Sustainability Reporting and Material Delusions

This interview with Frédéric Ducoulombier, Founding Director of EDHEC-Risk Climate, has been originally published in the October newsletter of the Institute. To subscribe to this complimentary newsletter, please contact: [email protected].

“Accountants are not going to save the world on their own”

Frédéric Ducoulombier, Director of the EDHEC-Risk Climate Impact Institute, answers key questions about recent developments in Environmental, Social, and Governance (ESG) reporting and the concept of “double materiality.” In particular, he sheds light on the European Sustainability Reporting Standards (ESRS), adopted by the Commission in July 2023. What are their implications? What are the challenges and opportunities in the field of sustainability reporting? And can sustainability reporting contribute to real-world progress?

First and foremost, why is the adoption of the European Sustainability Reporting Standards important?

Globally, corporate reporting on sustainability matters is grossly inadequate. Despite clarifications by international accounting and auditing bodies, discussion and quantification of financially material sustainability risks and opportunities remain largely absent from statutory financial reporting. And, owing to the lack of legally binding standards pertaining to sustainability reporting, companies selectively disclose information in sustainability reports to weave self-serving narratives that too often bear little relationship to their actual impacts. Strategic disclosure is one of the many shapes taken by greenwashing.

Against this backdrop, the publication in late July 2023 of the first set of European Sustainability Reporting Standards (ESRS) by the European Commission (the Commission) is a landmark. Indeed, this delegated regulation specifying the first implementation details for the Corporate Sustainability Reporting Directive (CSRD) clarifies disclosure requirements for financially material sustainability matters and codifies the reporting of corporate impact on society and people.

The CSRD is the successor of the Non-Financial Reporting Directive (NFRD)[1] and elevates sustainability to a central matter for consideration and reporting by companies. The entities within its scope are large European companies and those with a large presence in the European Union (EU),[2] insurers and credit institutions, and all but the smallest companies listed within the bloc.[3]

While the NFRD put the EU on a path towards greater transparency of corporate performance on social and environmental issues, it required neither standardisation nor auditing of sustainability information. Users found NFRD disclosures insufficiently comparable, unreliable, and often irrelevant, while reporting entities lamented that they had to produce additional disclosure for providers of Environmental, Social and Governance (ESG) data, institutional investors, and civil society.[4]

The CSRD was meant as a response to these shortcomings as part of the European Green Deal[5] announced at the end of 2019. It imposes comprehensive and standardised sustainability reporting upon nearly 50,000 entities, more than four times the number of companies covered by the NFRD.[6] It also requires auditing of the sustainability information starting with a limited assurance engagement.[7]

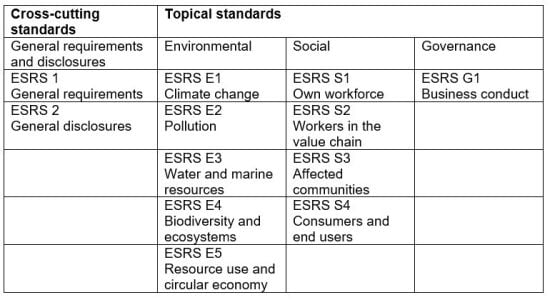

The first set of ESRS includes 12 standards that set general reporting principles. These identify “general disclosures”, which are essential information to be disclosed by all companies under the scope of the CSRD, and detail the format of disclosures and the datapoints to be disclosed across 10 “topical” ESG issues[8] when deemed material (that is when the information to be provided can reasonably expected to influence the decision-making of stakeholders in respect of the reporting company). The general requirements also require companies to produce entity-specific disclosures when they find that an impact, risk or opportunity is not covered or not covered with sufficient granularity by the standardised disclosures.

Table 1: Architecture of the First Set of European Sustainability Reporting Standards

The architecture of the ESRS disclosures follows that of the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). ESRS disclosures are thus organised along the familiar four pillars of Governance; Strategy; Risk Management (fittingly described as “Impact, risk and opportunity management”); and Metrics and Targets.[9]

It is expected that this first set of ESRS will be complemented by sector-specific standards (related to topics of particular materiality for specific industries), standards for small and medium enterprises (SMEs), and standards non-EU parent companies.

We also understand that the European Union has taken an original approach to the question of materiality, can you explain what is meant by double materiality and how it relates to international standards?

Materiality is a key principle of corporate reporting but its definition has evolved over time[10] and remains contested.

The CSRD upholds the “double materiality” principle that has become the hallmark of the original EU approach to sustainability reporting.[11] The CSRD requires in scope entities to report on both the material impacts of their activities on people and the environment (the impact perspective or outward view), and on how sustainability matters create material financial risks and opportunities for them (the financial perspective or inward view).[12] This is what is referred to as the double materiality perspective. The focus of the impact perspective in these ESRS is on the principal actual or potential adverse impacts, whether these impacts arise or may arise directly as part of the entity’s operations or indirectly via its value chain (i.e., including through its products and services or its business relationships).

To meet the criteria of double materiality, a piece of information need only be material from the financial perspective or the impact perspective, but of course it can be simultaneously material from both perspectives.

