The Role of Academics and Empirical Studies

The Role of Academics and Empirical Studies in the Debate on the Economic Role of Futures Trading

A number of empirical studies, mainly from academic researchers, have been crucial in the debate on the economic role of futures trading. This article briefly reviews these influential studies with a focus on agricultural futures contracts, financial futures contracts. and the transparency of data.Economic Role of Futures Trading

By Hilary Till, Research Associate, EDHEC-Risk Institute; and Principal, Premia Research LLC

Role of Academics with respect to Agricultural Futures Contracts

“Starting in the Populist era – the 1880s to 1915 – people began to associate the futures markets with soaring food prices and other economic upheavals that were reshaping society …”; as a result, “[American] federal lawmakers introduced more than one bill per year from 1884 to 1953 to ban futures markets, which were derided as ‘engines of wrong and oppression,’” explained Maulsby (2011), citing a presentation by Professor Scott Irwin of the University of Illinois. Irwin named the “three agricultural economists … [who] played a crucial role in changing perceptions of the futures markets as valuable market institutions.” These three economists were Holbrook Working, Roger Gray, and Thomas Hieronymous. “These economists showed that the futures markets are not mere speculative vehicles, but they contribute to the economic welfare of society by making the system more efficient,” according to Irwin.

Holbrook Working

Professor Working “challenged the misperception that futures markets are driven by speculators. His work from the 1950s still resonates today …”, noted Irwin in Maulsby (2011). Working (1970) described how fragile the existence of the futures-trading business in Chicago had been since its inception in the nineteenth century. He also described how the Grain Futures Administration[1] in the 1940’s had been led by statisticians who were trained in the natural sciences and who therefore allowed the data to provide answers to important policy questions. Judging by the Commodity Futures Trading Commission’s (CFTC’s) continued exhaustive data-gathering efforts, one can say that this tradition is continuing. A key Working principle is that a futures contract has to be commercially useful to hedgers. Traditionally, once hedgers are attracted to using a futures market, speculation follows, and not the other way around.

Roger Gray

Professor Gray “argued that a futures market widens opportunities to buy a commodity during the harvest surplus and sell the commodity later,” explained Irwin in Maulsby (2011). According to Otte (2012), “In the mid 1950s onions represented 20% of U.S. futures trading volume. Demand for onions is highly inelastic. Old-crop onions that have been in extended storage are worthless when new crop becomes available. Harvest delays can create supply shortages. When price volatility skyrocketed, critics blamed speculators. They rallied their legislators. In 1958 Congress outlawed futures trading in onions.”

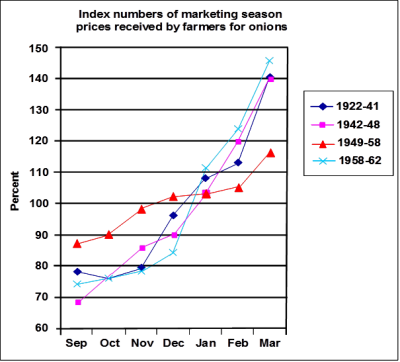

Otte (2012) recalled that “Stanford University economist Roger Gray plotted marketing season cash onion price volatility for time periods before, during and after the 1956 to 1958 period when speculators were charged with boosting price volatility.” This chart is reproduced as Figure 1. “Gray’s chart shows onion prices actually had less seasonal volatility during the time when critics were blaming futures for creating more volatility than prices had before that time and after futures were banned,” summarized Otte (2012).

Figure 1 - Source of Graph: Otte (2012), citing S. Irwin, whom in turn, cites Gray (1963).

Thomas Hieronymous

Professor Hieronymous popularized “the futures markets in the 1950s and 1960s … Dr. Hieronymous … [had a] gift for explaining things clearly and … [had a] genius for penetrating the mysteries of the futures markets,” according to Irwin in Maulsby (2011).

Scott Irwin

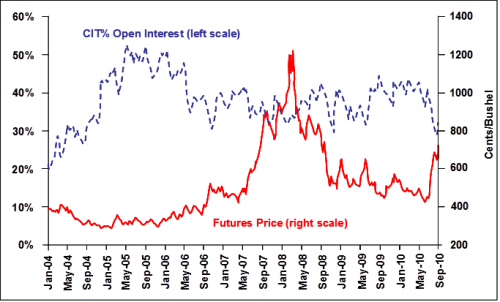

More recently, the crucial role for academics has reverted to defending futures markets rather than in pushing the frontiers of innovation. Professor Scott Irwin of the University of Illinois picked up the baton of his agricultural economist predecessors in carrying out empirical studies on the role of various types of market participants in grain price formation. Professor Irwin examined commodity index investor participation in the wheat market, for example. As seen in Figure 2, “Irwin plotted holdings of index funds in front-month Chicago soft red winter wheat futures contract and price action of the contract. The funds accumulated positions in 2005 and 2006. Prices really didn’t rally until mid-2007. Concluding that fund buying in 2005 and 2006 drove the price rally that occurred two years later is a stretch,” stated Otte (2012).

