Scientific Beta Low Carbon Option

By Frédéric Ducoulombier, ESG Director, Scientific Beta and Victor Liu, Quantitative Equity Analyst, Scientific Beta

Supporting the transition to a low carbon economy and protecting multi-factor indices against transition risks

Faced with the climate emergency, it is conservative to assume that there will be growing ecological, socio-political, and economic pressure on governments to set and enforce climate policies that materially reduce the gap between current emissions and the levels required to mitigate climate change. For most companies, this political response is a major component of the risks of a transition to a low carbon economy, which also include the impact from evolving technology, social norms and consumer behaviour. These risks could materially affect the financial positions of companies through balance sheet and income statement effects.

Thus, while ethical and socially responsible investors should be expected to orient their investments, engagement and outreach policies to contribute to the fight against climate change, all investors need to consider the possible financial impacts of climate change on their portfolios.

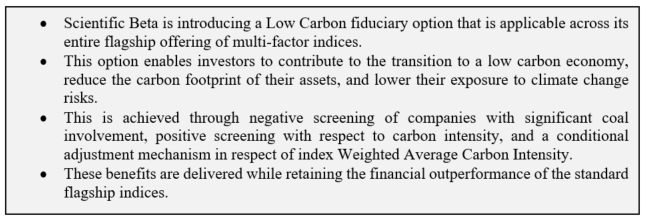

Against this backdrop, Scientific Beta is introducing a Low Carbon fiduciary option that is applicable across its entire flagship offering of multi-factor indices. It addresses the three most common decarbonisation objectives for investors:

- 1. Contributing to the transition to a low carbon economy;

- 2. Reducing the “carbon footprint” of investments;

- 3. Reducing exposure to climate change risks.

These objectives are achieved with three approaches to decarbonisation:

- Negative screening ensures divestment from companies with strong coal involvement. This acknowledges that phasing out coal is a priority in transition scenarios due to its importance and environmental inefficiency and that coal assets are thus at a particular risk of becoming stranded in the transition.

- Positive screening targets the companies with the highest emissions per unit of revenues (carbon intensity) across sectors. This acknowledges that the demands of the transition extend beyond shedding coal dependency and that transition risk is pervasive. Screening is region neutral and strikes a balance between exclusion efficiency and sector protection, while upholding best-in-class selection within each affected sector.

- A conditional adjustment mechanism reduces the potential shortfall between the quarterly level of the index Weighted Average Carbon Intensity (WACI) and a desired long-term reference level. This acknowledges that guaranteeing a high reduction in the metric favoured by the Taskforce on Climate-related Financial Disclosures (TCFD) protects the long-term decarbonisation strategy against potential challenges from short-term deviations.

The application of the Low Carbon option produces a drastic reduction in allocation to coal assets and to the most carbon-intensive companies. This incentivises the transition of shunned and other companies towards more sustainable activities and technologies. It also contributes to material reductions in both carbon footprints – i.e. measures of the portfolio’s indirect contribution to emissions – and exposures to the companies most liable to be affected by transition risks. Over the last ten years, the average index WACI is about half that of the benchmark on developed markets.

Decarbonisation is delivered without compromising the financial outperformance of the standard flagship indices.

ESG Incorporation Philosophy, ESG Screens and Decarbonisation Approaches

Scientific Beta ESG Incorporation Philosophy

Scientific Beta’s Environmental, Social and Governance (ESG) incorporation philosophy centres on exclusions that are determined solely on ESG merits and applied as the first step in index construction.

This approach respects the principles of socially responsible investors and, as a result, exclusions send clear signals to issuers and are straightforward to explain to stakeholders. From an ESG risk management point of view, the approach targets companies whose performance fails to meet standards. Designed in this framework, the Low Carbon option demonstrates unambiguous support for the transition to a low carbon economy and reduces index exposure to transition risks. Divestment from companies involved with particularly inefficient fuels or high carbon intensity contributes to increasing their cost of capital and incentivises transition by these companies and others. Reduced exposure to companies whose assets face high risks of stranding or with high potential exposure to overall transition risks promotes index resilience to climate change.

In the absence of sound academic evidence documenting the existence of non-redundant ESG performance factors, dealing with ESG concerns as a first step allows downstream index construction to concentrate on the rewarded systematic risks through factor-based security selection and the mitigation of conventional risks through diversification weighting and risk controls.