There has been a lot of spindoctoring over the last couple of years to present the work of the International Sustainability Standards Board (ISSB) as an emerging “global baseline of sustainability disclosures”, when in fact the Global Reporting Initiative (GRI) has been the framework of choice for sustainability reporting for some 25 years.[13]

The ISSB was recently established under the International Financial Reporting Standards (IFRS) Foundation and released its first two sustainability standards covering general requirements and climate-related disclosures at the end of June 2023. The definition of materiality therein is aligned with that of the IFRS, i.e., information is deemed to be material if omitting, misstating or obscuring that information could reasonably be expected to influence the decisions of primary users of general purpose financial reports (in relation to the reporting entity). In other words, we are dealing squarely with financial materiality. The ISSB standards have no legal force, but they have been promptly endorsed by the International Organisation of Securities Commissions (IOSCO) which called on its 130 member jurisdictions to align with them to promote consistent and comparable sustainability disclosures for investors.

The version of the GRI Standards applicable from 2023 defines materiality in relation to the actual or potential impact that the company’s business activities can have on the economy, the environment, and people, including human right impacts.[14] While stakeholders are not mentioned in the definition, engagement with relevant stakeholders is an essential part of materiality assessment in the GRI Standards.

Hence, the ESRS are truly unique in (having legal authority[15] and) requiring a double materiality assessment. The financial materiality assessment aims to identify information that is material[16] for primary users of general-purpose financial reports in making decisions relating to providing resources to the entity, with materiality being defined as in the ISSB Standards.[17] As for impact materiality, the ESRS have adopted the definition of the GRI Standards[18] and outlined an assessment process[19] that closely corresponds to that of the GRI Standards.

The alignment of these fundamentals permits a high degree of interoperability that reduces the risk that companies reporting in accordance with ESRS will need to produce separate reports under ISSB and GRI standards; the interoperability is actively sought in practice through dialogue between standard setters.[20]

For climate-related financial reporting in accordance with the de-facto standard (reporting against the TCFD recommendations is mandated by multiple jurisdictions and required by some thirty stock exchanges[21] worldwide), the mapping of the general and climate disclosures of ESRS to the TCFD recommended disclosures is excellent by design.[22]

It is clear how reporting on material impacts can complement financially reporting but why is reporting on financial material sustainability risks and opportunities needed in the first place?

I wish to stress that that there is no opposition between impacts and risks and opportunities (actual and potential material impacts will often be financially material to start with or may also become so with the passage of time; negatively affected communities or employees may seek redress) or with environmental and societal changes, including changes in norms[23] that can come about, inter alia, by way of activism (by norm entrepreneurs).

Of course, there are also financially material risks and opportunities that arise in the absence of material impacts. A company may face climate-change induced natural disasters or disruptions without contributing materially to climate change. Such impacts derive from the company’s dependencies on the environment and people, including the availability of so-called natural and human resources.

Now as to your question, it may be counter-intuitive for some, but the materiality of financial statements is not the same as the financial materiality of the sustainability statement...

This is because sustainability reporting requires disclosures of the potential financial impacts of all material risks and opportunities and that these may not be recognised in financial reports or not fully captured in these reports by application of basic accounting principles and financial reporting boundaries. The financial materiality of sustainability reporting extends beyond the time-horizon considered in preparing general purpose financial statements, goes beyond the assets and liabilities of the reporting entity, and embraces issues that are beyond the control of the reporting entity itself.

The ISSB standards should not be interpreted as a clarification of traditional financial reporting in respect of sustainability matters; they aim to provide additional decision-useful information to investors. Likewise the financial materiality assessment required by the ESRS should produce information that is not found in financial statements.

You expressed some concerns regarding the recent adoption of ESRS by the European Commission, notably in relation to a last-minute reduction in ambitions. Could you elaborate on what was preserved and what is gone?

Despite significant lobbying that aimed to maximise the alignment of the ESRS with ISSB (by parties defending geopolitical or industrial interests),[24] the ESRS preserved the “double materiality” approach that has been the hallmark of the original EU approach to sustainability reporting – as materiality is contested, this is an achievement.

Another hallmark of EU sustainability regulation has been its peculiar approach to planning. The regulator has indeed imposed sustainability integration and/or reporting obligations upon Financial Market Participants (FMPs) in respect of their investments[25] before requiring the corresponding disclosures of investee companies (via the CSRD). While this ‘cart-before-the-horse’ approach may have benefitted ESG data and service providers (whose influence on rule-making may have been insufficiently controlled), it has limited the reliability and comparability – and therefore the usefulness – of the data produced by FMPs, has done little to encourage the integration of sustainability issues “in the real world”, and may have contributed to greenwashing in the financial industry (as we highlighted to the European Supervisory Authorities at the beginning of the year).

