Using Taxonomies to Qualify the Sustainability of Infrastructure Investments

By Nishtha Manocha, Senior Research Engineer, EDHEC Infra & Private Assets Research Institute and Rob Arnold, Sustainability Research Director, EDHEC-Risk Climate Impact Institute

- The EU Taxonomy is the first global effort to address environmental sustainability and to provide a robust framework for classifying economic activities based on their environmental impact.

- In this study, we explore the practical challenges of using the Taxonomy to assess the sustainability of the infrastructure asset class.

- We conclude that while it marks a significant step in identifying sustainable economic activities, it does not provide comprehensive insights for the infrastructure asset class.

- We recognize the need for deeper insights into asset-level actions and strategies that can bridge the gap between eligibility and alignment with the EU Taxonomy’s sustainability criteria.

INTRODUCTION

This study explores the practical challenges of using the EU Taxonomy for Sustainable Activities to assess the sustainability of the infrastructure asset class. It concludes that, while the EU Taxonomy marks a significant step in identifying sustainable economic activities, it does not provide comprehensive insights for the infrastructure asset class. By mapping the EU Taxonomy to the infrastructure asset class using TICCS®, we address how green taxonomies can be applied to infrastructure sustainability assessments. We also propose key improvements to enhance the applicability of such green taxonomies in identifying and promoting the transition to a low carbon economy.

We also use the suggested mapping as a framework to assess the sustainability of the European infrastructure asset class under the EU Taxonomy. We find that USD1.5 trillion of the European infrastructure asset class (in the European Economic Area and UK) by size is likely to qualify as sustainable under the EU Taxonomy, while about USD 20 billion of assets by size is likely to have no sustainable characteristics and could be stranded in the transition to a low-carbon economy. Additionally, more than USD215 billion of infrastructure is not aligned with the Taxonomy’s current description of sustainability1.

THE ROLE OF SUSTAINABLE TAXONOMIES

The EU Taxonomy is the first global effort to address environmental sustainability and to provide a robust framework for classifying economic activities based on their environmental impact. The primary objective of the EU Taxonomy is to assist investors in discerning sustainable investment opportunities while preventing the misrepresentation of sustainability. Furthermore, the EU Taxonomy seeks to streamline investments aimed at transitioning towards a sustainable, low-carbon economy. Consequently, it holds significant sway over the perception and strategic approach to assets within the European Union, including infrastructure assets and financial products based on them.

Classifying an infrastructure asset as sustainable is likely to confer several advantages on it. Sustainable investments qualify for public sector financial incentives, such as cash grants, soft loans, and tax incentives, as well as increased access to private sector loans that may have more favorable terms than the market standard. A sustainable classification may also signify that the asset is aligned with long-term climate policy objectives that enable the transition to a low-carbon economy, thus making it attractive to long-term investors during the transition to a low-carbon economy.

Assets that fail to qualify as sustainable in the EU Taxonomy will be ineligible for participation in EU green finance programs. Ineligibility may arise from underlying technology or geographic location, an inability to shift away from greenhouse gas-emitting processes or difficulties in complying with regulatory requirements, hindering the collective transition to a low-carbon economy.

A FRAMEWORK FOR USING THE EU TAXONOMY TO IDENTIFY SUSTAINABLE INFRASTRUCTURE INVESTMENTS

The EU Taxonomy is a classification system established by the EU to identify environmentally sustainable economic activities, supporting the region’s transition to a greener and more sustainable economy. This framework presents a list of sustainable economic activities across various sectors, including infrastructure-related activities such as the generation of energy through bioenergy, geothermal sources, hydropower, and more.

Investors face a significant challenge when evaluating the eligibility and alignment of their investments with the EU Taxonomy, particularly at the individual company level. This is because the EU Taxonomy is structured as a list of activities and currently there is no framework that identifies the activities of an infrastructure company and subsequently maps it to those of the EU Taxonomy. Further, infrastructure companies have complex and diversified business operations which may engage in a mix of sustainable and unsustainable activities. For example, mapping the activities of a company in the transport or energy sector to the EU Taxonomy is a complex and challenging task. These sectors encompass a wide array of operations, from traditional fossil fuel-based activities to renewable energy generation, electric mobility, and sustainable transportation. The sheer diversity of activities within these sectors makes it difficult to isolate and categorize them accurately. Moreover, many companies in these sectors have interconnected processes that further complicate the classification. For instance, an energy company may simultaneously operate conventional power plants and generate electricity from renewable sources.