Coal Involvement Filter and other Negative ESG Screens

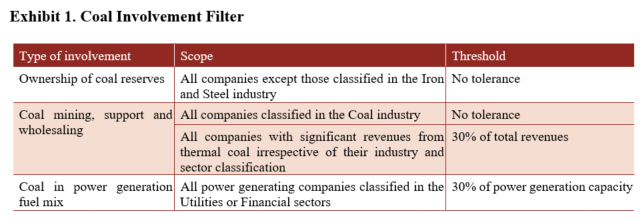

The Low Carbon fiduciary option includes a coal involvement filter that is part of the set of core ESG screens embedded in all of Scientific Beta's off-the-shelf ESG options. Quantitatively, the bulk of the exclusions, as per these negative screens, is in respect of coal involvement as defined in Exhibit 1.

From an ethical and socially responsible investment standpoint, the focus on coal is mandated by it being the largest source of electricity and the fuel with the lowest heating value normalised by greenhouse gas emissions. Divestment of companies with a major role in the supply and demand for coal is consistent with a deontological approach and sends a clear signal to stakeholders.

From the point of view of potential financial materiality of ESG risks, coal-mining and coal usage, especially for energy production, need to be drastically curtailed. If the transition is faster or more severe than the current base line scenarios, the book value and/or the earning potential of coal assets will be impaired. If such impairments are not correctly anticipated by investors, coal companies will be repriced. Mitigating this risk of stranding provides a financial motive for divestment.

The other negative screens cover companies that entail risks of association with serious violations of fundamental norms, notably in reference to the human rights, labour, environment and anti-corruption norms underlying the United Nations Global Compact. Companies that deny investor oversight by issuing only non-voting shares are also excluded in reference to the OECD Principles of Corporate Governance. Product-based exclusions, other than in respect of coal involvement, target companies with involvement in anti-personnel landmines and cluster bombs and tobacco-industry companies and manufacturers of tobacco products; companies with such involvements are not eligible to be recognised as participants in the United Nations Global Compact.

Removing companies that fall short of global standards of responsible business conduct and corporate governance or that are involved in activities that conflict with global ESG norms or their objectives ensures that the pursuit of decarbonisation and financial performance do not harm the respect of ESG norms.

Positive Exclusion of High-Carbon-Intensity Companies

The second decarbonisation approach implements a region-neutral flexible best-in-class filter that excludes companies with high carbon emissions to revenues while protecting sector representation. Both direct corporate emissions and indirect emissions from the generation of electricity, steam, heating or cooling purchased or consumed by the company are included (Scope 1 and 2 emissions, respectively) Data quality in respect of other indirect emissions remains insufficiently granular to support stock-level decisions (but we include these Scope 3 emissions in reporting).

The filter ranks constituents in each region according to company level carbon intensity and exclusion proceeds strictly from worst to best subject to sector rules, notably a 50% cap in the number of exclusions. Relative to a sector-neutral approach, the filter promotes materially higher impact for a given exclusion budget. This budget is set at 10% of the number of securities in each region.

From a non-financial point of view, this second approach to decarbonisation recognises that the transition to a low carbon economy goes beyond phasing out thermal coal and that carbon efficiency should be incentivised in key sectors and beyond. From the point of view of ESG risks with potential financial materiality, it acknowledges that transition risk pervades key transition sectors, e.g. Energy – Fossil Fuels, Utilities, Basic Materials (e.g. steel, cement), Transportation, Real Estate, and affects high-carbon-intensity companies across all sectors.

Weighted Average Carbon Intensity Assurance

The coal involvement and carbon intensity filters jointly remove the companies most exposed to transition risks from any derived index and promote improved index-wide average carbon metrics. In keeping with the ESG incorporation philosophy however, the latter are by-products of the screening and index construction methodology rather than objectives or constraints determining individual security selection and weighting.

To protect index strategies against questioning in respect of adverse short-term deviations of carbon metrics, the Low Carbon fiduciary option embeds a conditional shortfall reduction mechanism. The mechanism is triggered when the WACI of the index at rebalancing fails to achieve a reduction of 35% relative to the benchmark and targets a reduction of 40% by minute sector-weight adjustments. The trigger threshold was calibrated historically to ensure that activation would remain rare and adjustments are highly constrained to preserve the financial characteristics of the index.