The ESRS Delegated Act was thus an opportunity to ensure that, at a minimum, in-scope entities would start producing the data required by other entities under the scope of the existing EU sustainability regulation. Contrary to the intention of the CSRD however, the finalised ESRS fall short of imposing mandatory disclosure of the core sustainability indicators[26] that other parties require to comply with the extant EU sustainability regulation.[27]

The Commission also dispensed with the other core disclosures, other than general disclosures, that were regarded as key to support the bloc’s sustainability objectives.[28]

This core of mandatory disclosures had been identified by the Commission’s technical adviser – the European Financial Reporting Advisory Group (EFRAG) – after a rigorous due process of stakeholder consultations and were supported by European Supervisory Authorities as consistent and interoperable with the legislation within their remits.[29] Between the finalisation of the proposed standards by EFRAG in November 2022 and the presentation of a draft regulation for feedback in June 2023, the Commission was apparently subjected to intense lobbying and pressure to reduce the ambitions of the ESRS. It admits having held private consultations with and received written suggestions from undisclosed parties. During the final stakeholder consultation, the Commission’s proposal to water down the EFRAG proposals was opposed by the pension and investment industry, sustainable and responsible investment organisations,[30] civil society organisations, academic thinktanks, and the Commission’s own sustainability advisors.[31] However, that open consultation was carried out as a purely ceremonial requirement and the Commission maintained course.

Both for this core information and the other ESRS disclosures, the Delegated Act allows reporting entities to disclose voluntarily in respect of certain issues irrespective of their materiality, to withhold disclosure for issues they deem non-material (apart from core general disclosures), and to avail themselves of further flexibility in respect of certain mandatory disclosures. It also introduces additional phase-in provisions.[32]

Mandatory disclosures promote comprehensiveness and comparability. Subjecting most disclosures to corporate-specific materiality testing should be expected to produce piecemeal and inconsistent disclosures that undermine the intention of the CSRD to increase the availability, quality, comparability, and reliability of corporate sustainability information. We consider it particularly unwise to give each reporting entity broad discretion over the delimitation of materiality and thus disclosure in relation to issues central to the European Sustainable Finance Action Plan and Green Deal.

In this regard, we regret that the Commission missed an opportunity to provide guidance on materiality as well as clear criteria for materiality assessments. It would have been natural to reference the EU Taxonomy, which spells out science-based criteria to determine when an economic activity makes a substantial contribution to an environmental objective without causing significant harm to the environment.[33] And for those areas where a precise materiality threshold cannot be determined in reference to science, it would have been preferable to have the regulator specify the threshold for the sake of standardisation, especially in respect of the core set of indicators that preexisting sustainability regulation requires investors to use and report. Finally, precise methodological instructions on how to perform materiality assessments would have reduced the need for preparers and assurance providers to exercise judgment, thus promoting superior comparability.

And while the standards require entities to disclose the processes they apply to identify sustainability impacts, risks and opportunities and assess their materiality, they also allow entities to dispense with explaining why they consider a particular sustainability topic not to be material. In our observations to the Commission, we had suggested that materiality assessments and their conclusions be disclosed including when a topic is deemed nonmaterial. This would have mitigated the risk of strategic disclosure and allowed users of sustainability statements to understand and evaluate the basis for (disclosure or) non-disclosure. This will only be the case when a reporting entity considers climate change issues not to be material.

This question of subjectivity in relation to materiality is all the more important as assurance and supervisory practices in the emergent field of double materiality will require guidance and time to converge.

We call on reporting entities, the reporting ecosystem, and stakeholder groups to contribute to efforts aimed at standardising materiality assessments to enhance the availability and quality of data that are key to the EU sustainable finance framework and the European Green Deal.

The European Commission said it required the materiality test rather than making everything mandatory to ease reporting burdens. Is this a legitimate argument?

The number of disclosures in the final proposal by EFRAG had already been reduced by almost half relative to what was in the experts’ exposure drafts. And all information beyond the core set of disclosures was already subjected to a materiality assessment. That core set comprised the general disclosures, the climate standard, some disclosures about the company’s own workforce and the datapoints required by other parties for compliance with the existing EU sustainability regulation. Had the EFRAG proposals been adopted, most companies would still have been required to report on only a subset of the ESRS – specifically, the core set of disclosures and sustainability matters deemed material to them.

What the Commission has done is to reduce this set of unconditional disclosures to the general disclosures. The Commission represents that this will lead to a significant burden reduction and help to ensure that the standards are proportionate. The Commission also states that this will reduce compliance costs by avoiding “the costs associated with reporting information that may not be relevant”. Savings however are quite insignificant when scaled to entity level as they represent less than EUR230 million in total according to the Commission’s estimates.[34]

Relevance is in the eye of the beholder here – financial market participants are still required to comply with preexisting sustainability regulations; the various texts applicable do not offer any disclosure waiver for lack of materiality and will need to be updated or clarified.

As for the costs, one may also observe that mandatory disclosures reduce the overall efforts and expenses required for “robust” materiality assessments and that when this complex and time-consuming assessments are performed in earnest, the additional costs of complying with the disclosure requirements may be limited.

