Post-Workshop Interview with Gianfranco Gianfrate

By Fabiola Iuliano & Fiona Huang (EDHEC Student Finance Club - ESFC)

Climate Change, Credit Risk and COVID-19 – Post-Workshop Interview with Gianfranco Gianfrate

On the 5th of November, the EDHEC-Risk Institute, in collaboration with LTI@UniTO, has organized a workshop on environmental changes, their impact on credit risk assessment and their link with Covid-19, hosting Francesco Profumo from Fondazione Compagnia di San Paolo, Enrico Bernardini from Banca d’Italia, Professor Riccardo Rebonato from EDHEC-Risk Institute and Giorgio Baldassarri from S&P Global Market Intelligence, who shared their analysis and insights on green transition, sustainable investments and climate risks.

After an explanatory and admirable introduction from Professor Gianfranco Gianfrate of EDHEC and Professor Elisa Luciano of Collegio Carlo Alberto, Francesco Profumo, President of Fondazione Compagnia di San Paolo, took the floor. He recalled his recent paper on the positive relationship between firms’ exposure to climate and credit risks while raising both awareness about investing in ESG oriented firms and attention to the taxonomy of sustainable technologies.

But what does firm exposure to climate risks on an aggregate level mean? Enrico Bernardini from Banca d’Italia shed light on this aspect. Banca d’Italia is committed to measuring climate change-related risk through machine learning, using MSCI and REFINITIV data. Climate change’s physical risks and carbon transition risks both post threats to the economic and financial system, so it is a serious matter for central banks and financial authorities. Mr. Bernardini points out that although there is consensus on the need of appropriate risk measures related to climate change, unfortunately, financial intermediaries still lacks awareness and disclosure on exposure and risk management due to lack of resources, data and robust methodologies.

Similarly, EDHEC’s Professor Riccardo Rebonato explains the issue from an asset-pricing perspective. Given the uncertainty related to temperature anomaly, he mentions that the optimal timing for climate mitigation effort is front-loaded. He also compares the climate mitigation investments to war-effort scale infrastructures: serious climate actions will transform the resource allocation of the economy, or there will be severe negative repercussion on economic growth. In both cases, climate facts have implications on the absolute level of assets and on relative returns depending on assets’ climate sensitivities. Using scenario analysis, Professor Rebonato suggests that we could use a Bayesian Net (conditional probabilities) to analyze the effect of climate change to different financial instruments.

Our experiences in COVID-19 may also hint to what is at stake. Giorgio Baldassarri from S&P Global Market Intelligence explained that there is mounting evidence that the proliferation and transmission of diseases are facilitated by global warming. While governments have seized the opportunities to implement more serious carbon transition policies, S&P Global believes that the speed of carbon tax increase and the firms’ response type are critical drivers to their creditworthiness and can potentially trigger several defaults among public companies. Their analysis suggest that the risk is lower when companies start adopting greener technology and emission reduction methods early rather than business-as-usual or under forced action. Perhaps, we can already observe this phenomena in the pandemic: while radical changes due to lockdown create great disturbances, early preparation could minimize negative impact to businesses. Similarly, if firms react to climate change only during emergencies, they could lose out on the opportunities presented by anticipatory actions.

In the following section, we invited Professor Gianfranco Gianfrate, the organizer of this workshop, to speak with us about Credit Risk and Climate Change.

In the exchange below, ESFC represents the EDHEC Student Finance Club’s questions and GG represents Professor Gianfranco Gianfrate’s responses; texts in italic are supplemental information provided by ESFC post-interview.

ESFC Publishing Division: Thank you very much for inviting us to this workshop. We learned a lot from the experts from different field. There are a lot of risk and opportunities related to climate actions in the financial markets, including the more commonly discussed ESG-linked stocks. So first and foremost, why specifically credit risks? Why should people pay more attention to credit risks when we discuss about climate change?