This study addresses one of the most significant problems in this context: mapping the infrastructure asset class, classified by TICCS®, to the activities of the EU Taxonomy.

Currently, there are numerous large asset owners and asset managers using TICCS® for strategic asset allocation, portfolio construction and performance attribution. The mapping of TICCS® to the EU Taxonomy outlined in this paper serves as a valuable resource for these infrastructure investors, providing them with a systematic approach to understanding the sustainability and associated investment risks within their infrastructure portfolio. Using the TICCS® classification as a starting point, infrastructure investors can identify potential EU Taxonomy-eligible investments, positioning themselves a step ahead in meeting broader EU Taxonomy-aligned reporting requirements.

Taxonomy eligibility is an assessment of whether an economic activity has a set of corresponding criteria in the Taxonomy to be assessed against – in other words, whether the activity is in the scope of the Taxonomy to begin with. To be considered aligned, an economic activity must meet specific technical screening criteria showing that it contributes to at least one of the Taxonomy’s six objectives and also “Do No Significant Harm” (DNSH) to any other objective; and meets the minimum safeguards. This study focuses on assessing only the eligibility of infrastructure subclasses to the EU Taxonomy.

METHODOLOGY: MAPPING TICCS® TO THE EU TAXONOMY

The economic activities of the EU taxonomy are themselves derived using NACE as their basis. The European Commission maps the EU Taxonomy activities against the NACE classification system, and for each sustainable activity provides the corresponding NACE codes.

The first step in this exercise is to identify the primary activity of each infrastructure asset subclass and map it to the NACE classification system. This mapping focuses on the main activity rather than all possible activities of any given asset subclass. Considering the main activity instead of all sub-activities ensures that the sustainability assessment is centered around the primary function of the asset.

Using the NACE codes associated with the main activity of an asset subclass as a bridge, we determine whether a TICCS® asset subclass was consistent with activities classified as sustainable within the EU Taxonomy, specifically focusing on the objectives of climate change mitigation and climate change adaptation. Through this process, we facilitated the mapping of TICCS® asset subclasses to the specific activities outlined in the EU Taxonomy, enabling a clear understanding of the sustainability eligibility of these subclasses.

The EU Taxonomy is a list of sustainable activities, but it is not a list of unsustainable ones i.e. not being in the list of the activities identified by the EU Taxonomy does not mean that these excluded activities and associated asset classes are unsustainable. The asset classes that are not eligible for the EU Taxonomy thus cover a range of assets from those that are unsustainable such as fossil fuel power plants, to those that are inherently green such as parks.

To get a clearer picture of the (in)eligibility of the infrastructure asset class with the EU taxonomy, an additional step of discretionary categorization was carried out in this study, wherein we re-classified the ineligible asset classes into:

• Low-Carbon Assets: These assets have minimal adverse sustainability impacts but are not explicitly classified as sustainable by the EU Taxonomy. Examples include public parks and gardens. These assets are re-classified as eligible.

• Supporting Assets: These assets support and facilitate sustainable activities but do not primarily align with EU Taxonomy criteria. Examples include infrastructure for natural gas distribution. These assets are classified as ineligible.

• Potentially Stranded Assets: Assets like coal and oil are at risk of devaluation due to evolving climate policies and market changes. Gas is considered eligible for transition activities. These assets are classified as ineligible.

• Ambiguous Assets: Assets with activities that might be sustainable but do not directly align with EU Taxonomy, such as social infrastructure implementing renewable energy systems. These assets are classified as ineligible.

The final mapping that categorizes each TICCS® asset subclass under the taxonomy is presented in the study.

CASE STUDY: HOW SUSTAINABLE IS THE EUROPEAN INFRASTRUCTURE ASSET CLASS?

Using the mapping presented above, this study classifies about 5,300 companies of the EDHECinfra European universe (European Economic Area and the UK) as eligible or not under the activities listed as sustainable by the EU Taxonomy.