All that said, large companies do face a significant compliance burden, including in relation to sustainability matters, which may divert the efforts of sustainability specialists from arguably more impactful sustainability initiatives. This would be to the dismay of sustainability professionals with a sense of purpose aligned with the necessities of averting civilisational collapse, but not necessarily to that of their organisations.[35]

Now, when discussing the costs of this new legislation, I would stress that it is extremely disingenuous to represent that SMEs will be put at risk by the administrative cost of complying with the CSRD. Indeed, less than 0.2% of the 25+ million companies in the EU fall within the scope of the directive. The only SMEs that will need to report according to the CSRD are listed companies and they will benefit from a proportionate regime as per the directive. Many SMEs however will be affected indirectly by heightened value-chain scrutiny and due diligence by in-scope entities – this will require providing information to business relationships but may be taken up as an opportunity to compete on non-price elements.

Why do you think corporate lobbies oppose sustainability regulation?

I ascribe the phenomenon to two things: firstly, genuine concern about the extra preparation and assurance costs involved; secondly, the weight of established economic interests that exerts a gravitational pull towards business as usual and its preservation.

One obvious issue with preparation and disclosure costs is that they materialise with certainty in the short-medium term and are borne by reporting entities whereas the benefits from these disclosures are more diffuse, longer term and enjoyed by all. It is also fair to underline that in its earlier sustainability regulation work, the European Commission would have been well advised to keep the ESG indicator inflation at bay and better prioritise issues.

As for the gravitational pull, I would note that the business interests that have most to lose from the transition are particularly massive and show sectoral and country concentration. That said, the behemoths of the transitioned economy are unborn or undecided – at this stage, there is a message about possible futures and relatively minor emerging economic interests. If business as usual is represented as Jupiter, the representative of the future economy is Mercury – while we celebrate Light-footed Mercury as a symbol of agile, nimble, adaptable companies, the planet with the fastest revolution is also that with the lowest mass and hence gravitational pull.

And one must also acknowledge that powerful interests fuelling the climate crisis have been actively delaying substantive transition action, including by political and regulatory capture. Furthermore, a number of industries have been waging war against environmental science and disinforming the public for decades. The role of the oil and gas industry in disseminating misinformation about climate change and climate science (while being a primary enabler and beneficiary of the former and on top of the latter) is now a subject of academic research[36] and the Intergovernmental Panel on Climate Change (IPCC) itself acknowledges that successful influence campaigns by vested interests have created misperceptions and polarisations that are delaying urgent climate action.[37] The recent offensive to sweep ESG investing into the US culture war – by misrepresenting it as “woke investing”[38] violating asset manager fiduciary duties – was seeded and fuelled by the same fossil-fuel interests. While this ongoing campaign may be coloured by dog whistles and economic freedom rhetoric in an attempt to both muddy the waters and rally the support of bigots and a wide range of and socially and economically conservative groups, it is really aimed at delaying climate change action.[39]

This latest offensive came in the wake of the 2021 announcements by the US Securities and Exchange Commission (SEC) that it would review climate-related disclosures to ensure that investors have access to material information for decision making[40] and, following enthusiastic investor response, that it would develop a proposal to mandate such disclosures from companies[41] which may include whole value chain (Scope 3) greenhouse gas emissions.[42]

Both rational analysis and the prominent involvement of oil and gas public relations suggest that these interest groups oppose disclosure regulation because it would shed unwanted light on their massive negative impact on sustainability. This would challenge their sustainability narratives, undermine their ability to influence lawmaking and public perceptions and thus impair their social licenses to operate, increase their exposure to litigation risk, and possibly accelerate the stranding of some of their assets.

Are accountants going to save the world?

The President of the World Business Council for Sustainable Development promised as much at the Rio Conference back in 2012. It does appear less outlandish today than it did back then given the emergence of mandatory sustainability reporting with a double materiality lens.

There are classic words by early twentieth century Lawyer and US Supreme Court Justice Louis Brandeis[43] that are often cited to advocate in favour of a disclosure-based system in opposition to (more forceful) government intervention. The quote usually goes as “Sunlight is the best of disinfectants,” but it is worthwhile going back to the 1913 Harper’s Weekly to put it in context. It goes: “Publicity is justly commended as a remedy for social and industrial diseases. Sunlight is said to be the best of disinfectants; electric light the most efficient policeman.”[44]

Mandatory sustainability disclosures will force in-scope entities to publicly acknowledge their environmental and social impacts, risks, and opportunities and it is hoped that this will induce managers to incorporate these issues into decision making in a manner that will reduce negative impacts and risks and increase positive impacts and opportunities, possibly with the gentle or not-so-gentle prodding of shareholders and other stakeholders.

In this respect, we should underline that the materiality assessment that is at the heart of the ESRS is meant to help reporting entities identify their sustainability risks, opportunities and impacts through dialogue with stakeholders and experts and that this might promote genuine integration of sustainability considerations into strategic management. This is but an afterthought in the CSRD, but this expensive and expansive process might prove much more transformative than the act of disclosing sustainability information. A robust materiality assessment may be costly, but it could prevent a larger number of reporting entities from adopting a tick-box approach to sustainability disclosure. But of course, dialogue with stakeholders need not produce significant integration of their views and needs. And as we underlined in our public feedback to the Commission, the extent of discretion awarded by the ESRS with respect to the appreciation of what should be reported fails to send a clear signal to in-scope entities about the urgency and criticality of integrating sustainability risks and impact into operations. Even if a generalisation of the materiality assessment had been the proper thing to do, minimum criteria and thresholds could have been identified to ensure the proper working of the transmission belt of the bloc’s sustainability ambitions and priorities to corporate reporting.

