The EDHEC European ETF, Smart Beta and Factor Investing Survey 2019

EDHEC-Risk Institute conducted its 12th survey of European investment professionals about the usage and perceptions of ETFs, smart beta and factor investing, as part of the Amundi research chair at ...

Author(s):

Summary:

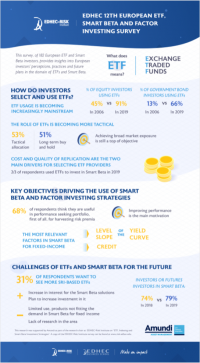

EDHEC-Risk Institute conducted its 12th survey of European investment professionals about the usage and perceptions of ETFs, smart beta and factor investing, as part of the Amundi research chair at EDHEC-Risk Institute on “ETF, Indexing and Smart Beta Investment Strategies”. The aim of this study is to analyse current European investor practices and perceptions on ETF, smart beta and factor investing strategies, as well as future plans in these domains. By comparing our results to those of our previous surveys, over more than a decade, we aim to shed some light on trends within the ETF market and within the smart beta and factor investing strategy offer.

Since 2006, EDHEC has annually surveyed European investors about their views and uses of ETFs. Starting in 2013, when we first considered smart beta in the survey, complementary questions about smart beta and factor investing strategies have been added each year to the survey, allowing participants to describe their general use of and give their opinions on products that track smart beta indices, and more generally on alternative equity beta strategies. From 2016, a section of the survey was fully dedicated to smart beta and factor investing strategies. In 2018, we introduced a special group of questions dedicated to smart beta and factor investing for fixed-income, and in the present edition of the survey, we emphasize this latest group of questions. This survey brings together the main vehicles of passive investment, namely ETFs – which are standard and very liquid products that track indices – and strategies based on the new forms of indices.

Discover main results by clicking on the image:

Register to download PDF

Register/Log in| Type : | EDHEC Publication |

|---|---|

| Date : | 26/09/2019 |