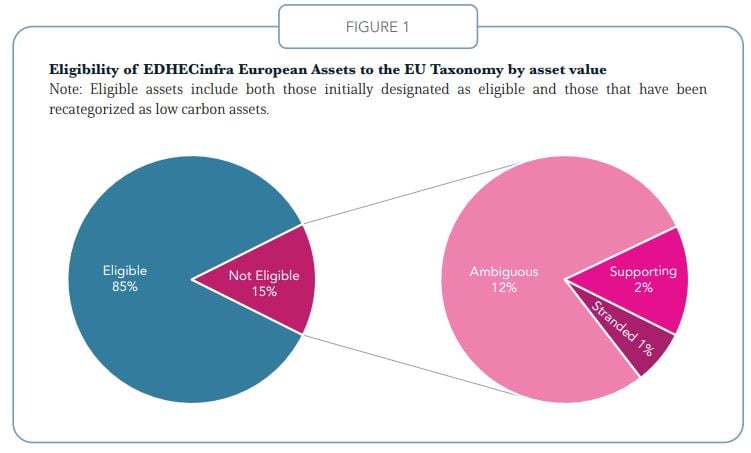

The 15% of companies that do not qualify as sustainable in this study constitute approximately USD275 billion worth of infrastructure investments in Europe. Among these, about USD20 billion of assets by size have no sustainable characteristics and would likely be stranded in the transition to a low-carbon economy. More than USD215 billion of infrastructure is not aligned with the EU Taxonomy’s definition of sustainability as is. While these assets are not explicitly classified as sustainable and are categorized as unaligned to the EU taxonomy, they could potentially be decarbonized with technological interventions and in the future could meet the requirements of the EU Taxonomy. The remaining USD40 billion assets do not explicitly align with the EU Taxonomy’s definition of sustainability but have activities that support other eligible activities. This distribution is presented in Figure 1.

Notably, the power sector stands out as a substantial contributor to this high level of compliance. This phenomenon can be largely attributed to the substantial investments made in renewable energy assets across Europe driven by various incentives and regulations, such as the EU’s Renewable Energy Directive.

In the development of the EU Taxonomy, there was considerable debate on the inclusion of nuclear and gas (classified as non-renewable power infrastructure in TICCS®) activities, reflecting the intricate task of balancing energy security and sustainability in energy mixes within EU member states. Key concerns centered on the sustainability of nuclear and gas, due to associated greenhouse gas emissions, and the management of radioactive waste. Despite objections from various stakeholders, including environmental groups and EU Parliament members, gas and nuclear were eventually added to the taxonomy as transition activities, acknowledging the absence of readily available low-carbon alternatives.

This study finds that excluding gas and nuclear assets (gas and nuclear power plants and gas pipelines) led to a notable decline in eligible assets, from 85% to 80%, with approximately USD80 billion worth of assets becoming ineligible. The share of stranded assets increases significantly, from USD20 billion to USD100 billion. This underscores the taxonomy’s sensitivity to technology inclusion/exclusion and emphasizes the crucial role of regulators in shaping sustainable infrastructure practices. This study, by delineating the activities of each infrastructure industry subclass and identifying their overlap with the EU Taxonomy, contributes to the initial step of determining the eligibility of an investment to the EU Taxonomy. This step is crucial for infrastructure investors seeking to incorporate sustainability considerations into their portfolios, providing a foundation for further evaluation and decision-making.

THE WAY FORWARD

The categorization of an asset class as eligible to the EU Taxonomy, as demonstrated in this study, does not make it automatically aligned with the taxonomy. The qualification merely signifies eligibility for further scrutiny against the “Substantial Contribution” and “Do No Significant Harm” criteria outlined by the EU Taxonomy.

While the study contributes to the initial step of determining eligibility by delineating the activities of each infrastructure industry subclass and identifying their overlap with the EU Taxonomy, it does not offer additional insights on how aligned eligible assets are or how can ineligible assets improve processes to improve their sustainability performance in the future. This result leaves investors without enough information on the risks they face when it comes to alignment (and resilience). For instance, if airports can, in principle, be green, what can a specific airport do in practice and how much will it cost? This highlights a knowledge gap that could potentially serve as a guide for the sustainability roadmap of any given infrastructure company.

The premise that alignment is possible is implicit in the taxonomy’s structure. However, answering this question forms the basis for a more comprehensive investigation, recognizing the need for deeper insights into asset-level actions and strategies that can bridge the gap between eligibility and alignment with the EU Taxonomy’s sustainability criteria. Addressing this knowledge gap is essential for understanding the practical steps and transitions required for aligning infrastructure assets with the objectives of initiatives like the EU Taxonomy. This knowledge will be instrumental both for asset owners to understand practical approaches to improving sustainability and for investors in identifying sustainable investments, guiding the allocation of funding and investments toward the goal of transitioning to a low-carbon economy, and facilitating the broader sustainability objectives.

A new research initiative at the EDHEC Infra & Private Assets Research Institute is building a body of knowledge on the most impactful asset-level strategies, their effectiveness, and associated costs, available to infrastructure assets to decarbonize and improve climate resilience. This intentional approach enables a focused examination of practical, assetlevel interventions within the current technological landscape.