Of course, disclosures in themselves do not guarantee positive outcomes. Some 30 years ago, sustainability consultant John Elkington coined the term triple bottom line for “people, planet, and profit”. Five years ago, he publicly recalled his concept admitting that, despite significant uptake, triple bottom line accounting practices had failed to counteract corporations’ narrow profit orientation.[45]

Over the 110 years since Brandeis gave a metaphorical twist to what was previously a prophylactic observation, disclosure has increasingly been advocated as light-touch regulation.[46] Seen in this light, disclosure could be not only ineffective but actually counter-productive in providing an excuse for lack of substantive action by reporting entities and regulators alike.[47] A belief that sustainability issues could be cured by capital and consumer markets, if only the proper information was made available, is but market fundamentalism and is extremely dangerous. Expecting that better sustainability disclosures will radically change the ability of civil society organisations to mobilise citizens and change societal norms also betrays dramatic lack of political leadership. The poly-environmental crisis we are facing is a proof of market failure linked to externalities – documenting these externalities and the risk that they become partially internalised can only go so far. What is needed is legislation to require that harm caused by economic activities be brought back to safe levels and to provide companies with an explicit and convincing schedule for the internalisation of externalities. The global, long-term, and complex nature of the environmental crisis makes it a difficult object to handle with the traditional political apparatus and several economic and social developments have made building political consensus more challenging. (Think of rising inequalities within countries and persisting inequalities across countries, reduced trust in institutions and the collective, increased polarisation and identity politics, dramatic reshaping of the media, etc.) The investments required to adapt to the environmental changes that we have already triggered and those needed to bring back human activity within planetary boundaries will require a major reorientation of economic activity that will dramatically impact lives and livelihoods and it is urgent they be discussed. A number of bold transition and adaptation promises or plans have been made but as “the window of opportunity to secure a liveable and sustainable future for all” is “rapidly closing” (to borrow from the latest IPCC synthesis report), it does not appear we are having the right conversations to move resolutely towards implementation. Instead, the interest groups that have most to lose from a challenge to the status quo are using their financial resources and privileges to influence the public debate, capture governments, and derail or delay substantive action.

And the continent that has often been considered a leader in sustainability regulation now appears to be a key battleground for the counteroffensive. During the Summer of 2023, the European Commission materially reduced the ambitions of a disclosure regulation, a watered-down version of a key element of the bloc’s biodiversity strategy – the Nature restoration law – barely survived a vote at the European parliament, and multiple political leaders called for a pause in sustainability regulation.[48]

Europe is approaching a crisis moment as the rubber of the Green Deal needs to meet the road. It will have to decide whether it is ready to confront the price of its sustainability ambitions. Accountants are not going to save the world on their own.

Footnotes

[1] The NFRD was adopted in 2014 as an update to the Accounting Directive and applied from the financial year 2017.

[2] For an entity to be considered large, it needs to either be based in the EU and exceed two of the three economic footprint thresholds on consecutive balance sheet dates (annual turnover of €40 million, balance sheet assets of €20 million, workforce of 250 employees on average throughout the year), or have consolidated turnover of more than €150 million in net turnover in the EU and own a large undertaking in the EU or a subsidiary with capital securities listed within the EU or a significant branch with turnover in excess of €40 million.

[3] Micro-undertakings are out of scope; under Article 3(1) of Directive 2013/34/EU, these are undertakings that do not exceed more than one of the following three thresholds: balance sheet (€350,000), net turnover (€700,000), employees (10).

[4] For consultation results, refer to: Summary Report of the Public Consultation on the Review of the Non-Financial Reporting Directive 20 February 2020 - 11 June 2020, Ares (2020)3997889, European Commission. For a summary, consult: Nora Hahnkamper-Vandenbulcke, Non-financial Reporting Directive, Briefing–Implementation Appraisal, European Parliamentary Research Service, January 2021.

[5] The European Green Deal is a package of policy initiatives meant to set the EU on the path to a green transition and net-zero by 2050. It includes initiatives covering the climate, the environment, energy, transport, industry, agriculture, and sustainable finance. The European climate law has made the net-zero objective, and the intermediate goal of reducing greenhouse gas emissions by 55% by 2030 (relative to 1990), binding for the bloc. The Fit for 55 legislative package is designed to achieve the latter goal and includes a wide range of measures aimed at reducing greenhouse gas emissions and increasing removal. These include increased ambition for the EU emissions trading system (EU ETS); upward revision of Member states’ emissions reduction targets; the introduction of a carbon border adjustment mechanism (CBAM); upward revision of the ambitions of the renewable energy directive; the introduction of a net removal target for land use; land use change and forestry (LULUCF); tougher emissions standards for light vehicles and promotion of decarbonised fuels in shipping and aviation; the introduction of methane emissions tracking and reduction in the energy sector; an upgrade of the energy efficiency and energy performance of buildings directives; and better alignment of the energy taxation directive with the bloc’s climate ambitions.