Gianfranco Gianfrate:

As climate change and global warming are addressed by tougher regulation by governments, new emerging technologies, and shifts in consumer behaviors, global investors are increasingly concerned with the implications of climate change on the pricing of financial assets. While the relationship between climate risks exposure and share prices has received a lot of attention, the impact on corporate bonds and loans has been mostly overlooked. However, there are climate-change-related risks borne by the global credit markets that are similar in magnitude to the ones emerged in the financial crisis.

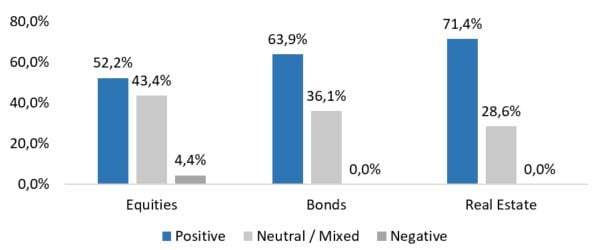

While the seminar focused on climate risk, the trend in ESG investing literature is a good proxy to show the lack of ESG discussion in non-equity asset classes. Friede, Busch and Bassen (2015) performed a meta-analysis on over 2000 empirical literatures related to ESG investing. One of their findings focuses on the sub-effect in asset classes: out of 334 vote-count studies sample, 291 samples analyzed ESG factors’ relation with equities, 36 samples analyzed relation with bonds and only 7 analyzed relation with real estate. The graph shows ESG factors’ impact on corporate financial performance by asset class from the 334 vote-count studies sample. While bonds and real estate display a higher share of positive findings, the two asset classes include less studies samples.

Friede et al. (2015) Vote-Count Studies’ Conclusion by Asset Class (334 net sample)

ESFC: All three guest presenters have mentioned some sort of environmental risk analysis in examining the financial/economic impact of climate change. What are some methods most used in practice today? How can we overcome limitations of the current methods?

GG: A promising way to think of climate risk is via internal carbon pricing (also referred to as “shadow carbon pricing” or “internal carbon tax pricing”). Internal carbon pricing is a voluntary method for companies to internalize the implicit (actual or expected) cost of carbon under various policies and regulations even when all or part of their operations are not currently subject to external carbon regulations. Internal pricing of carbon is used for risk management purposes: as companies are increasingly exposed to regulatory and financial risks attached to the implementation of governmental carbon pricing regimes, they seek to measure, model, and manage such risks. Internal pricing of carbon also allows investors to assess the extent to which companies’ activities are vulnerable to increasing carbon costs. Furthermore, internally defined prices of carbon are featured in strategic planning activities as carbon price is an important input in the definition of the long-term business model, including the identification of new strategic risks and opportunities.

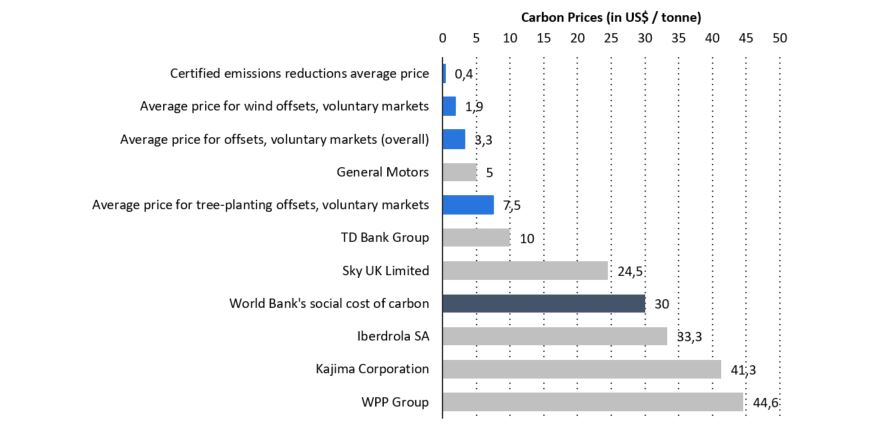

Eventually, carbon offset prices should reflect the true cost of climate change, but the current market prices for carbon assets (in light blue) often fall short of estimated social cost of climate impact (navy blue). Some companies have already started adopting internal carbon pricing, as shown by the samples below based on available data. However, although this method is much better at reflecting the reality, it is far from becoming industry standard. Even within offset buyers, only 18% use this method, according to 2014 survey used by Ecosystem Marketplace (a non-profit that focuses on climate finances and carbon markets).

