Retirement Investing

A major crisis is threatening the sustainability of pension systems across the globe and the investment industry is facing an ever-greater responsibility to provide suitable retirement solutions.

EDHEC-Risk Institute runs a strategic research programme on retirement solutions. The available investment products distributed by asset managers or insurance companies hardly provide a satisfying answer to the needs of investors and households in retirement, and academia can provide new insights into how best to design improved retirement solutions with a focus on retirement income.

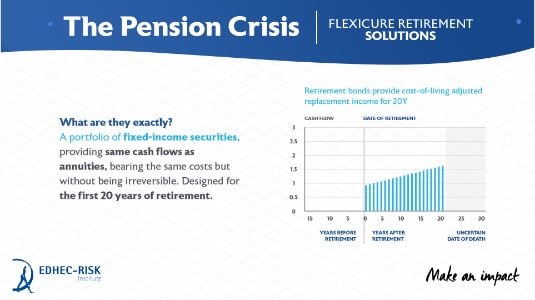

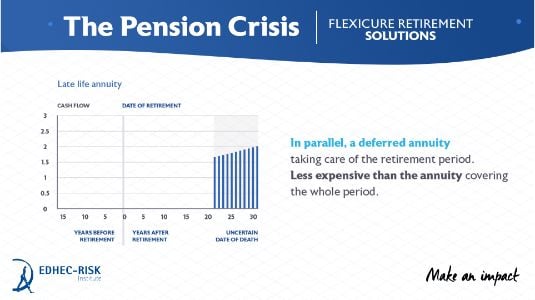

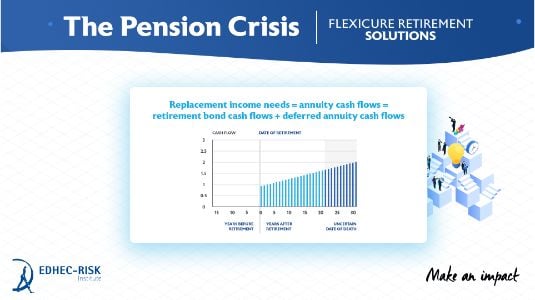

In particular the principles of goal-based investing can be applied to the design of a new generation of goal-based decumulation strategies, defined as the combination of an investment strategy and an income withdrawal strategy, and which aim to strike an efficient balance between security and performance with respect to the objective of generating retirement income.

In Video : P&I Webinar Introducing the Retirement Bond: The New Risk-Free Asset in Decumulation Strategies

In Illustration (GIF) : The Pensions Crisis and Flexicure Investment Solutions

In Video : P&I Webinar Introducing the Retirement Bond: The New Risk-Free Asset in Decumulation Strategies

Main Publications

Meaningful investment solutions should start with an understanding of clients’ goals. In retirement planning, the main challeng individuals face is to finance a sufficient and stable stream of replacement income in retirement. EDHEC-Risk Institute is grateful to Merrill Lynch for having supported a research project that has provided the conceptual foundations for the design of the EDHEC-Princeton Retirement Goal-Based Investing Index Series.

The Retirement Goal-Based Investing Indices, developed with the Operations Research and Financial Engineering Department at Princeton University as part of our joint research programme on Investment Solutions for Institutions and Individuals, are an example of these concepts being implemented. They represent asset allocation benchmarks for innovative mass-customised target date solutions for individuals preparing for retirement.

Exclusive interview with Anil Suri, Managing Director, Head of Portfolio Construction & Investment Analytics, Merrill Lynch Wealth Management

Construction Rules of Retirement Goal-Price Indices

Construction Rules of Retirement Goal-Based Investing Indices

EDHEC-Princeton Goal-Based Investing Index Series' publication has been discontinued in February 2022. The last update took place on January 10th 2022.

The research conducted in this programme relates to the design of novel welfare-improving forms of investment solutions for institutions and individuals.

EDHEC-Risk is collaborating with Swiss Life Asset Management to examine how dedicated forms of real estate investments can be used as part of goal hedging portfolios within improved retirement solutions, based on their ability to generate inflation-linked replacement income cash flows. This project also involves analysis of how insurance products can be integrated into real estate investments to provide a comprehensive solution for all stages of retirement.