[6] Entities already subjected to the NFRD will switch with statements pertaining to financial years beginning on or after 1 January 2024; other large entities will have to report for financial years beginning on or after 1 January 2025.

[7] It starts with an obligation on auditor to express an opinion about the compliance of the sustainability reporting with legal requirements based on a limited assurance engagement. The opinion should cover compliance with sustainability reporting standards and the process carried out by the undertaking to identify the information required by regulation. A shift to more demanding reasonable assurance engagements (which require extensive work including consideration of internal controls and substantive testing) is expected in time; the Commission plans to adopt assurance standards for reasonable assurance of sustainability reporting no later than 1 October 2028 if this higher level of assurance is found to be feasible for auditors and undertakings.

[8] The five environmental standards cover: (i) Climate; (ii) Pollution; (iii) Water and marine resources; (iv) Biodiversity and ecosystems; and (v) Resource use and circular economy. The four social standards cover: (i) Own workforce; (ii) Workers in the value chain; (iii) Affected communities; and (iv) Consumers and end users. The sole governance standard covers: (i) Business conduct.

[9] For an introduction to the TCFD Recommendations in force, turn to Frédéric Ducoulombier (2021), TCFD Recommendations and 2021 Guidance, Scientific Beta white paper (November), available at https://www.scientificbeta.com/factor/download/file/tcfd-recommendations-and-2021-guidance.

[10]See for example Carla Edgley (2014), A genealogy of accounting materiality, Critical Perspectives on Accounting, Volume 25 Issue 3, pp.255-271.

[11] The NFRD requires entities to disclose information on sustainability matters to the extent that such information is necessary for an understanding of the company’s development, performance, position and impact. In its 2017 Guidelines on non-financial reporting (2017/C 215/01), the European Commission asserted that this reference to impact introduced a new element that must be taken into account when assessing the materiality of information. In its 2019 Guidelines on reporting climate-related information (C(2019) 4490 final), it introduced the term “double materiality perspective”.

[12] The CSRD modified Article 19a of the Accounting Directive to require in-scope entities to “include in the management report information necessary to understand the undertaking’s impacts on sustainability matters, and information necessary to understand how sustainability matters affect the undertaking’s development, performance and position”.

[13] It is the sustainability reporting framework most used by companies in the scope of the NFRD as well as by the largest companies worldwide. The 2022 KPMG Survey of Sustainability Reporting found that it was adopted by 73% of the largest 250 global companies and by 68% of a wider sample of 5,800 businesses.

[14] Prior to the 2021 revision, the definition of materiality in GRI Standards combined the significance of the reporting entity’s economic, environmental, and social impacts and their potential influence on stakeholder assessments and decisions. The 2021 update prioritises significance/severity over influence and highlights human rights as a vital area for attention as they affect basic human dignity and equality and are also the most fundamental level of protection afforded to people in intergovernmental instruments. Influence is no longer a standalone factor to determines materiality.

[15] The CSRD entered into force on 5 January 2023; as a directive however, it does not directly create obligations for in-scope entities and must first be transposed into EU Member State legislation. The deadline for transposition of the CSRD is 16 June 2024.

[16] The ESRS provide that: “A sustainability matter is material from a financial perspective if it triggers or may trigger material financial effects on the undertaking. This is the case when it generates or may generate risks or opportunities that have a material influence (or are likely to have a material influence) on the undertaking’s cash flows, development, performance, position, cost of capital or access to finance in the short-, medium- and long-term time horizons. Risks and opportunities may derive from past events or future events and may have effects in relation to: (a) assets and liabilities already recognised in financial reporting or that may be recognised as a result of future events; or (b) factors of value creation that do not meet the financial accounting definition of assets and liabilities and/or the related recognition criteria but contribute to the generation of cash flows and more generally to the development of the undertaking.”

[17] The first IFRS sustainability standard requires the disclosure of all sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, as well as its access to finance or cost of capital over the short, medium or long term.

[18] The ESRS provide: “A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- and long-term time horizons. Impacts include those caused or contributed to by the undertaking and those which are directly linked to the undertaking’s own operations, products, or services through its business relationships. Business relationships include the undertaking’s upstream and downstream value chain and are not limited to direct contractual relationships.”

[19] Three steps are considered: (i) understanding the context of the organisation in relation to its impacts; (ii) identification of actual and potential impacts, including through engaging with stakeholders and experts; and (iii) assessment of the materiality of said impacts and determination of the material matters. This closely corresponds to the first three steps described in GRI 3: Material Topics 2021.

[20] Upon the adoption of the ESRS, the European Commission, its technical adviser, i.e., EFRAG, and ISSB confirmed a high degree of climate-disclosure alignment. On 4 September 2023, EFRAG and GRI confirmed they had achieved a high level of interoperability between their respective standards in relation to impact reporting.

