physical risks could wipe as much as 54% off the value of portfolios.

- Concerned investors say they have little confidence in the advice and data they are receiving.

- Two-thirds of those polled had carried out no evaluation of this physical risk themselves.

The risk: it’s real, but we can’t measure it

Investors and other industry professionals are concerned about physical climate risk and believe that they have almost no idea how it will affect unlisted infrastructure assets; that’s the clear message they delivered when we surveyed them on their views regarding the risks to the asset class and whether they feel the advice and information they are getting is sufficient or even reliable.

This survey was conducted among investors and other professionals invited to a presentation of our latest research paper[1] on 27 September 2023. Key takeaways from the survey, which polled 70 professionals including managers with more than $2trn under management, are as follows:

97% of investors polled believe physical climate risk is significant. Physical climate risk survey: Those in the infrastructure investment industry are concerned and lack data Noël Amenc, Director, EDHECInfra & Private Assets Research Institute, Affiliate Member, EDHEC-Risk Climate Impact Institute; Frédéric BlancBrude, Founding Director, EDHECInfra & Private Assets Research Institute; Alice James, Writer, EDHECInfra & Private Assets Research Institute Some 76% believe it will have a medium or high effect on their infrastructure investments.

However, only 16% think we actually know how it will impact these assets. 76% also stated that the climate scenarios used by financial institutions to evaluate transition risk to infrastructure are inadequate for the assessment of physical climate risk.

That said, some three quarters said that our research had helped them to better assess these risks and their potential impact.

The survey also revealed that some two-thirds of those polled had carried out no evaluation of this physical risk themselves.

In very concrete terms, this survey confirms that despite the importance attributed to physical climate risk, investors and managers are not in a position to estimate its impact on their own portfolio. This inability is all the more concerning because investor portfolios, being highly concentrated, can be very strongly exposed to physical climate risk without awareness of this. This lack of knowledge of risks raises important questions for the risk management and solvency measurement of insurance companies and pension funds, especially considering that institutional asset owners are increasingly investing in private assets, notably unlisted infrastructure.

This survey also raises the question of the right information and the management of climate risks and their financial consequences for long-term investors in infrastructure.

The research: physical risks could wipe as much as 54% off the value of portfolios

In August 2023, we published a new research paper, ‘It’s getting physical’, which revealed that an investor could incur losses of 54% on the value of their unlisted infrastructure portfolio due to both the realisation of climate risks before 2050 and the high level of concentration of institutional investor portfolios. This estimation was produced using the EDHEC Infrastructure & Private Assets Research Institute database of financial and extra-financial database on unlisted infrastructure, the largest in the world today. The energy transition and the alignment of economies bring a cost to private investors, but so does climate change! Importantly, however, our research also showed that if the relevant stakeholders could only organise the transition towards a decarbonised economy today, extreme losses could be reduced by half.

The findings reveal that the physical risks created by climate change are not limited to a distant future for investors in infrastructure, some of whom could well lose more than 50% of the value of their portfolio to physical climate risk before 2050 in the event of runaway climate change. Moreover, and beyond this extreme loss, it should be stressed that the average investor will also lose twice as much to extreme weather, which corresponds to a current policy scenario, mostly in OECD countries, compared to a low carbon scenario. On 27 September 2023 at 9am BST we held a webinar where we presented the findings of the paper to investment professionals globally.[1] Following this, we polled our invited audience for their views on some of the key questions regarding their views and practices regarding physical climate risk management for unlisted infrastructure assets.

Some 261 members of the investment community tuned in. (It is worth noting when scheduling live online events that time zones mean you can broadly favour Europe, the Americas or Asia. This webinar was scheduled to appeal to European attendees and thereafter the US. Full details are in the Appendix.)

The responses: concerned investors say they need better data

We posed seven questions to those invited to our webinar. Some of these required simple yes/no answers, some were more nuanced and several offered the opportunity for a narrative response. Details of each are given below, plus a selection of the written responses submitted.

Question 1: Is physical climate risk something you consider to be significant?