Risks and Performances of Low Carbon Multi-Smart-Factor Indices

In this section, we study the impact of the Low Carbon option on the ESG and financial risks and performances of the flagship Multi-Beta Multi-Strategy High Factor Intensity 6-Factor 4-Strategy EW index with and without sector control. ESG data is availed from Institutional Shareholder Services and public sources.

Decarbonisation Performance

In assessing decarbonisation, we consider both exposure to assets with high transition relevance and stranding risk potential and overall portfolio metrics.

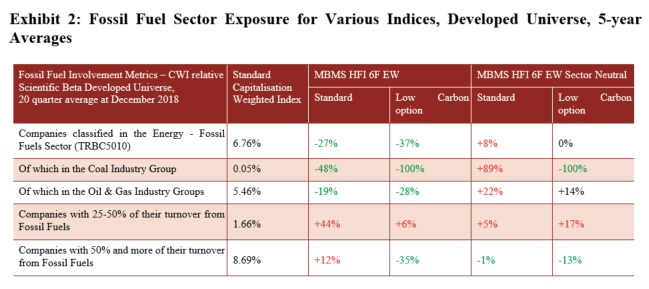

As shown in Exhibit 2, filtering leads to indices in which pure coal players are removed and exposure to companies with majority turnover from fossil fuels is reduced.

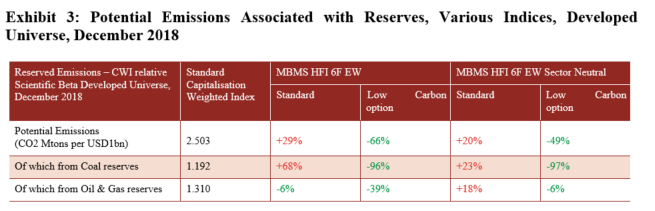

As shown in Exhibit 3, filtering leads to a dramatic fall in exposure to coal reserves, as measured by their potential carbon dioxide emissions normalised by investment.

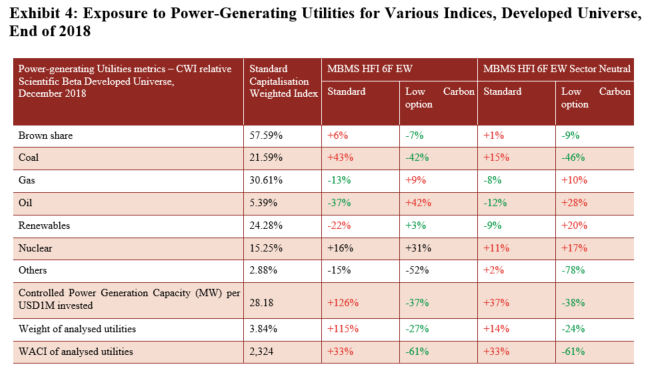

Exhibit 4 documents that the Low Carbon option reduces exposure to the transition risks associated with power generation by reducing the power generation capacity controlled and improving its WACI, notably by tilting the fuel mix away from coal.

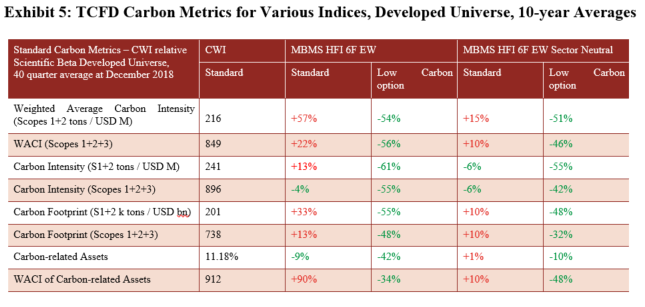

Exhibit 5 shows carbon metrics that the TCFD considers of interest for reporting. Carbon Footprint and Carbon Intensity inform on responsibility as they allocate corporate emissions to the portfolio in respect of the share of capital controlled (and then normalise owned emissions by portfolio value and owned revenues, respectively). WACI and Carbon-related Assets measure exposure to carbon-intensive companies and sectors. The exhibit documents that the Low Carbon option has historically produced indices with excellent decarbonisation assessed from both responsibility and risk-exposure angles.