[21] 31 at end September 2023 according to the TCFD database of the Sustainable Stock Exchanges Initiative: https://sseinitiative.org/tcfd-database/

[22] A detailed mapping is provided by EFRAG in Appendix (IV) to the draft ESRS standards of November 2022.

[23] Norms can be defined as generally accepted standards or rules that guide behaviour and shape social expectations.

[24] If not dispense with the ESRS altogether, as publicly suggested by some forty large German companies in March 2022 in a letter to the federal finance minister. The letter was coordinated by Deutsches Aktieninstitut, the interest group of listed companies and other important capital market actors. It was titled “Necessary endorsement process for the transfer of the ISSB standards into EU law” and includes this passage: “Within the framework of the CSRD, the EU has commissioned the European Financial Reporting Advisory Group (EFRAG) to develop its own very comprehensive European standards for sustainability reporting. If these are not in line with the international requirements of the ISSB, internationally active companies will have to report according to two different, in the worst-case contradictory sustainability standards. This must be prevented at all costs in order to provide consistent information to the addressees of the reporting and to limit the already very high reporting burden on companies. As supporters of the German ISSB headquarters, we are therefore addressing you today with an urgent request to advocate for an endorsement process with regard to the ISSB standards within the framework of the trilogue negotiations on the CSRD in April. The ISSB standards, as well as the requirements of the IFRS, would then be transferred into European law in a formalised process. This would not preclude the EU Commission or individual member states from issuing additional standards that go beyond this.”

[25] Notably via the Benchmark Regulation (BMR), the Sustainable Finance Disclosure Regulation (SFDR), and the Capital Requirements Regulation (CRR).

[26] The ESRS identify these indicators at Appendix B of ESRS 2 (found in Annex 1 of the Delegated Regulation). An entity that does not report the information required by one of these indicators needs to explicitly state that the omission is based on its assessment that the information is not material.

[27] Article 1(8) of the CSRD (adding Article 29(b)5 to the Accounting Directive) provided that the ESRS delegated act should at least include the information that FMPs need to comply with the SFDR; and the advice given by EFRAG to the European Commission in November 2022 had embedded (for mandatory reporting) the indicators and/or datapoints required for compliance with the SFDR, BMR, and CRR, among other relevant texts.

[28] In its Communication of 8 March 2018, the European Commission set out measures to achieve the following objectives: “reorient capital flows towards sustainable investment in order to achieve sustainable and inclusive growth, manage financial risks stemming from climate change, resource depletion, environmental degradation and social issues, and foster transparency and long-termism in financial and economic activity.” The second recital of the CSRD provides that disclosure of “relevant, comparable and reliable sustainability information is a prerequisite for meeting those objectives.”

[29] See inter alia: Opinion of the European Securities and Markets Authority of 26 January 2023 on the technical advice by the European Financial Reporting Advisory Group on European Sustainability Reporting Standards (Set 1), ESMA.

[30] Some 90 institutional investors and financial market participants signed a statement under the joint banners of the Institutional Investors Group on Climate Change (IIGCC), Eurosif (the leading European association promoting sustainable finance), the UN-supported Principles for Responsible Investment (PRI), the European Fund and Asset Management Association (EFAMA) and the United Nations Environment Programme Finance Initiative (UNEP FI).

[31] See: Platform Response to the Call for feedback on draft ESRS delegated act, EU Platform on Sustainable Finance, 7 July 2023.

[32] Mainly for companies with fewer than 750 employees and mainly for disclosures viewed as more challenging, e.g., biodiversity and various social issues. For a synoptic view, refer to the European Commission’s presentation of the ESRS to the EFRAG Sustainability Reporting Board (SRB) of 14 June 2023.

[33] The EU Taxonomy is established by Regulation (EU) 2020/852 on the establishment of a framework to facilitate sustainable investment. The Regulation provides a common framework for classifying economic activities based on their environmental sustainability. To be considered “environmentally sustainable”, the activity not only needs to “contribute substantially” to one (or more) of six environmental objectives, but it must also do so without causing “significant harm” to any of those objectives while also respecting “minimum safeguards”. These environmental objectives are climate change mitigation; climate change adaptation; sustainable use and protection of water and marine resources; transition to a circular economy, waste prevention and recycling; pollution prevention and control; and protection of healthy ecosystems. Substantial contributions and significant harm are addressed by technical screening criteria whereas minimum safeguards pertain to procedures implemented by companies to ensure the alignment of their activities with the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises (OECD Guidelines) and the UN Guiding Principles on Business and Human Rights (UNGP).

[34] The Commission estimates that “the proposed modifications with regard to materiality, combined with making certain disclosures voluntary, will reduce costs by EUR 230 million annually compared to EFRAG’s proposal” (C(2023) 5303 final).

[35] While this generalisation may be unfair to some organisations, I trust it is aligned with the publicised concerns of sustainability professionals – see in particular: Enough – A review of corporate sustainability, in a world running out of time, The Antithesis Project, Ernst and Young, 2022.