- Yes: 68 (97%)

- No: 2 (3%)

Unsurprisingly, and perhaps reassuringly, our cohort was almost unanimous on this front, with 68/70 (or 97%) stating that physical climate risk is something that they do consider significant. Indeed, it is perhaps most concerning that there are two respondents who still believe that they are not. In our recent paper, we showed that such risks are already material for a number of infrastructure assets even if these are generally located in developed economies; eg, the UN Office for Disaster Risk Reduction reported that the number of major flood events already more than doubled between 2000 and 2019, while the incidence of storms grew by 40% during the same period.

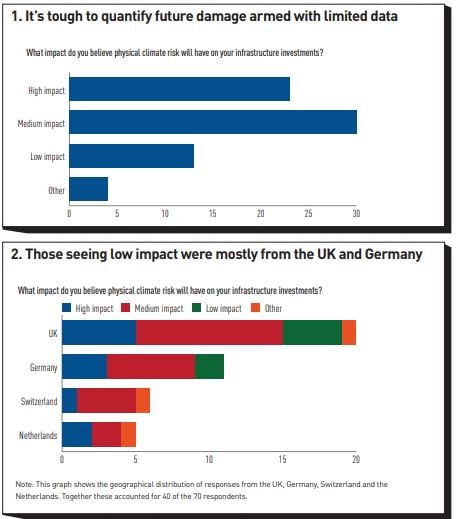

Question 2: What impact do you believe physical climate risk will have on your infrastructure investments?

- High impact: 23 (33%)

- Medium impact: 30 (43%)

- Low impact: 13 (19%)

- Other: 4 (6%)

Our respondents gave a slightly more mixed response to this question, but overall 76% stated that they anticipated physical climate risk having a medium or high impact on their infrastructure investments (see figure 1). The fact that we see such a broad spread between the responses highlights the impossibility of quantifying future damages armed with only the limited data on both effects and policy responses that we have today.

Perhaps the most interesting takeaway from the responses to this question is that close to a fifth of the polled sample of industry professionals are confident that their investments are reasonably secure; the answers to question 1 suggest that this is not because they are blasé about climate change; it may be that they think that their particular investments have been selected in the belief that they are less vulnerable.

There was no particular pattern to those stating they saw low impact: they were quite evenly scattered geographically. That said, those considering the potential impact would be small were overwhelmingly from the UK and Germany (see figure 2); however, these were also the largest categories of responders, and the sample size is small.

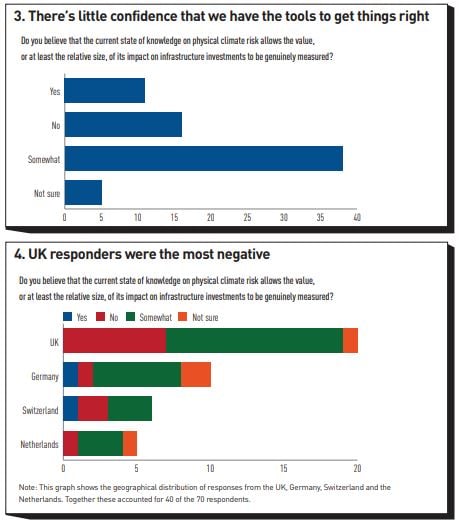

Question 3: Do you believe that the current state of knowledge on physical climate risk allows the value, or at least the relative size, of its impact on infrastructure investments to be genuinely measured?

- Yes: 11 (16%)

- No: 16 (23%)

- Somewhat: 38 (54%)

- Not sure: 5 (7%)

Responses to this question were more nuanced, but the overall message is one of a lack of confidence in our current ability to gauge the magnitude of climate risk impact on the asset class (see figure 3). Just 16% believe we currently have the tools to get it right. That said, more than half do believe we are part of the way there, which is encouraging but suggests that research will have to improve substantially to reassure the investment community that they have all the data needed on the potential magnitude of climate risk impact. In terms of clustering geographically, UK responders were the most negative, casting seven out of the 16 ‘no’ votes (see figure 4). That said, the sample size is small.

Question 4: Has the research carried out by the EDHEC Infrastructure & Private Assets Research Institute allowed you to assess this risk and its impact better? Yes/No? Please explain why.

- Yes: 40 (75%)

- No: 13 (25%)

We regularly poll our clients and those in the wider community for their views on key developments within the industry, the challenges they face and how we are helping them in this space. As such, it is reassuring that some 75% of respondents stated that our research is helping them to understand the climate risks that threaten investments in this field and their impacts. Below is a selection of the narrative responses:

With nil background I was persuaded by EDHEC’s methodological approach. You really have to get granular, and it’s difficult to diversify away from the risk.