Commodity Index Trader (CIT) % of Open Interest and Nearby Futures Price in CBOT Wheat,

January 6, 2004 – September 9, 2009

Figure 2, Source of Graph: Otte (2012), citing Irwin.

Role of Academics with respect to Financial Futures Contracts

Milton Friedman: Currency Futures

Recalled Melamed (1994), “At the behest of the CME, Dr. Milton Friedman authored a study in December 1971 which became the intellectual foundation for the birth of currency futures … His paper, entitled ‘The Need for Futures Markets in Currencies,’ provided the CME administration with academic authenticity of the highest magnitude to prove that their theory was a viable necessity.”

Nathan Report: Chicago Board Options Exchange

Mackenzie (2006) described how the Chicago Board of Trade also “sought legitimacy from economists.” “In 1969, it sought an assessment of the proposal for an options exchange from a leading economic consulting firm, Nathan Associates … For its report on [equity] options, Nathan Associates turned for assistance to … MIT’s Paul Cootner, the University of Chicago’s James Lorie and Merton Miller, and … Princeton[’s] … [Burton] Malkiel, [Richard] Quandt, and … William Baumol. [These academics] … provided Nathan Associates with an analysis of the [positive] impact of an options exchange on ‘the public interest’,” according to Mackenzie (2006).

Transparency of Data for Empirical Studies

Early Work

Thus far, futures trading has survived frequent challenges because market-participant data and positions have been made transparent. This transparency has meant that researchers have been able to carry out objective, empirical studies to prove or disprove the benefits (or burdens) of exchange-traded futures trading, dating back to at least 1941 with the release of the USDA’s Hoffman and Duvel report.

Long-Term Study

Professor David Jacks examined what happened to commodity-price volatility, across countries and commodities, before and after specific commodity-contract trading has been prohibited in the past. Jacks (2007) also examined commodity-price volatility before and after the establishment of futures markets, across time and across countries. Jacks’ study included data from 1854 through 1990. He generally, but not always, found that commodity-price volatility was greater when there were not futures markets than when they existed over 1-year, 3-year, and 5-year timeframes.

CFTC Data and Studies

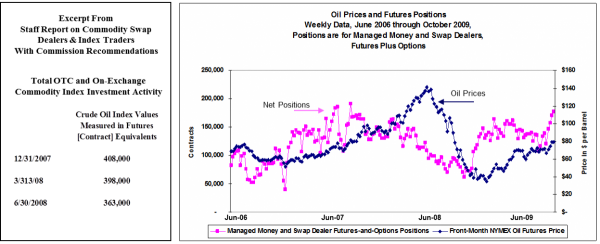

The transparency in futures markets has allowed researchers to examine data to determine what precisely is impacting the market. With this data, for example, one can examine the oil price spike of 2008. Could it have been that commodity index investments in 2008 actually caused the 7-month oil-price rally that culminated in July of 2008? This is an unlikely cause, given that total over-the-counter and on-exchange commodity index investment activity in oil-futures-contract-equivalents actually declined from December 31st, 2007 through June 30th, 2008, as shown in the left-hand-side of Figure 3.

An analysis in late 2009 by J.P. Morgan researchers also examined the CFTC’s Disaggregated Commitments of Trader data.During the 12 months from July 2007, “when oil prices spiked from $80 to $145 per barrel, banks and fund managers were steadily taking profit on their longs in oil futures contracts, correctly anticipating the eventual fall in oil prices,” informed the researchers.This is illustrated on the right-hand-side of Figure 3. Net positions of banks and fund managers are shown in the pink line, and oil prices are illustrated in the dark blue line.Again, note that the scale of these speculative positions was decreasing as the price of oil was spiking.

Essentially, the J.P. Morgan researchers found that prices and positions were correlated through common reactions to fundamental information.Specifically, from 2006 to 2009, the variability of oil prices can be shown to be “mostly due to changes in the U.S. Dollar, changes in oil market tightness, and expectations of future changes in oil inventories.”

CFTC Data and Studies: Prices and Positions During the Oil Price Spike of 2008

Figure 3, Source: CFTC (2008). Graph Based on Ribeiro et al. (2009), Chart 1.