[36] The work of Geoffrey Supran, Naomi Oreskes, and Benjamin Franta is particularly relevant here. By Supran and Oreskes, see: Assessing ExxonMobil’s climate change communications (1977–2014), Environmental Research Letters, Volume 12, Number 8, 2017 (and its update in Environmental Research Letters, Volume 15, Number 11, 2020) and the more recent Rhetoric and frame analysis of ExxonMobil’s climate change communications, One Earth, Volume 4, Issue 5, 2021, pp.696-719. By Franta refer to: Early Oil Industry Disinformation on Global Warming, Environmental Politics, Volume 30, Number 4, 2021, pp.663–668 and Weaponizing economics: Big Oil, economic consultants, and climate policy delay, Environmental Politics, 2022, Volume 31, Number 4, pp.555-575.

[37] In the Chapter dedicated to North America of the second working group 2022 contribution to the IPCC Sixth Assessment Report, the authors highlight the role of vested interests in delaying climate action: “Despite scientific certainty of the anthropogenic influence on climate change, misinformation and politicisation of climate-change science has created polarisation in public and policy domains in North America, particularly in the USA, limiting climate action (high confidence). Vested interests have generated rhetoric and misinformation that undermines climate science and disregards risk and urgency (medium confidence). Resultant public misperception of climate risks and polarised public support for climate actions is delaying urgent adaptation planning and implementation (high confidence).”

[38] The adjective woke has its roots in African-American vernacular English and initially referred to being aware to racial prejudice and discrimination. It is now used to refer to broader awareness of social inequalities and discriminations. In the expression “woke investing”, the adjective is used pejoratively to reduce the integration of environmental, social, and governance issues into investment management to the adoption of, or the kowtowing to, a leftist agenda. In the words of former US vice president Mike Pence: “ESG empowers an unelected cabal of bureaucrats, regulators and activist investors to rate companies based on their adherence to left-wing values.” (Republicans Can Stop ESG Political Bias – The progressive left is using it to advance goals it could never hope to achieve at the ballot box, Op-Ed, Wall Street Journal, 26 May 2022).

[39] Refer inter alia, to: How Republicans Are ‘Weaponizing’ Public Office Against Climate Action, David Gelles, New York Times, 5 August 2022 and The curious origins of the anti-ESG movement, Emily Atkin, Heated, 14 October 2022.

[40] Statement on the Review of Climate-Related Disclosure, Allison Herren Lee, US Securities and Exchange Commission, 24 February 2021.

[41] Prepared Remarks Before the Principles for Responsible Investment “Climate and Global Financial Markets” Webinar, Gary Gensler, US Securities and Exchange Commission, 28 July 2021.

[42] The indirect emissions of a company are emissions that can be traced to its activities but occur at sources that are not owned or controlled by the company, i.e., from upstream and downstream activities in its value chain, including at the product-use and product end-of-life stages. In the Greenhouse Gas (GHG) Protocol Corporate Standard, the de-facto international standard for corporate GHG emissions inventory, indirect emissions from purchased energy (in the form of electricity, steam, heating or cooling) consumed in equipment or operations owned or controlled by the entity are termed Scope 2 and other indirect emissions in the entity’s value chain are termed Scope 3 (Scope 1 are for direct emissions). Crucially for oil and gas companies, Scope 3 emissions include the emissions generated by the use of the products. See Frédéric Ducoulombier (2021), Understanding the Importance of Scope 3 Emissions and the Implications of Data Limitations, The Journal of Impact and ESG Investing, Volume 1, Issue 4, pp. 63-71.

[43] The son of European immigrants, Louis Brandeis (1856-1941) obtained his law degree (1877) from Harvard with the highest grades ever achieved up to then. His success as a barrister allowed him to take on progressive cases pro-bono and establish him as “the people’s attorney”. His work influenced the passage in 1914 of the Clayton Anti-Trust Act and the Federal Trade Commission Act. He was appointed as the first Jewish Justice to the Supreme Court of the United States in 1916 and served until 1939; he was noted for his devotion to freedom of speech.

[44] Brandeis was advocating for disclosure of investment banker fess in relation to offerings of securities to help investors make decisions and reduce the power of the small group of large and interrelated financial institutions that held significant control over the country’s banking and financial markets (and against which antitrust action was also required).

[45] John Elkington (2018), 25 Years Ago I Coined the Phrase “Triple Bottom Line.” Here’s Why It’s Time to Rethink It, Harvard Business Review.

[46] On this, refer, inter alia, to Paula Dalley (2007), The Use and Misuse of Disclosure as a Regulatory System, Florida State University Law Review, Volume 34 Issue 4, pp.1089-1131 and David Pozen (2018), Transparency’s Ideological Drift, Yale Law Journal, Volume 128, pp100-165.

[47] See inter alia, Jena Martin (2017), Hiding in the Light: The Misuse of Disclosure to Advance the Business and Human Rights Agenda, WVU College of Law Research Paper No. 2019-004.

[48] Meanwhile in the UK, an embattled government announced new development of oil and gas fields and rolled back decarbonisation policies, all in the name of a pragmatic approach to net-zero that protects the economy and hard-pressed British families. The offensive against net-zero had been initiated from the fringes 18 months earlier by the climate-change denialist former leader of the Brexit party but had not managed to significantly erode public support for net-zero policies.