Why Is the Market Not Believing the Fed?

By Riccardo Rebonato, Professor of Finance, EDHEC-Risk Institute, EDHEC Business School

Riccardo Rebonato, Professor of Finance, EDHEC-Risk Institute, EDHEC Business School is specialist in interest rate risk modelling with applications to bond portfolio management and fixed-income derivatives pricing, He gives us his insights on the release of the latest blue dots.

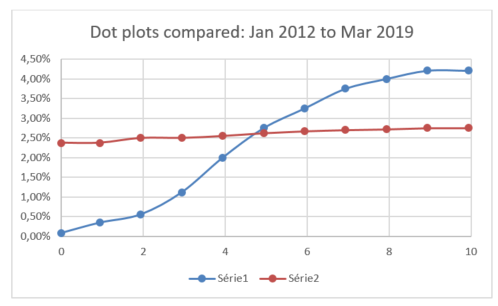

The latest (March) projections by the Fed Monetary Committee for the Fed Funds in the year to come (the ‘blue dots’) have come out significantly lower than the December projections. In particular, no more rate cuts are expected between now and the end of the year. Yet, even these much lower rates do not seem to be low enough for the market, that seems to be pricing in a substantial probability of a rate cut by year-end. What is going on?

There are a few possible explanations:

- Market yield are not (just) expectations. Market yields do reflect expectations but also incorporate a risk premium (a compensation for bearing risk). This is generally thought to be positive (say, for equities), but in the case of Treasury bonds the picture is more nuanced: to the extent that investors have come to believe that the Fed will always come to the rescue to mop up the debris of any severe market turmoil (the Greenspan/Bernanke/Yellen and now perhaps Powell ‘put’), Treasuries have become insurance instruments. A yield below expectations can just reflect the cost of insurance (investors bid up prices of Treasuries to build an insurance portfolio, as the prices move up, yields fall below expectation).

- The Blue Dots are not expectations. The members of the Fed Monetary Committee are asked about the ‘most likely’ outcome. Especially in the present environment, deviations from the most likely outcome are likely to be placed very asymmetrically, with more negative than positive surprises in the wings. Left-skewed deviations from the most likely scenario result in a lower expectations – and prices reflect expectations, not modes.

- The market has different expectations. Expectations against the what the Fed say may seem like a daring bet, as it is the Fed, after all, that sets the course of Fed Funds rate. However, throughout 2012 and 2013 yields below (that path of the) blue dots were the norm rather than the exception, and, that time at least, it was the market who got it right.

- Political interference. President Trump has adopted a more interventionist policy with the Fed than any of his predecessors in recent memory. Investors may just think that betting against the Fed is, in the end, less risky than betting against trump.

Which one is true? Nobody knows, of course. In order of decreasing importance, I would rank explanations 3, 1, 2 and 4. Be as it may, the most striking observation is how much the expected path of the Fed Funds has flattened in the last few years – see the chart below; if anything the market yield curve even shows a small inversion. And a flat or inverted yield curve has traditionally been associated with low or negative risk premia, with challenging times for bond investors, and for sluggish economic growth.

Riccardo Rebonato is Professor of Finance at EDHEC Business School. He was previously Global Head of Rates and FX Research at PIMCO. He also served as Head of Front Office Risk Management and Head of Clients Analytics, Global Head of Market Risk and Global Head of Quantitative Research at Royal Bank of Scotland (RBS). Prior joining RBS, he was Head of Complex IR Derivatives Trading and Head of Head of Derivatives Research at Barclays Capital. Riccardo Rebonato has served on the Board of ISDA (2002-2011), and has been on the Board of GARP since 2001. He was a visiting lecturer in Mathematical Finance at Oxford University (2001-2015). He is the author of several books, in particular having published extensively on interest rate modelling, risk management, and most notably books on SABR/LIBOR Market Model pricing of interest rate derivatives, as well as on the use of Bayesian nets for stress testing and asset allocation. He has published articles in international academic journals such as Quantitative Finance, the Journal of Derivatives and the Journal of Investment Management, and has made frequent presentations at academic and practitioner conferences. He holds a doctorate in Nuclear Engineering (Universita' di Milano) and a PhD in Science of Materials (Condensed Matter Physics, Stony Brook University, NY).