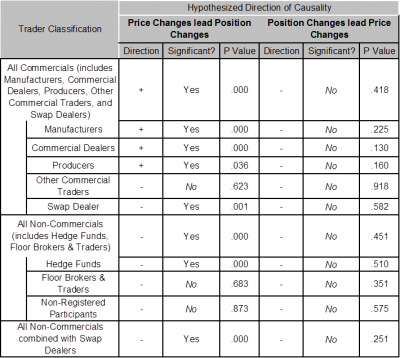

More evidence on the impact of transparency of data in commodity markets was cited in a May 2010 Wall Street Journal article (Lynch, 2010).The reporter obtained unreleased Commodity Futures Trading Commission reports through a Freedom of Information Act request. CFTC staff had found that for crude oil prices from January 2003 to October 2008, price changes led position changes, rather than the other way around. See Figure 4. If speculators were indeed driving price changes, one would have expected their position changes, instead, to have led price changes. “Price changes that systemically precede position changes indicate reactive behavior by a particular trading group,” noted CFTC researchers in ITF (2009).

CFTC Data and Studies: Oil Futures Price Changes and Position Changes

Figure 4, Source of Table: Büyükşahin and Harris (2008).

Their study uses daily data from January 2003 to October 2008.

Conclusion

Empirical studies have provided essential information regarding the economic role of futures trading. The key lessons from the past work are to constantly revisit the economic usefulness of commodity futures trading; insist upon transparency in market-participation and position data in a sufficiently disaggregated fashion as to be useful, but also in a sufficiently aggregated fashion as to not violate individual privacy; and that empirical studies should be carried out to confirm or challenge the benefits and/or burdens of futures trading.

Endnote

This article is excerpted from a seminar that Hilary Till provided in Chicago to Shanghai Futures Exchange staff.

[1]The Grain Futures Administration (1922 to 1936) and the Grain Futures Commission (1922 to 1936) preceded the Commodity Exchange Administration (1936 to 1942), Commodity Exchange Authority (1947-1974), and the Commodity Exchange Commission (1936 to 1974). The Commodity Exchange Commission and the Commodity Exchange Authority merged in 1974 to form the present Commodity Futures Trading Commission [CFTC].

References

Büyükşahin, B. and J. Harris, 2008, “Do Speculators Move Crude Oil Prices?,” CFTC Office of the Chief Economist, Working Paper, Fall, as cited in ITF (2009).

[CFTC] Commodity Futures Trading Commission, 2008, “Staff Report on Commodity Swap Dealers & Index Traders with Commission Recommendations,” September 11.

Friedman, M., 1971, “The Need for Futures Markets in Currencies,” Commissioned Paper for the Chicago Mercantile Exchange.

Gray, R., 1963, “Onions Revisited,” Journal of Farm Economics, Vol. 45, No. 2, May, pp. 273-276.

Hoffman, G. and J. Duvel, 1941, “Grain Prices and the Futures Markets: a 15-Year Survey, 1923-1938,” United States Department of Agriculture, Technical Bulletin No. 747, January.

[ITF] Interagency Task Force on Commodity Markets, 2009, “Special Report on Commodity Markets,” Draft, 5 January. Accessed via website:

http://online.wsj.com/public/resources/documents/DraftITFReport010509.pdf on June 21, 2020.

Jacks, D., 2007, “Populists Versus Theorists: Futures Markets and the Volatility of Prices,” Explorations in Economic History, Elsevier, Vol. 44, No. 2, April, pp. 342-362.

Lynch, S., 2010, “CFTC Documents Reveal Internal Debate on Position Limits,” Wall Street Journal, May 4.

Mackenzie, D., 2006, An Engine, Not a Camera: How Financial Models Shape Markets, Cambridge, MA: MIT Press.

Maulsby, D., 2011, “An Untold Leadership Story, How Ag Economists Saved the Markets,” The Messenger, November 6.

Melamed, L., 1994, “A Brief History of Financial Futures: Presented at the Seminar on Financial Futures,” Shanghai, May 3. Accessed via website: http://www.leomelamed.com/Speeches/94-china.htm on June 21, 2020.

Otte, J., 2012, “Curb Excess Speculation?,” Farm Futures, May 8.

Ribeiro, R., Eagles, L. and N. von Solodkoff, 2009, “Commodity Prices and Futures Positions,” J.P. Morgan Global Asset Allocation & Alternative Investments, December 16.

Working, H., 1970, “Economic Functions of Futures Markets,” in H. Bakken (ed) Futures Trading in Livestock – Origins and Concepts, Madison: Mimir Publishers, pp. 3-47.