Selected Companies’ Internal Carbon Prices compared to Current Market Offsets (Light Blue) and World Bank Estimate of Carbon Cost (Navy) via Ecosystem Marketplace (2019)

ESFC: You have recently published a Working Paper “Climate Change and Credit Risk” with your colleague Giusy Capasso and Marco Spinelli in February. Your research was mentioned in the seminar. Could you briefly discuss with us about your findings and its application in policymaking?

GG: Our paper investigates whether firm’s exposure to climate risks, measured as level of CO2 emissions, is associated to Merton’s distance to default, a measure or creditworthiness widely used by rating agencies and investors. The paper shows that there is a significant and negative relation between distance to default and the level of CO2 emissions. The paper also analyzes the impact of the 2015 Paris Agreement. After the Paris agreement, high emitting companies significantly shorten their distance to default in comparison to low emitters. This finding supports the view that financial markets are increasingly pricing climate change exposure of listed companies, and such exposure affects the overall creditworthiness of companies.

ESFC: Mr. Bernardini from Banca d’Italia mentioned that inconsistency in ESG scores and lack of good quality data have been one of the major obstacles in climate change finance research. Have you encountered this problem during your research? What needs to be done to overcome this issue?

GG: Unfortunately, the input for most sustainability ratings are based on self-reported and unaudited data. Also, the measurement and rating aggregation approaches differ across rating providers. As a consequence, ESG ratings, differently from financial creditworthiness ratings, show a high degree of inconsistency. This issue makes sustainable finance research difficult, but it is also an opportunity. At EDHEC, we have several research projects under-way to detect greenwashing by corporates and investors. Also, we are thinking of new science-based metrics to capture more effectively the sustainability footprint of financial assets.

Professor Gianfrate and colleagues discuss the determinants and consequences of greenwashing in US firms in a recent study. They conclude that larger boards experience less greenwashing and that greenwashing decreases the firm value, likely because investors penalize firms for not delivering their environmental commitments. More details on this study please see Ghitti, Gianfrate and Palma (2020).

ESFC: More specifically on the ongoing crisis, how do you think investors’ perception of climate change finance have changed due to COVID-19? How can we make this momentum (if any) last after the pandemic?

GG: COVID-19 is making a (further) evident argument in favor of corporate sustainability. The “S” of ESG includes employees’ health and safety, and the companies around the world most responsive in protecting their workers in a pandemic outbreak are likely to experience less disruptions and recover the quickest. Epidemics depend in many cases on the disruptions of ecosystems and involuntary mass migration determined by climate change. In the aftermath of the pandemic, I would expect responsible investment to become even more central in finance.

About Gianfranco Gianfrate

Gianfranco Gianfrate is Professor of Finance at EDHEC Business School and Research Director at EDHEC-Risk IClimate Impact nstitute. He writes and researches on topics related to innovation financing, corporate valuation, and climate change finance. Prior to joining EDHEC Business School, he held teaching and research positions at Erasmus University (Netherlands), Harvard University (USA), and Bocconi University (Italy). Gianfranco also has extensive experience in the financial industry, having worked, among others, for Deloitte Corporate Finance (Italy), Hermes Investment Management (UK), and iStarter (UK). Gianfranco holds a BA and a PhD in Business Administration from Bocconi University and a Master in Public Administration from Harvard University.