Successful EDHEC webinar explores climate risk impacts on global equity valuations

Written on 08 Jul 2024.

The EDHEC-Risk Climate Impact Institute hosted a highly successful webinar on July 2nd, titled “Assessing the Impact of Climate Risk on Global Equity Valuations.” With over 800 professionals registered from 70 countries, the event provided crucial insights into the innovative research conducted by the Institute’s Scientific Director, Professor Riccardo Rebonato.

Key Highlights from the Webinar

Professor Rebonato presented the key findings of a new study, How Does Climate Risk Affect Global Equity Valuations? A Novel Approach, conducted within the research chair established by EDHEC Business School and Scientific Beta. This study introduces a groundbreaking approach to understanding the impact of climate change and related policies on global equity valuations.

The EDHEC-Risk Climate Impact Institute's study reveals that the impact of physical climate risk on global equity valuation can be material, especially in scenarios with limited climate action. It addresses key limitations of current climate-aware valuation approaches and demonstrates that the impact of climate risks on global equity valuation can be significant.

During the webinar, organized by EDHEC-Risk Climate Impact Institute and moderated by Felix Goltz, Research Director at Scientific Beta, Riccardo Rebonato, Scientific Director at EDHEC-Risk Climate Institute, introduced and explained the new approach to valuation developed in the study before explaining the results and what conclusions can be taken from them.

Three Principal Components of the Valuation Approach:

- Probabilistic Approach: incorporating climate and economic uncertainties into a probabilistic framework for a more realistic and comprehensive evaluation of potential outcomes.

- State-Dependent Discounting: recognizing that physical damages from climate change impair cashflows in a state-dependent manner and allowing discount factors to be determined by economic conditions and damages, which highlights the neglected role of state-dependent discounting.

- Transition and Physical Risk: upgrading a popular integrated climate economics assessment model to estimate the effect of transition costs (associated with regulatory measures to curb greenhouse gas emissions) and physical damages on the value of global equity stock, providing a holistic view of climate-related financial risks.

Results and Conclusion

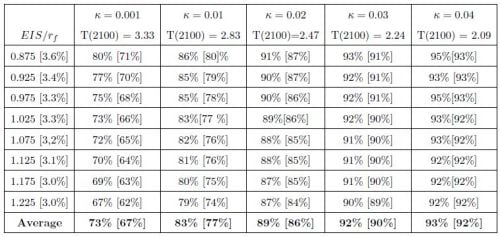

Professor Rebonato reveals that the magnitude of the losses depends on the aggressiveness of emission abatement policy; the presence or absence of tipping points; on the extent of Central banks' willingness and ability to lower rates in states of economic distress, represented clearly by the different parameters for the results.

The clear message is that a severe impact on equity valuation can be obtained with very plausible combinations of policies and physical outcomes; and that there is considerably more downside than upside risk – over 40% of global equity value is at risk unless decarbonization efforts accelerate and losses could exceed 50% with near climate tipping points.

Additional Insights

During the Q&A session, Professor Rebonato addressed several pertinent questions from the audience, providing deeper insights into the study’s methodology and implications. He emphasized the importance of considering both transition and physical risks together, rather than in isolation, and the conservative nature of the study’s estimates due to the mild assumptions used in the making of the model.

The webinar also underscored the critical need for aggressive and immediate climate action to safeguard global equity values by emphasizing the risk. Comparing the possible loss to the one incurred by another worldwide catastrophic event, Riccardo says “after COVID, for instance, we had a massive GDP loss, but then a rebound. Here, it seems to be like a headwind, a continuous headwind without a rebound … It could be the climate loss generation in equity returns.”

To watch the replay of the webinar, follow this link or see the video below:

Click here to access the written Q&A.

Contact us at [email protected] to access the slides of the presentation.

Further Readings

For those interested in gaining more insights into the research led by Professor Rebonato, we invite you to read some of his recent contributions:

- R. Rebonato, D. Kainth and L. Melin. (2024) The Impact of Physical Climate Risk on Global Equity Valuations, SSRN working paper

- R. Rebonato. (2024) The Problems with Climate Scenarios, and How to Fix Them, initially published on The Conversation Europe

- R. Rebonato. (2024) How Can Strategic Investors Deal With Climate Uncertainty, EDHEC-Risk Climate publication

- Rebonato, R., D. Kainth and L. Melin (2023) Portfolio Losses from Climate Damages – A Guide for Long-Term Investors, EDHEC Risk Climate Impact Institute position paper.

- R. Rebonato (2023) Why We Need New Climate Scenarios, EDHEC-Risk Climate Newsletter