Yes, investment into infrastructure will continue within multi-asset funds, but we need to be aware of the ever-changing material risks associated.

This whole body of work will evolve, and it is really important to look at physical risk sooner rather than later.

Helpful perspectives on the methodology and data needed to try to predict climate risk and value at risk to a given asset under a given scenario.

I learned that it is important to consider the probable impact of physical risks and to be as precise as possible in its estimation. We would assign the asset manager to initiate an analysis. It allows us to consider that physical risks could eventually be higher than estimated.

Question 5: Have you implemented an evaluation of this physical risk yourself?

- Yes: 24 (34%)

- No: 46 (66%)

Two thirds of respondents have carried out no evaluation of physical climate risks themselves. This response serves to highlight just how dependent professionals in the industry are on the advice and data available from researchers and consultants. It is clear that this lack of real evaluation of the climate risk to which investors’ assets are exposed heightens the risk to which these assets are exposed, because these same investors have highly concentrated investments in assets whose exposure to potentially very high risks is not measured.

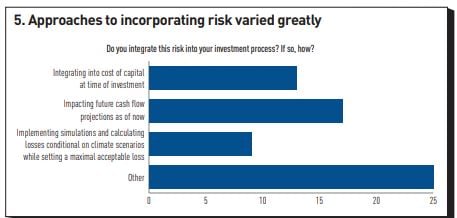

Question 6: Do you integrate this risk into your investment process? If so, how?

- By integrating it into the cost of capital at the time of the investment: 13 (20%)

- By impacting the future cash flow projections as of now: 17 (27%)

- By implementing simulations and by calculating losses conditional on climate scenarios while setting a maximal acceptable loss: 9 (14%)

- Other (please specify below): 25 (39%)

The replies to this question show how very varied approaches to incorporating risk can be – even when considering a single class of risks on a single asset class within a highly regulated industry (see figure 5). Responses were spread across the four options, with 25 saying they use a different approach to integrate physical climate risk into their investment process, 17 favouring impacting the future cash flow projections as of now, 13 integrating it into the cost of capital at the time of the investment and nine by implementing simulations and by calculating losses conditional on climate scenarios while setting a maximal acceptable loss.

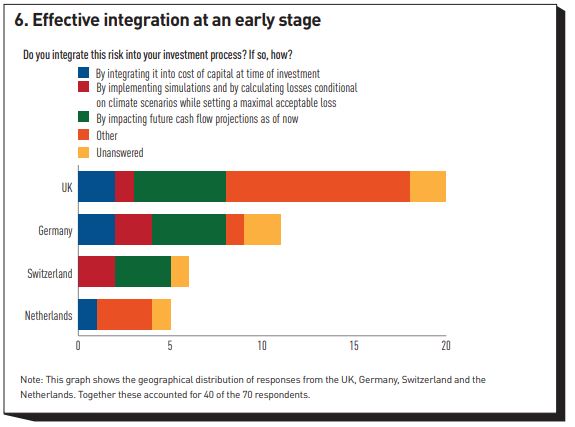

The ‘Other’ option refers essentially to investors who do not have a quantified or formal approach to assessing climate risk in the investment process. It should be noted that even when the investments have a process that integrates this risk, the inadequacy of the assessment of the reality of this risk makes this integration questionable (see figure 6).

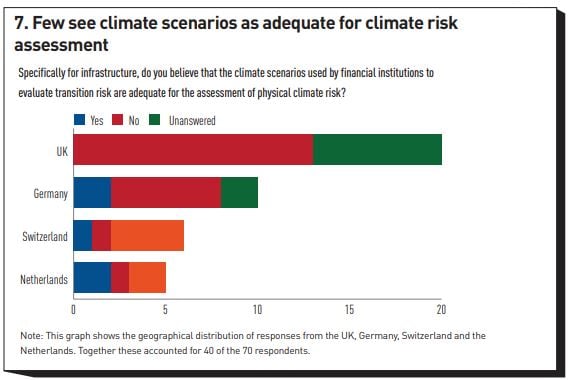

Question 7: Specifically for infrastructure, do you believe that the climate scenarios used by financial institutions to evaluate transition risk are adequate for the assessment of physical climate risk?