Financial Risks and Performance

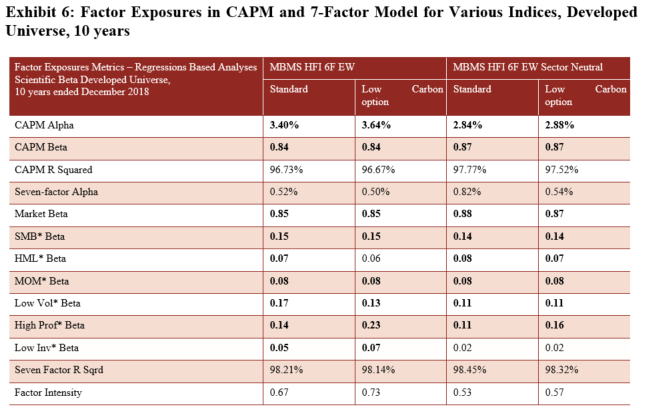

Exhibit 6 presents factor analysis of index performance with and without application of the Low Carbon option and shows that filtering does not reduce the potential for adding value with common factor tilts.

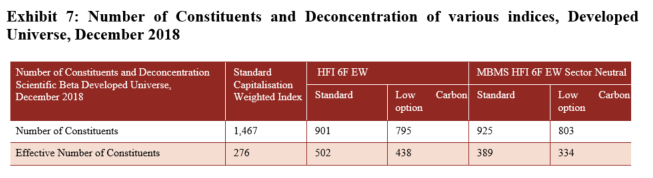

Exhibit 7 shows that despite the reduction in the number of constituents linked to exclusions, Low Carbon indices remain significantly more deconcentrated than the benchmark, leaving good potential for adding value through diversification of idiosyncratic risk.

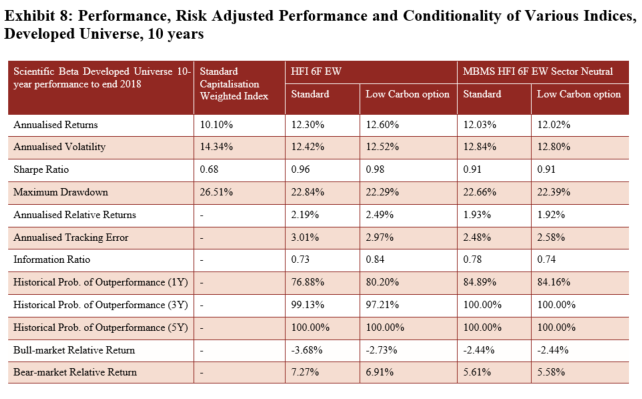

Finally, Exhibit 8 shows that the Low Carbon version of the multi-smart factor index slightly outperforms its unfiltered counterpart over ten years but that this advantage disappears if sector biases are controlled.

Conclusion

The Low Carbon fiduciary option applicable across Scientific Beta’s flagship offering allows ethical and socially responsible investors to dissociate from companies with significant coal involvement and further promote the transition to a low carbon economy by reorienting investments towards less carbon-intensive activities and companies. The application of the option produces material reductions in the coal-asset exposure of derived indices and in the indirect contribution of these indices to climate change. Since it relies on an approach that determines potential inclusion in derived indices based solely on the coal involvement of each firm and its carbon intensity relative to peers, the Low Carbon fiduciary option sends clear signals to issuers regarding the urgency of decarbonising their operations and is straightforward to explain to beneficiaries, clients and other stakeholders.

By delivering a drastic reduction of exposure both to coal assets and to the most carbon-intensive companies, the Low Carbon fiduciary option produces derived indices with higher resilience to transition risks relative not only to standard multi-factor indices but also to parent universe benchmarks. Derived indices also boast benchmark-relative reductions in respect of Weighted Average Carbon Intensity, the carbon exposure metric recommended by the Taskforce on Climate-related Financial Disclosures for reporting by asset managers and asset owners, of circa 50% over the last ten years. As such, they are also particularly relevant for investors who wish to implement multi-factor investment strategies but recognise that climate change risks may materially impact portfolio values and wish to apply ambitious mitigation of these risks as a precaution.

Over the last ten years, the multi-factor indices to which the Low Carbon fiduciary option has been applied are found to protect the sources of financial outperformance of the Scientific Beta multi smart-factor offering and typically perform in line with their unfiltered counterparts. Supporting the transition to a low-carbon economy and protecting against the risks of this transition had no meaningful impact on financial performance.