EDHEC-Risk is collaborating with Swiss Life Asset Management to examine how dedicated forms of real estate investments can be used as part of goal hedging portfolios within improved retirement solutions, based on their ability to generate inflation-linked replacement income cash flows. This project also involves analysis of how insurance products can be integrated into real estate investments to provide a comprehensive solution for all stages of retirement.

This research programme currently benefits from the support of FirstRand for a research chair on the design and implementation of welfare-improving investment solutions for institutions and individuals. The aim of the chair is to expand the scientific literature on investor welfare-enhancing methodologies for portfolio construction in a goal-based investing framework.

This research programme currently benefits from the support of FirstRand for a research chair on the design and implementation of welfare-improving investment solutions for institutions and individuals. The aim of the chair is to expand the scientific literature on investor welfare-enhancing methodologies for portfolio construction in a goal-based investing framework.

On the individual side, EDHEC-Risk has received renewed support from Bank of America Merrill Lynch to develop new research on goal-based investing for the construction of retirement investment solutions for individuals and develop a holistic goal-based investing framework to analyse optimal retirement investing decisions for individuals in the transition or de-accumulation phase of their investment lifecycle, by using a broad range of investment product categories including stocks and bonds as well as annuity-related products.

On the individual side, EDHEC-Risk has received renewed support from Bank of America Merrill Lynch to develop new research on goal-based investing for the construction of retirement investment solutions for individuals and develop a holistic goal-based investing framework to analyse optimal retirement investing decisions for individuals in the transition or de-accumulation phase of their investment lifecycle, by using a broad range of investment product categories including stocks and bonds as well as annuity-related products.

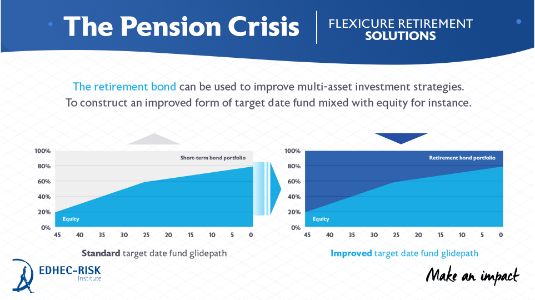

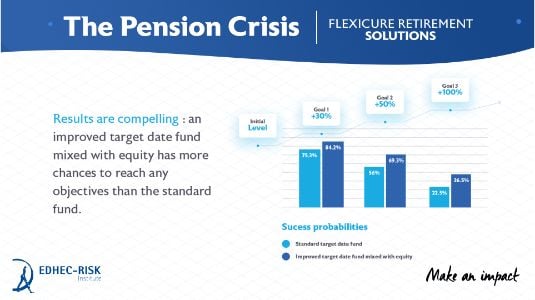

The research conducted at EDHEC-Risk Institute on goal-based investment solutions has also led to a consulting assignment with MLWM on the construction of dynamic retirement solutions, as well as the launch of the EDHEC-Princeton retirement goal-based indices, again with the support of MLWM. EDHEC-Risk Institute’s ambition is to develop strategic partnerships with investment managers worldwide for the launch and promotion of meaningful mass-customised investment solutions for individuals. It has also built upon previous work supported by ORTEC and Pictet on ALM for individuals, as well as a research chair supported by La Française AM on improved forms of target date funds.

On the institutional side, this research programme has benefited from the support of BNP Investment Partners for a research chair on dynamic liability-driven investment solutions. It has also benefited from the support of the Ontario Teachers’ Pension Plan for a research chair on improved methods for inflation-linked liability hedging, and Deutsche Bank for a research chair on asset-liability management techniques for sovereign wealth fund management.

The research conducted at EDHEC-Risk Institute on liability-driven investment solutions has also led to a consulting assignment with CalPERS on the construction of a comprehensive factor-based asset-liability management framework conducted jointly with Professor John Mulvey from Princeton University’s ORFE department.