- Yes: 11 (24%)

- No: 35 (76%)

Once again, the answers to this question reveal industry professionals’ frustration with the data that is available to them (see figure 7). More than three quarters do not think that the climate scenarios used by financial institutions to evaluate transition risk are adequate for the assessment of physical climate risk.

Below is a selection of the narrative response to this final question:

No – definitely not. There are some huge concerns around the present state of scenarios ... but fortunately, further work is ongoing to develop better scenarios.

Not ideal but is probably a good way to think about it. Otherwise you will have a separate set of scenarios for transition risk and a separate set of scenarios for physical risk. And can’t combine risks.

I suspect the risk is currently understated and reflective of experience rather than potential futures.

No, because current models run on regression of historical data and climate change might bring us a completely unknown future scenario.

No, they are present and in development but insufficient or inadequate. Right now we apply full risk methodology with no regards for the project specificities, it needs to be tailored by sector.

Yes because these scenarios exist and allow to share a common understanding.

These responses are generally consistent with our research and with the importance of going beyond the NGFS scenarios to estimate physical climate risk.

The EDHEC Infrastructure & Private Assets Research Institute is improving on the macro- level understanding of physical risk, which consists of a national-level damage function impacting the productivity of factors, by estimating very granular physical risk exposures at the asset level (down to a 30-metre resolution) for floods, storms and heat. This technology combined asset-level characteristics, eg, types of physical assets, with the most recent assessment of physical hazards and state-of- the-art, hazard and activityspecific damage functions. The result is a refined estimate of the physical damage at risk (PDaR) for a given hazard return period today, which can serve as the basis for asset-level physical risk exposures in different scenarios.

Conclusions

Our survey reveals that industry professionals have much pessimism about the data they are being given regarding physical climate risk, considering it to be both incomplete and unreliable. They have doubts about the models being used, and they want more and better research.

Responses to the seven questions highlight the following:

Responders overwhelmingly consider that physical climate risk is something significant.

Expectations of its impact vary hugely, but most believe it will have a medium or high impact on their infrastructure investments.

They display a lack of confidence in our current ability to gauge the magnitude of climate risk impact on the asset class. Very few believe we currently have the tools to get it right.

Most say that our research is helping them to understand how these risks threaten investments in this field and their potential impacts.

Most have carried out no evaluation of physical climate risks themselves. Almost all integrate consideration of these risks into their investment process, though in many different ways, and most of those who do not do so yet say they plan to.

Most believe that the climate scenarios used by financial institutions to evaluate transition risk are inadequate for the assessment of physical climate risk.

This high level of risk shows the importance of implementing more ambitious policies to cope with climate change. The energy transition and the alignment of economies bring a cost to private investors, but so does climate change! Importantly, however, our research also showed that if the relevant stakeholders could only organise the transition towards a decarbonised economy today, extreme losses could be reduced by half.

And our research has shown that investors are right to be concerned and to question the calibre of the data that they are receiving. On the one hand, runaway climate change could lead to losses as large as half of the portfolio of some investors because of physical damage; on the other, a delayed transition, even if it achieved decarbonisation, would create a gigantic price and interest rate shock and could wipe out as much as $600bn of infrastructure asset value for the same investors.

The climate impacts and risks to infrastructure assets are a key point of focus but investors often lack the full picture of their level of impact or exposure. And they are incorporating them into their strategies in many different ways. Moreover, physical risk estimates are often simplified to a ‘point on a map’ estimation and do not take into account the granularity of the terrain or the type of damage that different hazards can cause to an asset.

Proper integration of climate risks requires an evaluation of the impact of these risks, which, the survey shows, has been insufficiently developed. It is clear that given the level of concentration of the portfolios, and therefore of the potential concentration in the riskiest assets, proper knowledge of these risks and their consequences is essential. The results of the survey show that this is unfortunately not the case currently.

Appendix

Footnotes

[1] See https://publishing.edhecinfra.com/papers/2024-01_physical%7C_climate_ris...

[2] For our next event, which will take place in Chicago on 17 October 2024, please see here: https://scientificinfra.com/private-asset-day/.